In the fast-paced world of finance, standing still is akin to falling behind. ATRAM, a leading digitally-powered independent asset and wealth management firm, has proven it’s not just keeping pace with the fintech revolution, it’s riding the wave.

The firm has announced exceptional 2024 results across its unit investment trust funds (UITFs) and mutual funds (MFs), solidifying its market dominance, particularly within the burgeoning feeder fund space.

Double-digit returns in several funds underscore ATRAM’s agility and ability to navigate a complex and ever-shifting economic landscape.

The asset and wealth management firm’s strategic embrace of technology has clearly paid off. By leveraging digital platforms and innovative financial tools, the firm has streamlined its operations, enhanced client access, and ultimately, delivered superior investment performance.

This forward-thinking approach has not only fueled impressive returns but also propelled ATRAM to capture a commanding 48% market share in the Philippines’ feeder fund sector. This achievement is a testament to the asset and wealth management firm’s foresight in recognizing the potential of feeder funds and pioneering their introduction in the country.

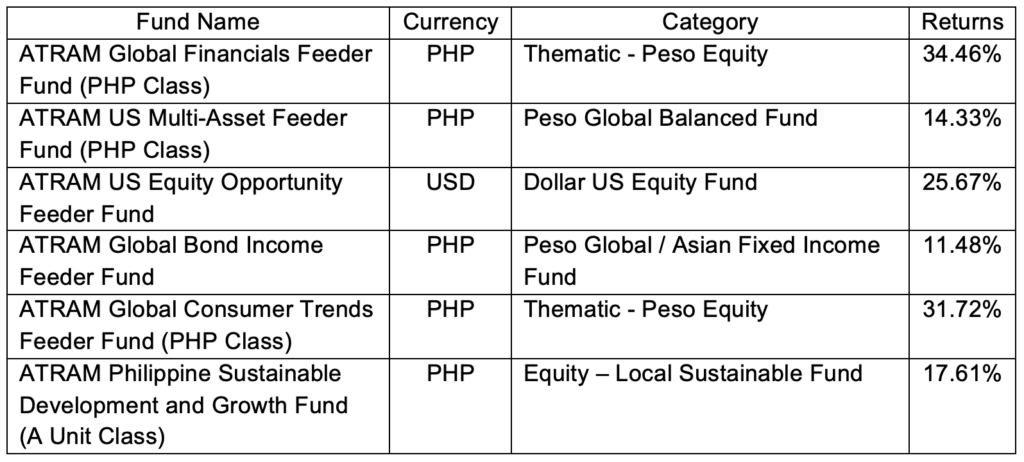

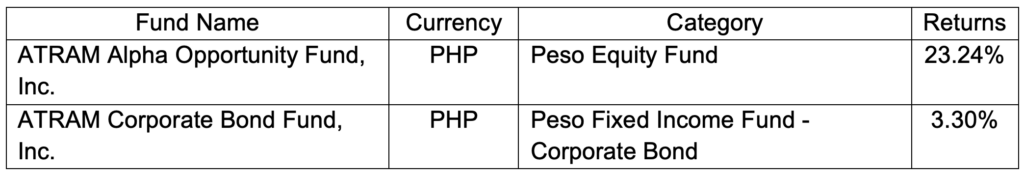

The numbers speak for themselves.

Among the top-performing UITFs, the ATRAM Global Financials Feeder Fund (PHP Class) soared with a 34.46% return, followed closely by the ATRAM Global Consumer Trends Feeder Fund (PHP Class) at 31.72%. The ATRAM US Equity Opportunity Feeder Fund (USD) also impressed, delivering a 25.67% return.

On the mutual fund front, the ATRAM Alpha Opportunity Fund, Inc. led the charge with a robust 23.24% gain. These stellar results, calculated from December 27, 2023, to December 27, 2024, for UITFs and December 31, 2023, to December 31, 2024, for MFs, offer compelling evidence of ATRAM’s investment prowess. (* NOTE: It is important to remember that past performance is not indicative of future results.)

The asset and wealth management firm’s success isn’t just about chasing high returns; it’s about providing investors with access to diversified, globally managed portfolios.

Through strategic partnerships with world-renowned asset managers like BlackRock, Allianz, and J.P. Morgan, the firm opens its doors for Filipino investors to participate in global markets. This access, coupled with ATRAM’s own expertise, has translated into Php 363 billion in assets under management as of December 2024.

ATRAM’s commitment to fund management and innovation

Alessandra Araullo, ATRAM’s Chief Investment Officer

“Our long-standing commitment to fund management and access to diverse financial markets enable us to deliver superior investment performance,” Alessandra Araullo, ATRAM’s Chief Investment Officer, explained.

“Our disciplined investment and fund selection process, underpinned by in-house research capabilities and understanding of our clients’ distinctive needs, profiles, and financial goals, ensure that we offer the best investment solution and continuously adapt to changing market conditions, achieving the best possible outcomes for our investors,” she further stated.

ATRAM’s commitment to innovation extends beyond traditional investment strategies. The firm’s focus on sustainable investing is exemplified by the ATRAM Philippine Sustainable Development and Growth Fund.

This fund, which invests in local companies aligned with the UN’s Sustainable Development Goals (SDGs), generated a remarkable 17.61% return in 2024, significantly outperforming the Philippine Stock Exchange Index (PSEi).

This performance highlights ATRAM’s belief that financial success and positive social and environmental impact can go hand in hand. This commitment has earned the firm consistent recognition from The Asset Triple A Sustainable Investing Awards, including Editor’s Triple Star (2021), Asset Management Company of the Year-Highly Commended (2022 & 2023), and Mandate of the Year (2024).

Anticipating a dynamic economic landscape

Gen Z and millennials are reshaping the investment landscape, sharing some similarities with older generations but also exhibiting key differences. A recent survey by The Motley Fool reveals that while younger and older investors often agree on portfolio size and stock evaluation factors, Gen Z and millennials are far more active traders than Gen X and baby boomers.

This generational divide is further highlighted by contrasting views on cryptocurrency risk, with Gen Z demonstrating a unique approach. These evolving investment patterns are undoubtedly influenced by technological advancements and the distinct economic experiences of each generation.

Looking ahead to 2025, the firm anticipates a dynamic economic landscape, projecting continued disinflation and a stronger Philippine peso. However, the firm also acknowledges potential challenges, including threats to external demand and upward pressure on longer-term yields.

ATRAM’s proactive approach to market analysis and its deep understanding of global economic trends position it well to navigate these challenges and capitalize on emerging opportunities. The firm remains steadfast in its mission to provide robust, digitally-driven investment solutions that generate long-term value for its clients in this rapidly evolving world.

For those seeking to achieve their financial goals in a rapidly evolving world, ATRAM’s digitally-driven approach and commitment to superior performance offer a compelling proposition. Learn more about how ATRAM can help you achieve your financial aspirations at www.atram.com.ph.

* Disclaimer: Past performance does not guarantee future results. All investments carry risk, including the potential loss of principal. Mutual funds are managed by ATR Asset Management, Inc., regulated by the Securities and Exchange Commission (SEC). UITFs are managed by ATRAM Trust Corporation, regulated by the Bangko Sentral ng Pilipinas (BSP).