In a country where both sari-sari store owners and city commuters are key players in the daily economy, the Bangko Sentral ng Pilipinas (BSP) is connecting the dots between education and innovation by bringing financial empowerment to where it matters most — the streets, the stations, and the small businesses of everyday Filipinos.

From classrooms in Dasmariñas to turnstiles in Metro Manila, the BSP’s dual initiatives this July — a two-day Economic and Financial Learning Program (EFLP) for micro, small, and medium enterprise (MSME) owners and workers, and the launch of tap-to-pay and scan-to-pay technology in MRT-3 stations — form a united front in the country’s digital and financial transformation.

Held on July 23 and 24, the BSP’s EFLP session in Dasmariñas City gathered over 1,800 onsite and online participants. MSME owners, workers, and employees joined the sessions to learn about essential topics like inflation, interest rates, budgeting, microfinance access, and the safe use of digital tools such as QR Ph and mobile wallets. “This year, our advocacy on financial literacy will reach more people nationwide,” the BSP posted on its website as it amplifies the program.

The program on financial empowerment featured speakers from the BSP, FinTech Alliance PH, Microfinance Council of the Philippines, Department of Trade and Industry, and Registered Financial Planners Philippines.

“At the BSP, we believe that real financial empowerment starts with education,” said BSP Deputy Governor Bernadette Romulo-Puyat. “Pero ang edukasyon, hindi lang dapat sa classroom. It should be something that relates to and permeates into your real life.”

Day 1 focused on helping MSMEs become more financially resilient and digitally equipped, while Day 2 zeroed in on enabling employees to make smarter economic decisions — underscoring the BSP’s belief that inclusive growth starts with informed individuals.

New ‘Tap-to-Pay’ system bolsters financial empowerment for Filipinos

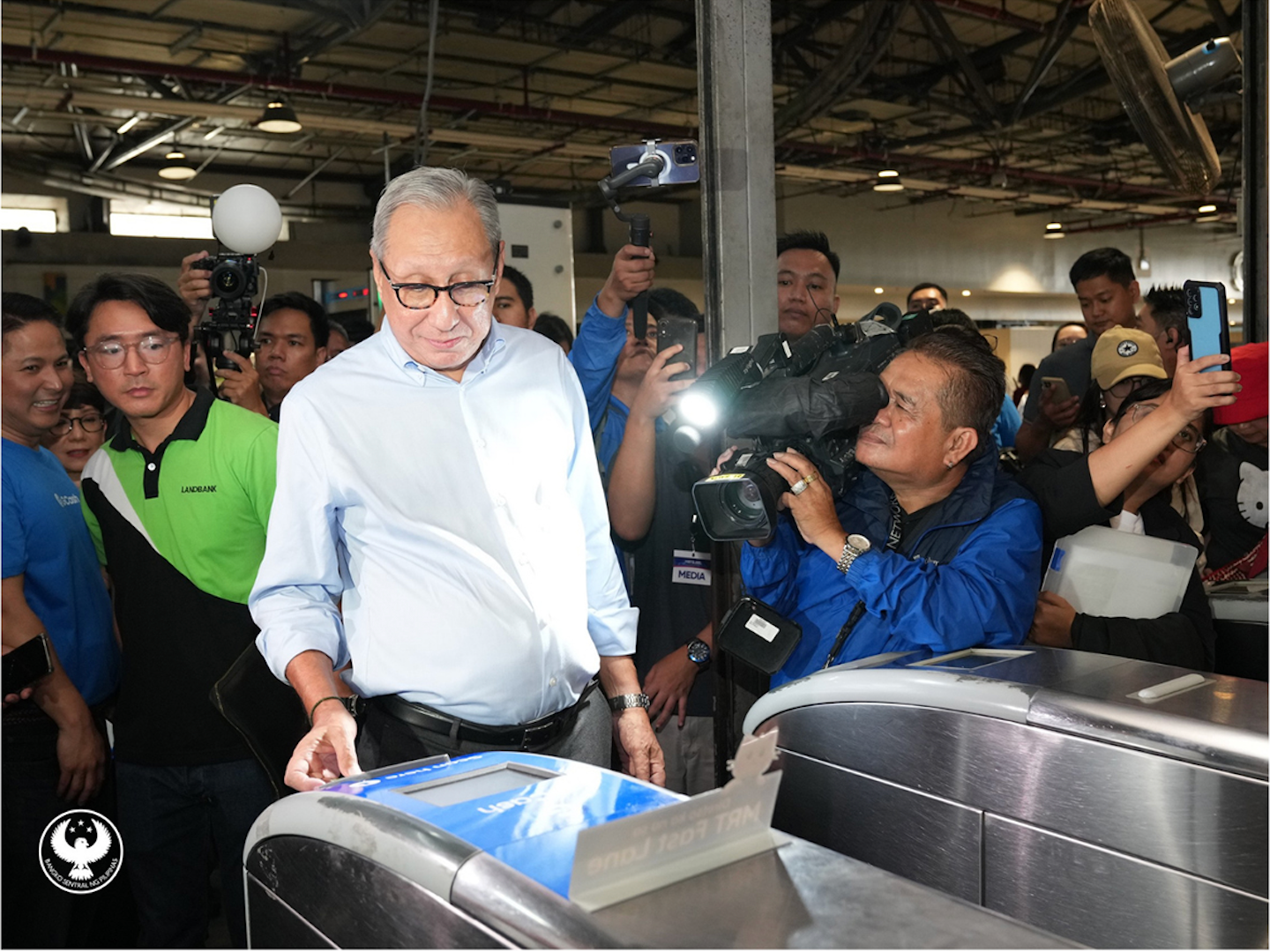

BSP Monetary Board Member Walter C. Wassmer (in blue polo, with glasses) pays train fares using a debit card on the new tap/scan-to-pay turnstile.

Just a day later, on July 25, the BSP marked another milestone in public access to digital finance and financial empowerment — this time in the fast-paced world of urban commuting.

In partnership with the Department of Transportation (DOTr) and GCash (G-Xchange Inc.), BSP helped roll out a tap-to-pay and scan-to-pay system at MRT-3 stations. Commuters can now simply tap their debit or credit card or scan a QR code from their e-wallets to pay for fares — no physical top-ups or paper tickets required.

The innovation is part of the Automated Fare Collection System (AFCS) project, a DOTr-led initiative aligned with the Philippine Development Plan’s goal to digitize 60 to 70 percent of all retail payments by 2028. BSP Governor Eli M. Remolona, Jr., through Monetary Board Member Walter C. Wassmer, highlighted this as a critical step toward a “cash-lite” economy — where digital payments become the norm for everyday transactions.

BSP Deputy Governor Mamerto E. Tangonan (in gray polo, with glasses) pays train fares using his mobile phone on the new tap/scan-to-pay turnstile.

BSP Deputy Governor Mamerto E. Tangonan, for his part, emphasized the continued effort to integrate public transport into the broader digital payment landscape. “We’re working to ensure that these systems are interoperable, secure, and reliable,” he said, noting that collaboration with payment service providers and government agencies is key to reaching nationwide digitalization targets.

Both efforts — in the classroom and on the train platform — reflect BSP’s broader vision: to foster a more financially aware, digitally confident population. Whether it’s an entrepreneur learning how to use mobile wallets to expand their business or a commuter breezing through MRT-3 turnstiles with a tap of a card, the message is clear — digital empowerment is for everyone.

By bringing economic education directly to grassroots communities and embedding digital payment systems into everyday routines, the BSP is not just promoting financial literacy; it is building the foundation for a future-ready Filipino society.