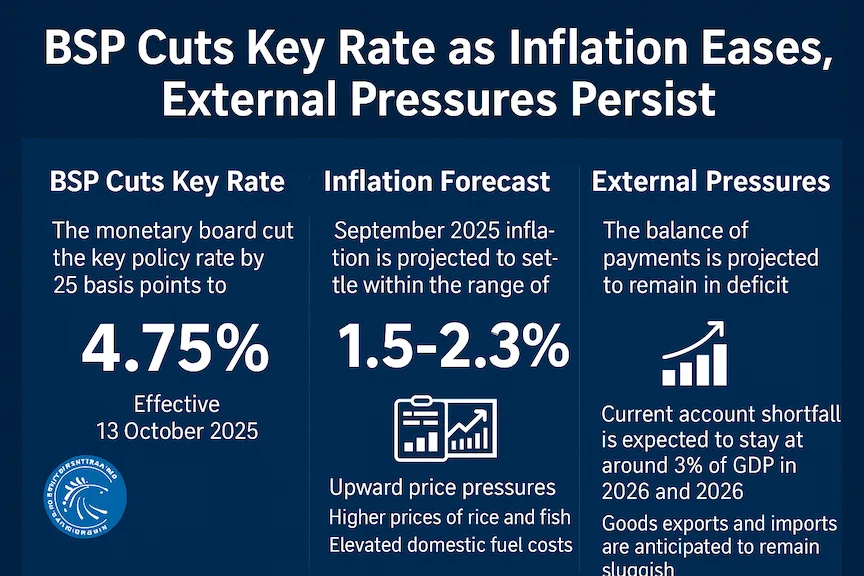

The Bangko Sentral ng Pilipinas (BSP) has lowered its key policy rate by 25 basis points to 4.75 percent, signaling a measured shift toward monetary easing as inflation continues to stabilize and growth risks rise amid persistent global headwinds.

The decision, made by the Monetary Board earlier this month, reflects the central bank’s growing confidence that inflation will remain within target in the near term, while also supporting domestic liquidity and investment momentum.

The rate cut brings the overnight deposit and lending rates to 4.25 percent and 5.25 percent, respectively. Correspondingly, the peso Discount Window Facility (DWF) rates were adjusted to 5.93 percent for short-term (1–90 days) and 6.11 percent for medium-term (91–180 days) loans.

However, the BSP maintained its foreign currency DWF interest rates unchanged, with the U.S. dollar facility at 6.47 percent and the Japanese yen facility ranging between 2.70 percent and 2.88 percent, depending on loan maturity.

The central bank noted that these changes are consistent with its goal of aligning domestic borrowing conditions with evolving market dynamics while retaining flexibility to respond to external developments. “The appropriate spread on DWF interest rates may change periodically to complement monetary policy goals and reflect movements in market rates,” the BSP said in a press release.

Inflation expected to stay within target range

In a separate report, the BSP projected September 2025 inflation to settle between 1.5 and 2.3 percent, well within the 2–4 percent target range.

According to the central bank, upward price pressures for the month were mainly due to higher prices of rice, fish, and fuel. These were partially offset by lower electricity rates and declining prices of vegetables and meat.

“Going forward, the BSP will continue to monitor evolving domestic and international developments affecting the outlook for inflation and growth,” the central bank said, emphasizing its commitment to a data-driven policy stance.

The lower inflation outlook, combined with moderating demand-side pressures, has given policymakers more room to support economic growth through rate adjustments — a move seen by analysts as a cautious attempt to balance price stability with sustained recovery.

External sector faces ongoing challenges

Despite easing inflation, the Philippines continues to face external account pressures. The BSP projects the Balance of Payments (BOP) to remain in deficit through 2026, with the current account shortfall expected to hover around 3 percent of GDP.

The persistent deficit reflects a widening trade gap, slower global demand, and subdued capital inflows amid heightened geopolitical and trade uncertainties. Export and import growth are expected to remain sluggish due to softening commodity prices and tempered domestic activity, although ongoing infrastructure investments and trade diversification may cushion some of the external drag.

Meanwhile, services exports, particularly in business process outsourcing (BPO) and tourism, are projected to moderate in the coming years as these sectors navigate U.S. reshoring trends and slower inbound travel.

Still, overseas Filipino remittances remain a bright spot. The BSP expects remittances to stay resilient, buoyed by strong labor demand abroad and the continued confidence of Filipino workers in formal transfer channels, despite new tax policies in major host economies such as the United States.

Foreign direct investment inflows are likely to soften as well, though the BSP pointed to policy reforms — including the amendments to the Investors’ Lease Act — as steps toward improving the country’s investment climate.

Foreign currency loans edge higher

Supporting signs of steady activity, foreign currency deposit unit (FCDU) loans rose 0.9 percent quarter-on-quarter to US$15.93 billion as of June 2025.

Of this amount, 63.5 percent or US$10.12 billion went to Philippine-based borrowers, led by exporters, trucking and logistics firms, and power generation companies.

The bulk of the loans — 79 percent — had maturities longer than one year, reflecting demand for medium- to long-term financing in key industries.

The modest rise in FCDU loans coincided with a 10 percent increase in foreign currency deposits, which reached US$60.67 billion, suggesting sustained liquidity and confidence in the country’s financial system despite tighter global credit conditions.

Cautious optimism amid global uncertainty

As 2025 draws to a close, the BSP faces the delicate task of supporting domestic growth while managing external vulnerabilities.

With inflation moderating and lending activity showing signs of life, the rate cut may provide a modest boost to credit and consumption. Yet, with the BOP deficit, volatile capital flows, and soft global demand still casting uncertainty, the BSP has made clear it will remain vigilant.

“The central bank’s policy recalibration reflects a balancing act — one that prioritizes both stability and recovery,” said a market analyst. “The next few quarters will test how far that balance can hold.”