Union Bank of the Philippines (UnionBank) is deepening its push toward end-to-end digital banking, rolling out a zero-touch payroll account opening solution while strengthening its leadership bench with a new appointment in its consumer banking business.

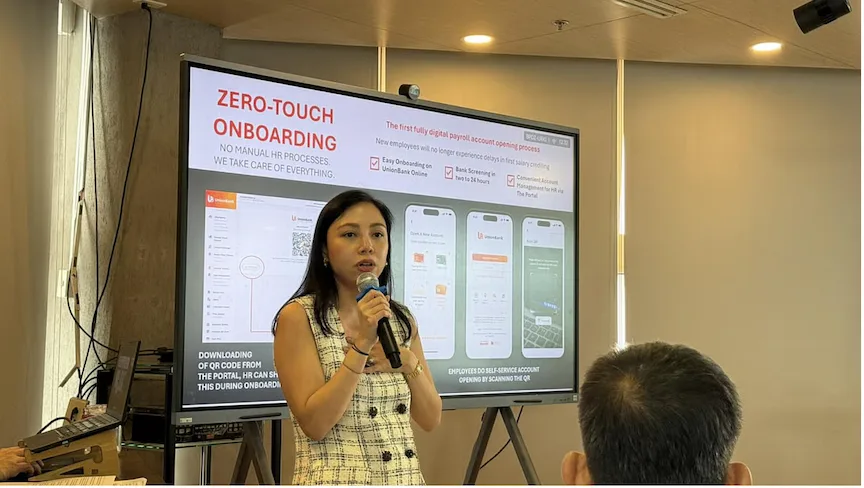

The bank recently introduced Zero-Touch Onboarding, a payroll account opening solution that allows employees to open their accounts in less than 24 hours by simply scanning a QR code using their mobile phones.

The QR code is generated through The Portal, UnionBank’s business banking platform, removing the need for manual processing by human resources and operations teams.

Under the new system, HR departments no longer need to collect, review, and submit employment documents to the bank for each new hire — a process that can take days, particularly for companies with large workforces or frequent hiring cycles.

“Payroll onboarding has long been a pain point for both employers and employees,” UnionBank said in a press statement, noting that traditional workflows often involve multiple handoffs between HR teams, operations staff, and banking partners.

Across the industry, payroll account opening typically requires companies to gather physical or digital documents, screen applicants internally, and coordinate account setup with banks. Delays are common, especially during peak hiring seasons or large-scale onboarding initiatives.

Simplifying payroll onboarding for digital workplaces

IMAGE CREDIT: Toby Magsaysay

As reported in Insider.ph, UnionBank’s Zero-Touch Onboarding aims to address these inefficiencies by automating the entire process from account initiation to activation.

Once employees scan the QR code and complete the required steps on their mobile devices, their accounts are opened without manual intervention from either the employer or the bank.

After account creation, employees’ account numbers are immediately visible on The Portal, allowing HR teams to proceed with payroll disbursement without further coordination. UnionBank said the solution is the first in the local market to fully eliminate manual intervention in payroll account opening.

The rollout comes as Philippine enterprises continue to digitize back-office functions such as payroll, payments, and employee administration. With remote and hybrid work arrangements now commonplace, companies are increasingly looking for faster, more seamless digital experiences — not just for customers, but also for employees.

For new hires, particularly first-time jobseekers, the ability to open a payroll account using a smartphone removes a common source of friction. Employees no longer need to visit a branch or submit multiple documents through HR, helping speed up access to salaries and benefits.

UnionBank has been steadily expanding its digital banking capabilities for both retail and corporate clients, leveraging a mobile-first strategy and API-driven infrastructure. The Zero-Touch Onboarding solution builds on these efforts by embedding payroll account creation directly into existing corporate workflows.

UnionBank bolsters leadership bench amid digital push

Gauraw Srivastava, wealth head and executive vice president of UnionBank

As the bank strengthens its digital offerings, it is also reinforcing its leadership team.

UnionBank recently appointed Gauraw Srivastava as wealth head and executive vice president for its consumer banking business, effective December 16, 2025.

Srivastava was previously head of private banking, wealth management, and segments at Vietnam’s VPBank. He also served as managing director for wealth and asset management at VNDIRECT Securities Corporation from 2022 to 2023. Earlier in his career, he held roles at ICICI Securities and Standard Chartered Bank.

He brings over 20 years of experience in banking and financial services across Vietnam and India, with a focus on wealth management and consumer banking.

In addition to Srivastava’s appointment, UnionBank’s board approved several new leadership hires. These include Vincent Dante Benedicto as HR business partner and vice president, and Rene Guzman as onboarding fraud detection and governance head and vice president.

New assistant vice presidents include Jose Gil Pineda, talent capability manager; Emmanuel Thomas Gerard Valeña, digital experience manager; and Antonio Villafria Jr., problem management head.

Industry observers note that as banks compete on digital capabilities, investments in both technology and leadership talent are becoming critical differentiators. Faster onboarding, reduced administrative costs, and stronger governance are increasingly seen as essential to supporting growth in a digital-first economy.

UnionBank did not disclose how many corporate clients have adopted the Zero-Touch Onboarding solution so far, but said the initiative forms part of its broader effort to help businesses and consumers operate more efficiently in an increasingly digital financial landscape.