The CoVid 19 pandemic has devastated millions of businesses and careers around the world. Previously impregnable sectors such as food, clothing, and shelter took a beating. Companies had to close shop and workers were given the pink slip.

But there is a silver lining. The Fintech industry’s march to growth barely missed a beat. With people staying indoors, fintech companies actually grew during the pandemic. The industry is projected to grow by $305 billion by 2025. It will create thousands of jobs for people who have the knowledge and skills sought after by this disruptive industry.

Fintech is the industry that was born from the convergence of finance and technology sectors. It offers financial services to the masses previously monopolized by big banks and big money. Loans, investments, money transfers, insurance, payments, and so many other financial transactions can be done via an Internet connection and a smartphone, thanks to Fintech.

The growth of the fintech industry means the demand for people with the knowledge and skill to serve as fintech professionals will equally grow. The industry is still evolving and innovating.

Aside from stalwarts sectors such as mobile payments, e-wallets, and digital banking, other fintech services are opening up such as single-touch payroll, robotics process automation, regtech, and open API (application programming interface).

The future for professionals in fintech looks bright. The last decade saw fintech come onto the stage. This decade will see fintech shine on the stage.

People in fintech can expect an industry that is dynamic, exciting, and innovative. Fintech companies will be looking for talent. The competition for new hires will be fierce and rewarding for successful applicants.

Here are the top twelve careers in fintech, starting from the lowest-paying at entry-level to the highest:

The best careers in fintech

1. UI/UX designer – $59/yr to $85k/yr

Any application or software has an interface and functionalities that people interact with. This, the front that people see and use is what UI/UX designers create.

Think of it as your dashboard where you can access all the buttons and knobs so that you can achieve what you aim to do. That dashboard hides all the complexities and codes that you don’t want to see.

UI (user interface) is what people see and the UX (user experience) is how they flow from one UI to the next so that they can solve their problems. A good UI/UX can differentiate a product from its competitors. With the innovations that the fintech industry keeps rolling out, UI/UX designers will always be in high demand in this sector.

A UI/UX designer must have soft skills such as empathy and communication. It is vital to reach out and talk to people who are current users or will be using the product. A good communicator will draw out what people really want in the product.

Technical skills are, of course, a must. This is where the job gets done. A lot of coding, graphics design, and visualization are involved.

2. Financial analysts – $66k/yr for entry-level to $85k/yr for ten years or more of experience

A financial analyst searches and analyzes trends in the market. By building financial models, they can simulate market movements, identify risks, look for opportunities, and make recommendations to top executives of companies.

Investors follow the forecasts of financial analysts so that they can take positions and gain an advantage before the situation develops. Due to the extensive impact of their recommendations on the finances of a firm or large group of people, the work may be stressful.

Entry-level salary can be low but you can quickly climb the pay ladder as you gain experience. Bonuses, stock options, and allowances significantly add to a financial analyst’s income.

The surprising thing is that there is no specific bachelor’s degree to become a financial analyst. Anyone with a college education and who is numbers-savvy can succeed in this career. Those with degrees in finance, accounting, economics, statistics, and math have a higher rate of success in the field.

3. Data analyst – $70k/yr to $82k/yr

Data analysts review huge chunks of data to advise on investments, target customers, and assess risks. They scan vast oceans of information to spot trends, make forecasts and extract data to help top executives make data-driven decisions.

Data analysts work in investment firms, hedge fund companies, banks, credit bureaus, tech firms, insurance companies, and a whole lot more. Data analysts have been some of the most sought-after professionals in the world for many years.

We are producing more data in the 21st century than all the previous centuries combined, this ensures that the demand for data experts will only continue to grow.

Few people outside of a math-related field of study get hired as data analysts. If you prove to be the standout from your group of hires, you can be given supervision over the next batch. From there you can get a managerial position and climb up the corporate ladder with the salary to match.

4. Business development managers – $70k/yr to $149k/yr

A business development manager looks for contacts, leads, and customers. A BDM is an essential asset to any company which is why successful BDMs are given very competitive salaries and bonuses to retain their services.

Employee piracy is common for BDMs. Those who work as BDMs are seldom behind a desk. They go out on client calls, participate in networking events, and nurture relationships with leads. They are only in the office when making reports or preparing for a presentation.

This job is suited for people with an outgoing personality, confident, and who enjoy public speaking. A college degree in finance, marketing, and business management will be helpful but not strictly required.

There are some certification courses for those who want to brush up on what they already know.

5. App developer – $75/yr for entry-level to $144k/yr for senior developer

Applications or simply apps are the software programs that we use on our devices such as PCs, tablets, and smartphones. There are now 8.93 million apps in the world just for mobile devices according to RiskIQ. That number is still rising. In connection, the demand for app developers is still increasing.

App developers create helpful apps so that people can solve their problems. They also maintain and keep these products updated in terms of features and security. The main markets are iOS and Android devices.

