InstaPay-DuitNow marks a major step in Southeast Asia’s push for seamless, real-time payments, as the Philippines and Malaysia officially activate a cross-border QR linkage.

Timed with the Philippines assuming the ASEAN chairmanship, the launch highlights how regional cooperation is translating into everyday convenience for travelers and small businesses.

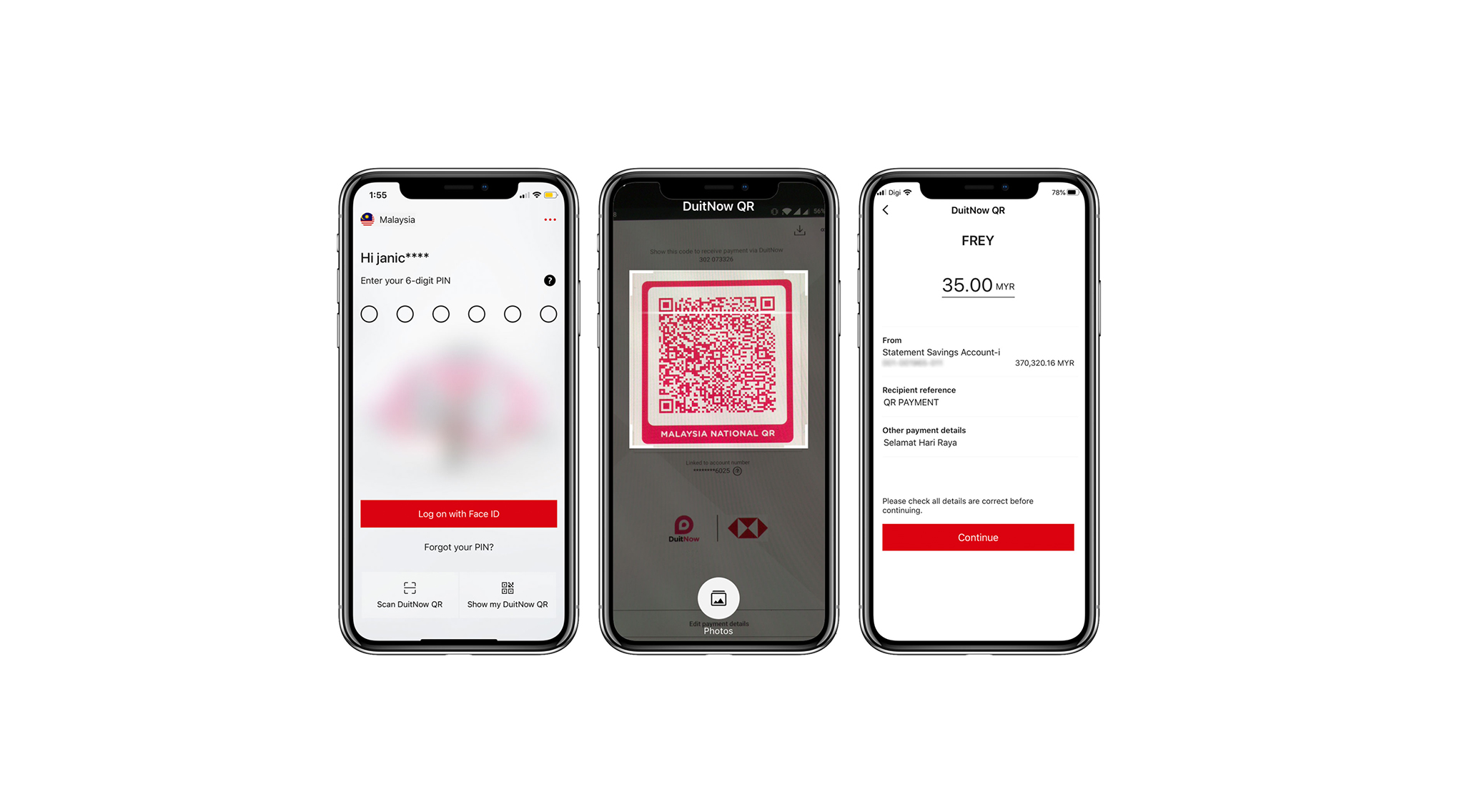

For Filipinos visiting Kuala Lumpur or Malaysians holidaying in Manila, the experience is simple: scan a QR code and pay using your local e-wallet or banking app. No cash exchange, no cards, and no complex onboarding. Behind that simplicity, however, is a strategic payments bridge designed to strengthen tourism flows and MSME trade between the two economies.

