In an effort to further promote financial inclusion in the country, global digital payments platform Visa and local finance super app GCash have recently formalized an agreement that would provide unbanked Filipinos with access to and the advantages of a payment card.

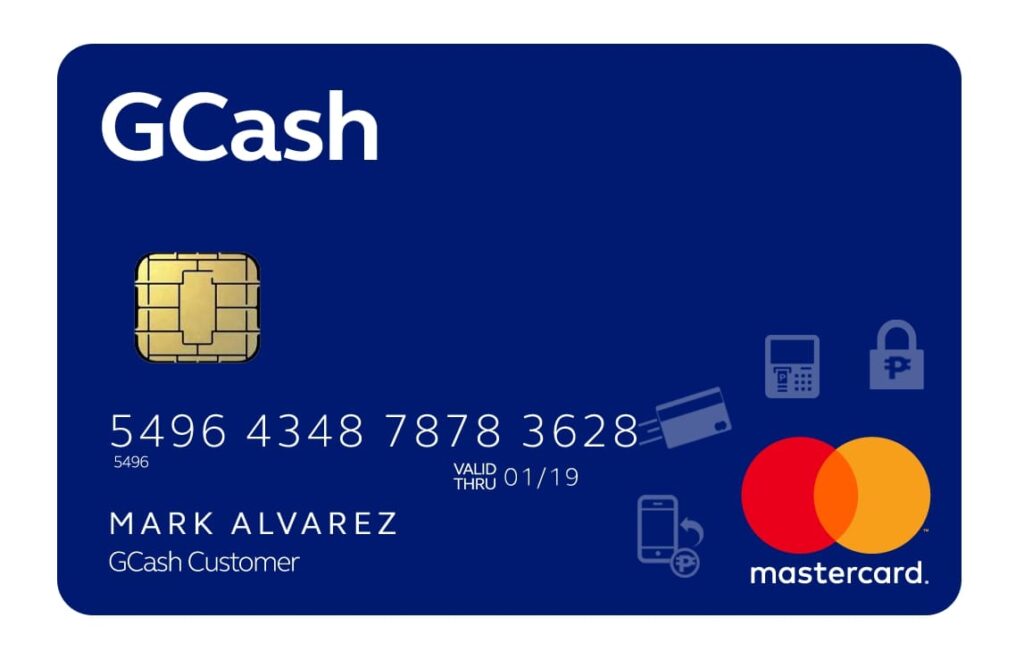

According to Jeff Navarro, country manager for the Philippines and Guam at Visa, the agreement shall allow for the launch of the GCash Card, a contactless payment card that is designed to address the issue of financial inclusion for millions of unbanked Filipinos.

“The card’s contactless capability enables Filipino shoppers, especially those who don’t usually pay with cards, to shop conveniently and securely and join millions of people around the world who have been tapping to shop, dine, and travel,” Navarro said in a press statement.

IMAGE CREDIT: https://thesmartlocal.ph/

According to Ren-Ren Reyes, president and CEO of G-Xchange, the GCash Card may be used to make secure online purchases on users’ preferred websites and apps as well as in actual retail stores by tapping or inserting the card in terminals.

“GCash is providing every Filipino with access to the advantages of possessing a card, wherever they may be, especially those without bank accounts or the paperwork traditionally needed to apply for a card. These include Filipinos with unofficial sources of income, such as independent contractors and freelancers, as well as micro and small businesses,” explained Reyes.

Thanks to the new GCash Card, more Filipinos will now have access to a new cashless payment option that they can use for regular expenses like groceries, dining out, and transportation.

“GCash customers may use the new card powered by Visa at more than 100 million merchant locations in the Philippines and around the world. More payment alternatives will also become available to them without requiring any further paperwork or approvals. Every fully verified user may now obtain their own GCash Card powered by Visa through the app,” Reyes added.

Kaya All with the Card for All

With their slogan, “Dahil Kaya All with the Card for All,” the goal of the GCash Card introduction is to give Filipinos access to a range of advantages comparable to those enjoyed by individuals with bank accounts, such as speedy ATM withdrawals both domestically and overseas.

Thanks to Visa’s extensive worldwide network, the card can also be used to make international purchases in more than 200 countries and territories at more than 100 million merchants.

This provides GCash Card users who are traveling, as well as overseas Filipino workers, with another safe and practical method of making payments abroad.

The GCash Card users would also have access to GInsure, where they could receive free insurance up to P20,000 coverage for fraudulent transactions for the first 30 days following activation.

Additionally, this covers the P185 cost of a new card in the case that one is accidentally lost or damaged, as well as the P225 delivery charge.

As part of its Digital Payments Transformation Roadmap, the Bangko Sentral ng Pilipinas (BSP) has been working to boost the proportion of banked Filipino adults to 70% by 2023. Since its launch, adult Filipinos with bank accounts have increased from 29% in 2019 to approximately 60% in 2021.