Apps are at the tip of the spear when it comes to disrupting industries. Think Grab, Airbnb, Netflix, and Amazon which disrupted traditional industries.

You can earn a degree in computer science. Then continuously upskill by attending coding boot camps, or even learn by self-study. Some people just attend a coding boot camp to learn all the practical skills they need in about 12 months. This beats accumulating a bunch of debt going through college. Companies are increasingly hiring from these boot camps.

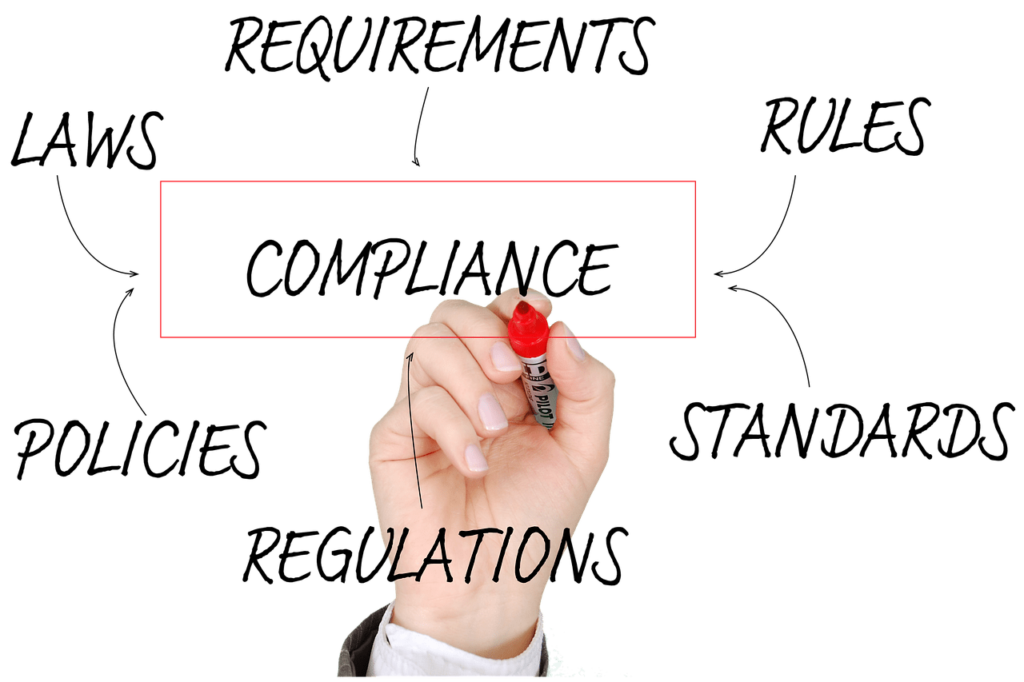

6. Risk and compliance expert / RegTech – $76/yr for entry-level to $95k/yr for 6-9 yr experience

The constant changes and updates on rules and regulations in financial services, just to name one industry, have created a need for risk and compliance experts. Demand for these professionals is rising along with their pay offers.

Chief compliance officers now rank among C-level executives because the compliant environment they create keeps the government away.

The primary duty of a compliance officer is to ensure that a company is being run according to the law. This means not only complying with local and national regulations but also ethically.

In the fintech industry, with thousands of transactions occurring online, there must be a way to ensure that these are being monitored and no fraud, like money laundering, is in progress. This has given rise to regtech. It is the management of regulations in the finance industry through technology.

Degrees in engineering, law, and chemistry are plus factors for applicants. But risk and compliance officer is not an entry-level position in most companies.

There are certifications available online and in some countries, you have to get a license from the regulatory body for the finance industry.

7. Behavioral scientist – $77k/yr to $112k/yr

Automation and machine learning drives most of the fintech customer-facing technology. This automation allows the technology to be intuitive in how it approaches human interaction.

A behavioral scientist observes, researches, and analyzes these human-machine interactions. Their work builds the foundation that allows complex processes and computing to remain in the background while still serving the intent of customers.

A bachelor’s degree in a related course, plus a master’s degree will help one land a job as a behavioral scientist. Data analysis, research, and focus group discussions are some of the major skills or job descriptions of behavioral scientists. The entry point for the inexperienced is often as a research assistant.

8. Cybersecurity – $80k for Penetration Testers to $250k for Information Security Manager

For as long as there are cyber criminals out there, there will always be cybersecurity experts trying to catch them. This is why cybersecurity will always be an in-demand job not only for fintech but across many industries.

Cybersecurity has a gamut of professionals patrolling its halls. There are security engineers, consultants, developers, pentesters, security architects, and even lawyers.

The field is still growing and there is the possibility of 3.5 million unfilled job positions by 2021 according to a study by Cyber Security Ventures. High demand, low-supply mean high salaries and low competition.

