At a time when cybersecurity threats are growing more sophisticated, Maya, the country’s leading fintech ecosystem and no. 1 digital bank, is taking a bold step to protect Filipino consumers. The company has launched the Maya Black credit card, a product designed from the ground up with security as its core feature, setting a new benchmark for digital banking in the Philippines.

Unlike traditional credit cards that display sensitive numbers and rely on cumbersome hotlines for fraud protection, the Maya Black card is numberless.

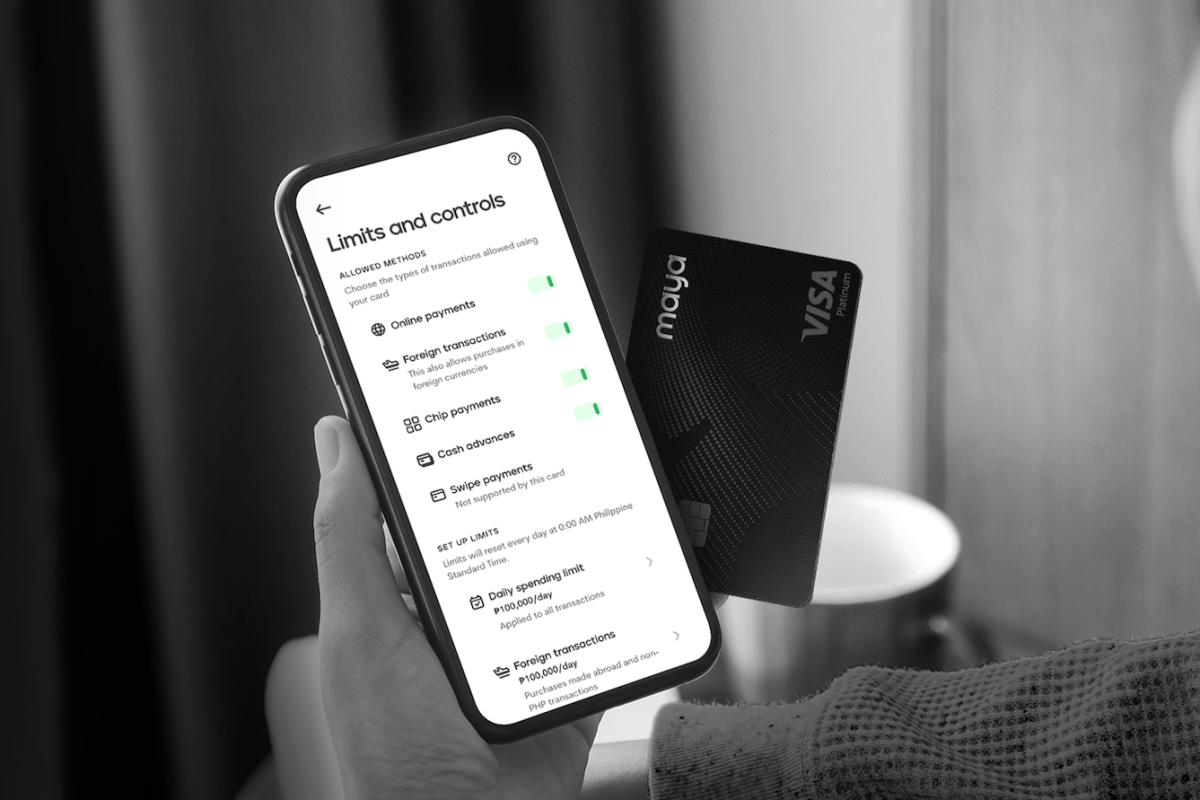

Its Card Verification Value (CVV) refreshes dynamically with every use inside the Maya app. In addition, a built-in Security Center gives customers the power to instantly freeze accounts, set spending limits, or block suspicious transactions with a single tap.

Maya redefines credit card security with real-time control

This move directly addresses one of the most pressing issues in Philippine banking: the persistent fear of fraud and account breaches.

Cybercriminals have become increasingly adept at phishing, card skimming, and exploiting static card details. In many cases, consumers discover fraudulent activity only after the damage has been done, and their only recourse is to call a hotline — a process that can take hours and leaves customers feeling powerless.

“Security should not feel complicated — it should give peace of mind,” said Shailesh Baidwan, Maya Group President and Maya Bank Co-Founder. “We’re giving customers simple, powerful tools to protect themselves in real time. When people know they are in control, they are more confident to use credit and grow with it.”

Beyond user-facing controls, the Maya Black card integrates enterprise-grade protections. These include biometric logins, one-time passwords, and AI-driven fraud monitoring that can instantly block suspicious transactions before they are completed.

By combining visible consumer tools with invisible back-end defenses, Maya is positioning itself as the first digital bank in the Philippines to deliver a truly integrated cybersecurity model for credit cards.

Breaking fraud fears to expand financial inclusion

This innovation could not have come at a more critical time.

According to TransUnion Philippines, only 15% of Filipino adults owned a credit card as of 2024. A significant reason behind this low adoption is fear of fraud — a sentiment reinforced by frequent headlines about data breaches and scams.

By empowering users to take direct control over their accounts, Maya hopes to break down that barrier and expand financial inclusion.

“This is the future of secure finance: visible, real-time and customer-driven,” Baidwan added. “By raising the bar for digital banking and credit cards in the Philippines, we are proving that world-class security and everyday usability can go hand in hand. That’s how we build lasting trust — and that’s how we grow financial inclusion.”

Cybersecurity experts often stress that consumer trust is the foundation of any successful digital financial system. Maya’s approach reflects this thinking by making security not just a back-office safeguard but a front-and-center customer feature. It is a strategic move in a market where trust is fragile, yet essential for growth.

The Maya Black card’s launch is also part of the company’s broader vision of “elevated finance,” where every product — whether savings, payments, or credit — comes with protection and simplicity as standard. For Maya, security is not an add-on; it is a design principle.

Setting cybersecurity blueprint for PH digital banking

In a digital economy where scams evolve daily, Maya’s proactive security stance signals a shift for the industry.

It forms part of the company’s broader vision of “elevated finance,” where every product — from payments and savings to credit — is designed with both protection and simplicity built in.

By embedding cybersecurity into the everyday banking experience, the company is sending a clear message: trust can be engineered, and financial growth can only thrive when customers feel secure.

As Filipinos increasingly adopt digital banking, Maya’s security-first innovations could serve as the blueprint for a safer, more inclusive financial system — one where confidence, not fear, drives participation.