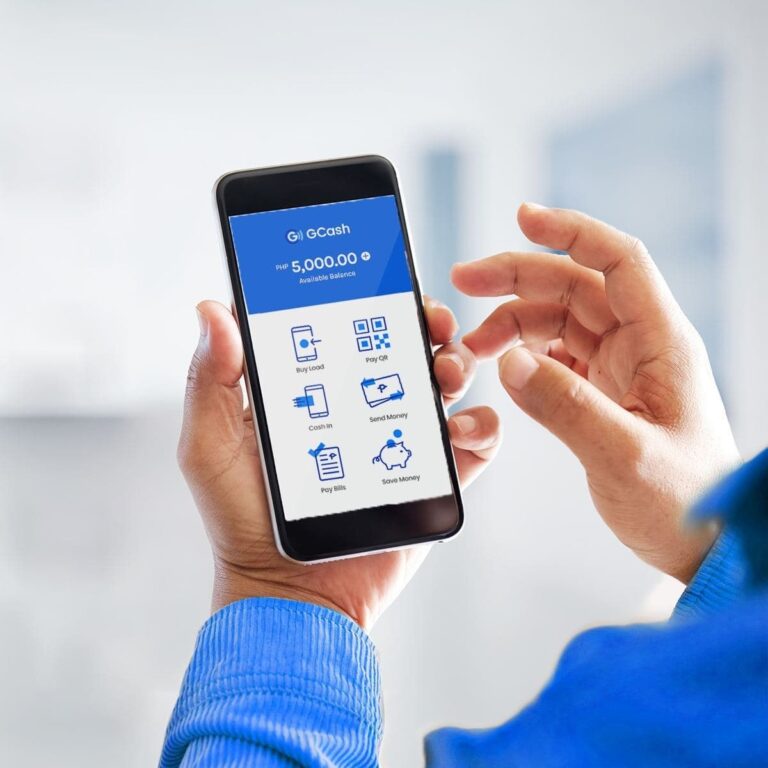

GCash passionately champions financial inclusion at 2025 Manila Tech Summit

By Edielyn Mangol, Reporter As the Philippines accelerates into the digital age, GCash is emerging as a key player in shaping financial inclusion — and. Read More...