Cybersecurity experts have a lot of things to do and focus on depending on their responsibilities. They monitor their organization’s networks for security breaches and investigate violations when they occur. They install firewalls and data encryption programs to protect sensitive information.

Cyber security experts prepare documentation on security breaches and the extent of the damage. They also regularly conduct simulated attacks to look for and fix vulnerabilities before the real thing happens. These are just a few of the security issues they deal with.

The degrees required for cybersecurity are not clear cut given that this is still a new field. Companies usually prefer their cybersecurity expert to have a degree in computer science or programming. An MBA in information systems and information technology will help you get hired. But those who want to move horizontally from other careers can seek certifications in systems security to systems auditing.

9. Product managers – $96k/yr for an associate product manager to $149k/yr for director level

Product managers are like mini-company owners. For the particular product that they manage, they determine the sales, marketing, strategy, packaging, pricing, budget, vision, and road map. The success or failure of the product lies on their shoulders.

The pay range depends largely on the industry and the company that employs the product manager. Even geography plays a role. A Silicon Valley product manager will command a higher salary than one in Idaho. For sure the challenges and roles are exciting and personally rewarding.

An associate product manager is the usual entry point. A bachelor’s degree in business or marketing plus a master’s degree is preferred. Internship programs in some companies are also used as entry points.

Product Management Certifications are also available online or in open university programs. These certifications and higher education make a candidate more attractive and command higher pay.

10. Artificial Intelligence & Machine Learning – $100k/yr for coders to $200k/yr for AI engineer

Artificial Intelligence or AI, has graduated from the movie screen to become one of the fastest-growing fields today.

According to LinkedIn, the demand for AI specialists will rise 74% annually. Research by the New York Times found only 10,000 AI experts worldwide. Since this is still somewhat of a sunrise field, AI engineers report high levels of job satisfaction and above-average salaries.

AI specialists study, test, and build AI models for use in the real world. In simple terms, AI engineers build software or machines that mimic human behavior. As an AI specialist, you will maintain, improve, and innovate on these systems.

AI engineers have a background in mathematics with leanings in robotics, or computer science for writing algorithms.

These algorithms have to fire off without human intervention which means they follow neural network models rather than regular strings of code. This highly specialized skill and high innovation in fintech are key factors for the demand for AI engineers.

You must have the right skills and training to land a high-paying role in AI. For skills, you must know programming, linear algebra, and statistics, knowledge of big data tech, algorithms and framework, communication, and problem-solving skills.

For degrees, it is ideal that you have degrees in computer science or cognitive science with a focus on AI or machine learning.

11. Quantitative analysts – $125/yr entry-level to $250/yr for experienced quants

Quantitative analysts or quants build mathematical models to reduce risks and generate profits for trading in financial securities.

The rapid growth of automated trading systems, the need for greater access to pricing and risk models, and the search for market-neutral investment strategies are driving the demand for quants. They work mostly in investment and hedge fund firms.

Fintech companies such as financial software and information providers also employ quants. One can find quants in regional financial centers like New York, London, Hongkong, and Tokyo.

The skills required for a quant are financial, mathematical, and computer programming, with special emphasis on the last two. In terms of education, degrees in mathematics, economics, statistics, and financial engineering, coupled with a Ph.D. are highly desirable.

A Certificate in Quantitative Finance can be earned through an intensive six-month distance learning program.

12. Blockchain developer – $150k/year to $175k/year

Demand for blockchain developers is very high in the fintech industry. Pay for a blockchain professional is the highest anywhere. A six-figure salary is often entry-level.

This is a very niche skill so demand far outstrips supply. Blockchain developers appreciate and believe in the value of decentralization and distributed money. Building these types of systems and applying them for every use is the job of a blockchain developer.

You’ll need to take up programming languages for blockchain development if you want their salary. Start with Java, C++, and Scala. For dApps or decentralized applications get good at Haskell and Solidity. Those are just a few of the hard skills.

For soft skills, since blockchain developers are scattered throughout the world, you will need to be able to communicate mostly in English, but a second global language would be best.

There are certification courses in blockchain development. To earn your certification, you must already have a good foundation in software programming. A degree in IT, engineering, and mathematics are preferred by companies.

Since blockchain is still an emerging discipline, one of the best ways to learn is to immerse yourself in the community. Connect with people on Reddit, Slack, and Git. Join events, meetups, conferences, and webinars. Get involved in volunteer projects.

Build upon your learning layer by layer. Blockchain could be one of those civilization-altering technologies. And you may find yourself right smack in the middle of it, with a good salary to boot.

Conclusion

These careers in fintech are in the realm of the seller’s market. The demand is simply way above the supply.

Fintech companies don’t look like they will stop innovating and offering products anytime soon.

The pandemic has only made business leaders realize how important fintech is to keep society functioning.

This means more chances for you to do a career shift or guide your kids to careers in the leading edge of technology that will alter the lives of many people for the better.