A cross-border QR link goes live

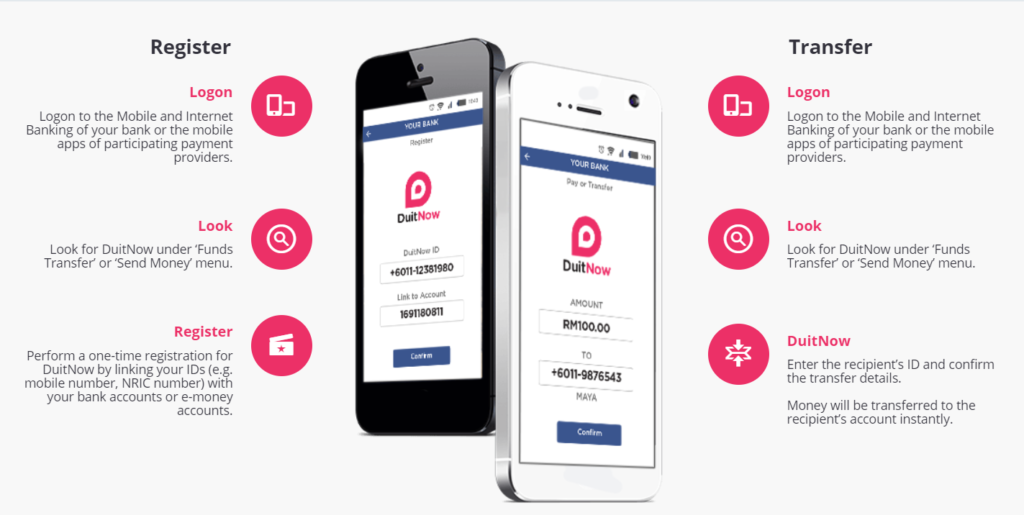

The InstaPay-DuitNow connection links the Philippines’ InstaPay system with Malaysia’s DuitNow, enabling interoperable QR payments across borders. This means Malaysian users can pay at QR Ph merchants, while Filipinos can transact at DuitNow-enabled stores, using their existing apps and local currency accounts.

For tourists, this removes a long-standing friction point in regional travel. Small purchases — transport, meals, souvenirs — no longer require cash conversion or international card fees. The result is a smoother travel experience that encourages spending, especially among digital-first travelers who prefer mobile payments.

Beyond convenience, the linkage also signals a maturing payments infrastructure in ASEAN. Rather than building new rails from scratch, countries are connecting domestic systems, creating a network effect that benefits users without forcing them to change habits.

Unlocking opportunities for MSMEs

For MSMEs, InstaPay-DuitNow opens the door to a wider customer base with minimal operational changes. A Philippine café or retail shop already accepting QR Ph can now serve Malaysian customers instantly.

Likewise, Malaysian micro-merchants can cater to Filipino visitors without adding new terminals or payment contracts.

This is particularly significant for tourism-driven MSMEs, which often operate on thin margins. Faster settlements and reduced reliance on cash improve cash flow and lower operational risk. For cross-border trade, even at small volumes, digital payments make it easier to test new markets and serve niche demand.

Over time, this linkage could also support informal cross-border commerce, such as pop-up markets, festivals, and community-based tourism. By lowering payment barriers, InstaPay-DuitNow helps MSMEs participate more actively in regional economic activity.

ASEAN chairmanship and regional momentum

The timing of the launch is not incidental.

As the Philippines takes on the ASEAN chairmanship, the InstaPay-DuitNow rollout reinforces the country’s role in advancing regional digital integration.

Cross-border payments are a practical expression of ASEAN cooperation — visible, usable, and immediately relevant to citizens.

This initiative also aligns with broader goals of financial inclusion and digital transformation. By leveraging existing domestic rails, regulators and payment operators can scale cross-border use cases without excluding smaller players or rural users.

Looking ahead, the PH–Malaysia linkage sets a template for future connections with other ASEAN markets. Each new corridor strengthens the regional payments ecosystem, making Southeast Asia more connected, competitive, and resilient.

Looking ahead: Payments without borders

InstaPay-DuitNow is more than a technical integration—it is a signal of where regional finance is heading. As tourists enjoy frictionless spending and MSMEs gain easier access to cross-border customers, digital payments become an enabler of growth rather than just a utility.

As ASEAN economies deepen cooperation, cross-border QR payments could soon feel as routine as domestic transfers. For the Philippines and Malaysia, this launch is an early but meaningful step toward a truly interoperable regional payments landscape.