RCBC Pulz feature now allows users to hold and convert U.S. dollars directly within the app, strengthening RCBC’s digital banking capabilities for Filipinos earning or receiving funds from abroad.

The update reflects the growing demand for smarter foreign exchange management, especially among freelancers, remote workers, and remittance recipients.

As cross-border transactions become more common, having the flexibility to manage USD within a local banking app gives users greater financial control without relying on multiple platforms or costly intermediaries.

What the RCBC Pulz feature offers

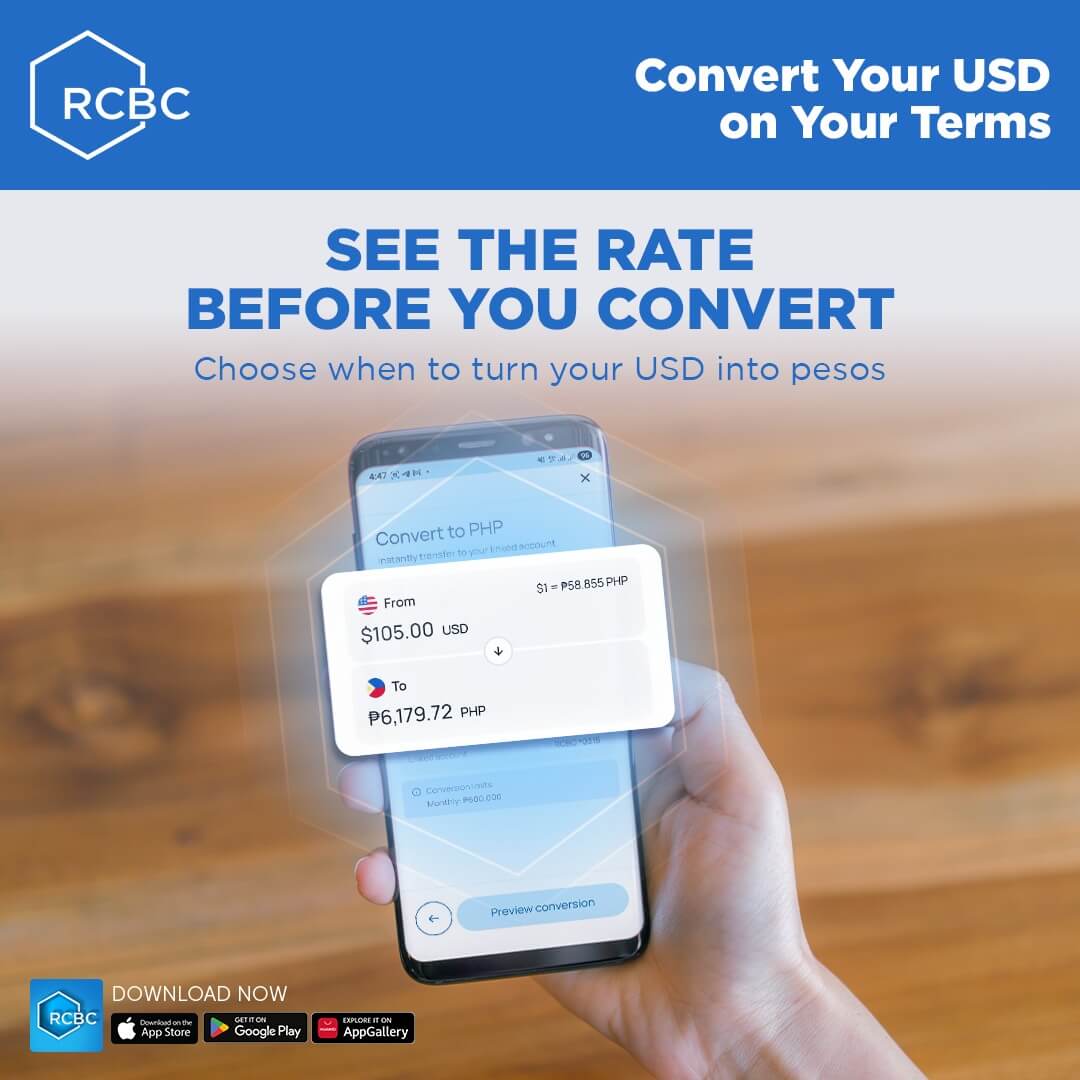

The RCBC Pulz feature that enables users to hold and convert U.S. dollars is designed to provide greater autonomy over foreign currency funds. Instead of automatically converting dollars to pesos upon receipt, users can now retain USD in their account and decide when to convert based on preferred exchange rates.

This flexibility allows customers to better manage currency fluctuations. For individuals who depend on overseas income, even small differences in exchange rates can significantly impact monthly budgets. By holding USD within the app, users gain more strategic control over their funds.

Expanding digital banking for global Filipinos

The introduction of the RCBC Pulz feature builds on the bank’s broader efforts to enhance cross-border financial access. With digital platforms increasingly supporting international payments, RCBC is positioning Pulz as a comprehensive solution for Filipinos engaging in global work and remittance flows.

For freelancers paid in dollars or families receiving financial support from the United States, the ability to hold and convert U.S. dollars eliminates unnecessary conversion pressure. It also reduces the need to immediately withdraw or transfer funds, allowing users to plan their finances more efficiently.

Why holding and converting U.S. dollars matters

The RCBC Pulz feature highlights a shift toward more user-centric foreign exchange solutions. In a country where remittances play a vital role in household income, empowering users to decide when to convert their dollars can translate into better value retention.

Beyond convenience, this update reflects how Philippine banks are evolving to meet modern financial behaviors.

As more Filipinos participate in the digital economy, tools that simplify cross-border money management will become essential. By allowing users to hold and convert U.S. dollars seamlessly within the app, RCBC strengthens its position in the competitive digital banking landscape.

Smarter forex control for everyday users

The rollout of the RCBC Pulz feature signals a continued commitment to innovation in Philippine digital banking.

By enabling users to hold and convert U.S. dollars on their own terms, RCBC delivers greater flexibility, improved financial control, and a more responsive banking experience tailored to today’s globally connected Filipino user.