“Biglang naubusan ako ng rekado, kaya takbo agad kay mare para manghiram!” It’s a line many Filipinos can relate to — that moment when you’re cooking adobo and realize you’ve run out of laurel or soy sauce, and payday is still a few days away. For many, it’s a familiar story of diskarte — making do with what’s left, or finding creative ways to stretch the budget.

In a country where everyday ingenuity is a part of life, GCash recognizes these small but meaningful acts of resourcefulness.

From stretching the last drop of shampoo to walking home to save on fare, these moments reflect the resilience and creativity that define the Filipino way of getting by — and GCash aims to be there when even the most practical diskarte needs a little backup.

Stretching every Peso, the Pinoy way

For Filipino breadwinners, the art of stretching every peso is nothing new. In today’s world of rising prices, Pinoys have become even more creative in managing their daily expenses.

One of the most familiar stories goes, “I added water to my shampoo so it could last until tomorrow.” Simple, but true. Sometimes, even baby’s milk or soap gets diluted or scraped clean down to the very last bit.

Then there’s the classic line: “I just walk home when I’m short on fare.” For many, that’s not just saving money — it’s a survival move. As they say, kinapos pero kinaya — you ran short, but you made it through.

These stories of diskarte aren’t just funny—they’re inspiring. They show how strong and resourceful Filipinos can be when faced with financial gaps. No matter how small the problem, there’s always a way to get by.

Resourcefulness — with a little help from GCash

But no matter how resourceful you are, there are times when you simply need a little help. After all, you can’t just add water to your gas tank — or borrow baby’s milk from the neighbor every day.

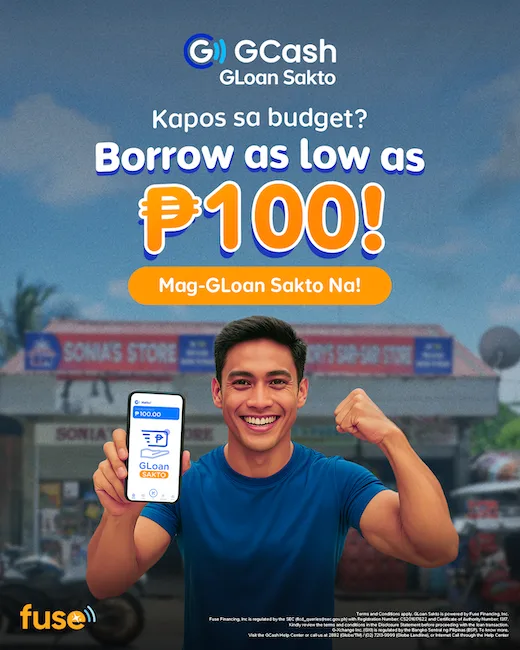

For moments like these, Filipinos now have a new ally: GLoan Sakto — a pre-qualified entry loan from GCash that gives users instant access to small but meaningful amounts of cash, from ₱100 to ₱300, directly through the app.

With GLoan Sakto, it’s easy to fill those “just enough” needs such as:

- Transportation – when you’re short on fare or gas money for your ride.

- Food or groceries – when you suddenly run out of ingredients or meal essentials.

- Minor emergencies – like needing shampoo, soap, baby’s diapers, or medicine.

Fast, simple, and just right for your needs

The great thing about GLoan Sakto is that you don’t have to line up or wait long for approval. It comes with a 14-day term, minimal fees, and only a few simple steps to apply:

- Open the GCash app and tap “Borrow.”

- Choose GLoan, then tap “Get Started.”

- Select your loan purpose and tap “Get this loan.”

- Check your personal details, agree to the terms, and confirm.

- Wait for the OTP and a confirmation message to see if you’re eligible.

Once approved, the loan amount goes straight to your GCash wallet — ready to cover your small but important daily needs.

No drama, just pure ingenuity

In the end, it’s not about how big the loan is or how much money you have — it’s about the timing and right kind of help when you need it most.

As several breadwinners told us, sometimes you don’t need a big loan. What you really need is something just enough — to get through the day, fill up the table, or make it home safely.

With GLoan Sakto, resourcefulness comes with peace of mind. Even when funds fall short, you can still pull through — because GCash is there to help.

For those who want to learn more or apply, simply open the GCash app or visit help.gcash.com.

In these times of thrift and creativity, remember: you’re not alone. Sometimes, the real galawan (move) is knowing there’s help that’s just right — for your needs, and for the Filipino way of life.