Filipinos are known for being “budgetarians” — practical travelers who plan trips months in advance, hunt for seat sales, and map out every pasalubong stop to make the most of every peso. But while most have mastered the art of saving on airfare and hotel deals, one sneaky travel expense still slips through the cracks: ATM and currency conversion fees.

According to data from Wise, a global financial technology company, some of Filipinos’ favorite travel destinations are also the most expensive places to withdraw cash.

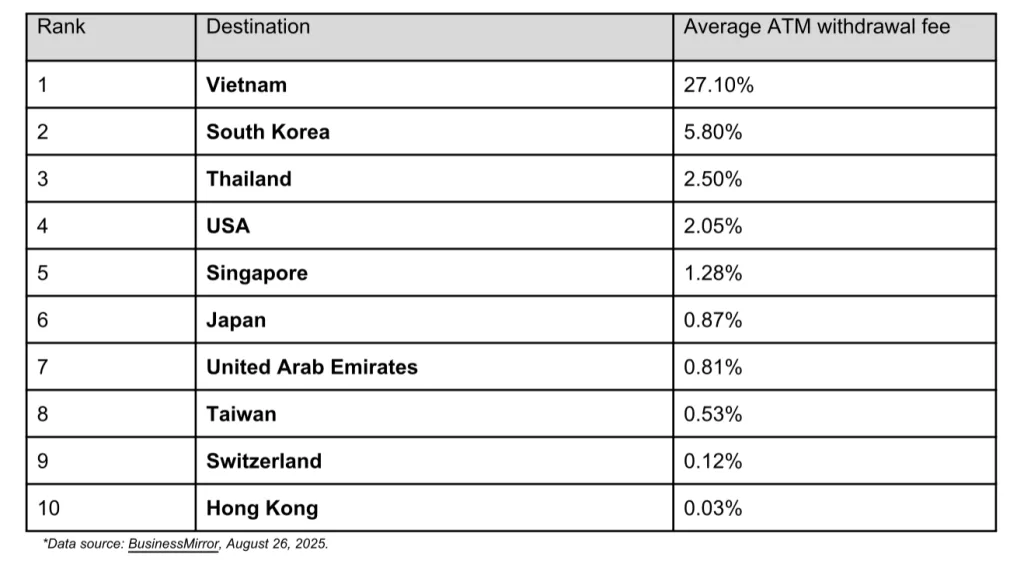

Vietnam tops the list with an eye-watering 27.10% average withdrawal fee, followed by South Korea (5.80%), Thailand (2.50%), and the United States (2.05%). Even typically budget-friendly destinations like Singapore (1.28%) and Japan (0.87%) come with a cost when you use the wrong card.

These small fees might not seem like much — until they pile up. Between airport taxis, café stops, and souvenir hunts, ATM charges can quietly eat into a travel budget faster than you can say “exchange rate.”

“The fees are invisible at first, but when you tally them at the end of your trip, that could mean one less meal, one less museum ticket, or one less pasalubong for Lola,” says a fintech analyst from Wise.

Wise to the rescue: Avoiding hidden currency conversion, ATM fees

With the school holidays and the much-awaited Christmas break approaching — the country’s busiest travel season — Wise is encouraging Filipinos to travel smarter by managing their money digitally and avoiding unnecessary costs abroad.

Here are some practical Wise travel tips to help make every peso go further:

1. Set a realistic budget and commit to it — Use the 50-30-20 rule: 50% of your income for needs, 30% for wants, and 20% for savings. Wise suggests checking cost-of-living sites or watching travel vloggers to estimate daily expenses in your destination — especially during peak holiday season.

2. Save automatically — If you’re planning next year’s trip, set up automatic transfers to a separate savings account. Saving just ₱3,000 a month can grow to ₱36,000 in a year — enough for a five-day getaway to Thailand. Wise’s Jars feature even lets you set aside money in different currencies, so your travel fund stays organized and protected from currency fluctuations.

3. Pick practical accommodations — Hostels and serviced apartments often offer hotel-like amenities at lower prices. Booking early also gives you better options and rates — something budget travelers swear by.

4. Watch out for international transaction fees — Traditional bank cards often charge up to 3% in foreign transaction fees, plus poor exchange rates. Wise warns travelers to be cautious of Dynamic Currency Conversion (DCC) — when merchants offer to charge in pesos instead of the local currency at inflated rates. The smarter move? Always choose to pay in the local currency.

5. Choose a card that uses real exchange rates — Many banks quietly add hidden margins to conversion rates, making overseas spending more expensive than it should be. The Wise card, however, automatically picks the lowest conversion fee available among 40+ currencies using its Smart Conversion technology. That means you always get the real mid-market rate and can spend like a local — keeping more money for pasalubong.

And in case of emergencies, friends or family can easily transfer money to your Wise account for quick access — a lifesaver when you’re overseas.

The new way Pinoys travel

As more Filipinos embrace digital payments, fintech tools are becoming as essential as a passport or boarding pass. Apps like Wise, GCash, and Maya now offer international payment options, allowing travelers to spend, send, and save seamlessly across borders.

What began as a convenience for online shopping has become a lifeline for travelers who want to avoid hidden charges and stretch their travel funds. “With fintech, you don’t have to stress about exchange counters or ATM fees,” says Bea, a 27-year-old communications professional who recently traveled to Seoul. “I just tap my card or phone and pay like a local — no surprises when I check my balance.”

Experts say this shift reflects a broader cultural change among Filipino travelers — from cash-heavy tourists to digitally empowered global citizens. The growing adoption of e-wallets and fintech platforms is helping turn every trip into a smarter, more connected experience.

So as the holidays draw near, Filipinos are not just booking flights and stays — they’re also learning to pack smarter, save earlier, and pay wiser.

Because in the age of fintech, the best travel companion isn’t a credit card or a bundle of foreign cash. It’s a wallet that lives right in your pocket — and works just as hard as you do to make every peso count.

Fueling a new kind of travel mindset

As digital payments become second nature in the Philippines, travelers are realizing that convenience and cost-efficiency no longer stop at the airport gate. The country’s rapid fintech adoption — driven by mobile-savvy Gen Zs and millennials — is empowering Filipinos to travel smarter, spend safer, and make every peso count wherever they go.

Even local e-wallets are catching up. GCash Global Pay, for instance, allows direct overseas payments through partners like Alipay+, while Maya’s Visa integration lets users pay in multiple currencies abroad. These developments reflect a larger shift: Filipinos no longer need to rely on thick cash envelopes or uncertain exchange counters to enjoy seamless travel.

So as the holiday season approaches, practical travelers aren’t just packing lighter — they’re also paying smarter. Because in today’s fintech-powered world, the best travel companion isn’t just a sturdy suitcase or a good itinerary. It’s a wallet that lives right on your phone — one that helps you save more for the memories that truly matter.