The Philippines’ external financial position showed signs of strengthening in the third quarter of 2025, with the country’s net external liability narrowing significantly after expanding earlier in the year amid rising corporate and government financing needs.

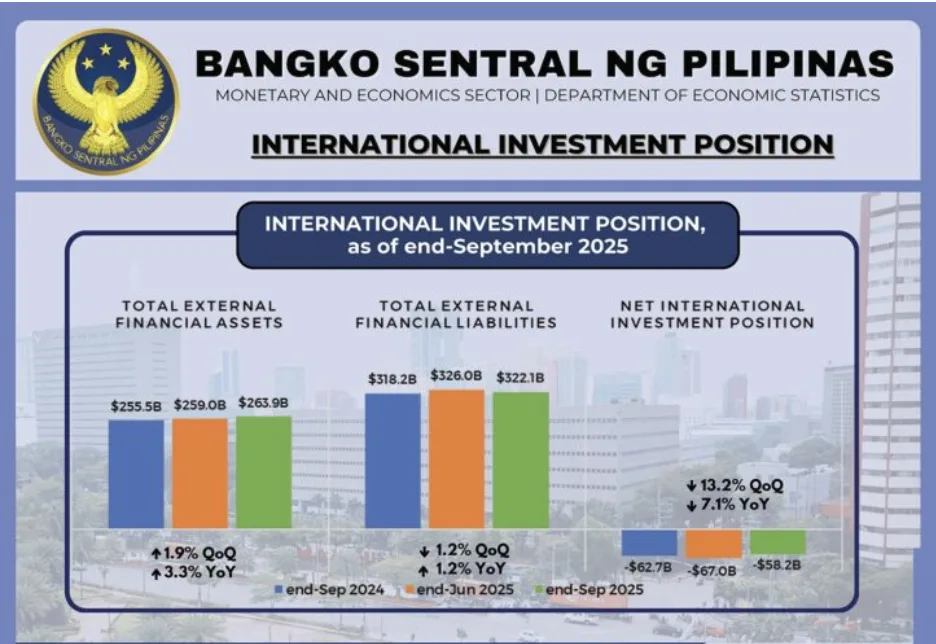

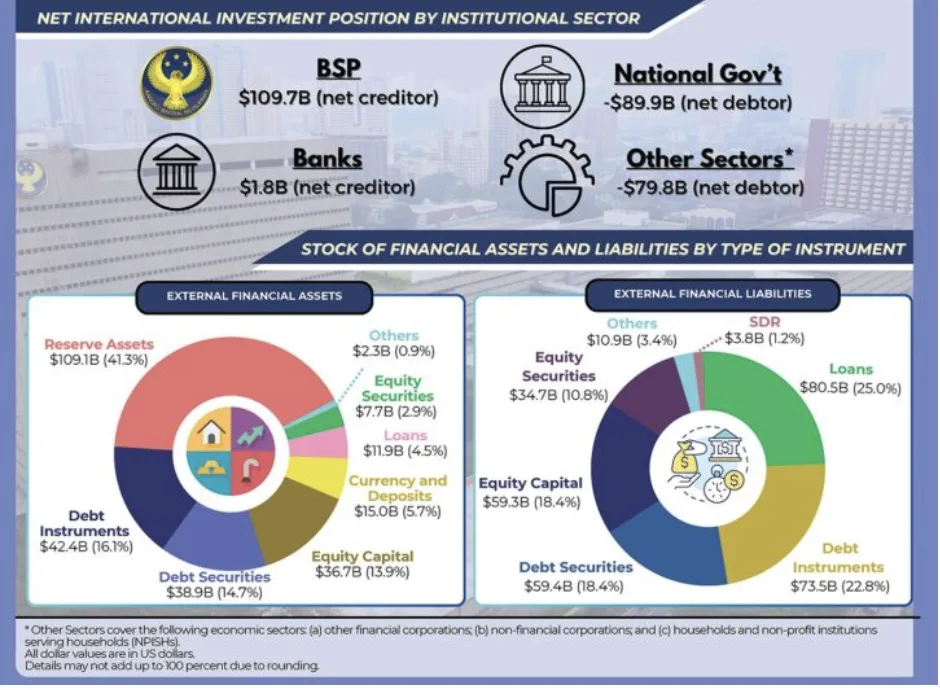

Data from the Bangko Sentral ng Pilipinas (BSP) show that the country’s International Investment Position (IIP)posted a lower net external liability of US$58.2 billion as of end-September 2025, down 13.2 percent from US$67.0 billion at the end of June.

The improvement reflects a combination of higher Philippine investments in foreign assets and a moderation in foreign investments in domestic assets, suggesting a more balanced set of financial links with the rest of the world.

In GDP terms, the net liability position eased to 12.1 percent of output, from 14.1 percent in the previous quarter — pointing to reduced external vulnerability as global financial conditions remain volatile.

Asset growth, easing foreign obligations

As of end-September, Philippine residents’ holdings of foreign financial assets rose by 1.9 percent to US$263.9 billion, while foreign investments in Philippine assets declined by 1.2 percent to US$322.1 billion.

The IIP provides a snapshot of what the country owns and owes internationally at a given point in time and is widely used to assess an economy’s exposure to external shocks and its overall financial resilience.

The latest data indicate that while foreign capital continues to play a significant role in the Philippine economy, asset accumulation abroad and reduced foreign obligations helped improve the country’s net external position in the third quarter.

A contrast to Q2 pressures

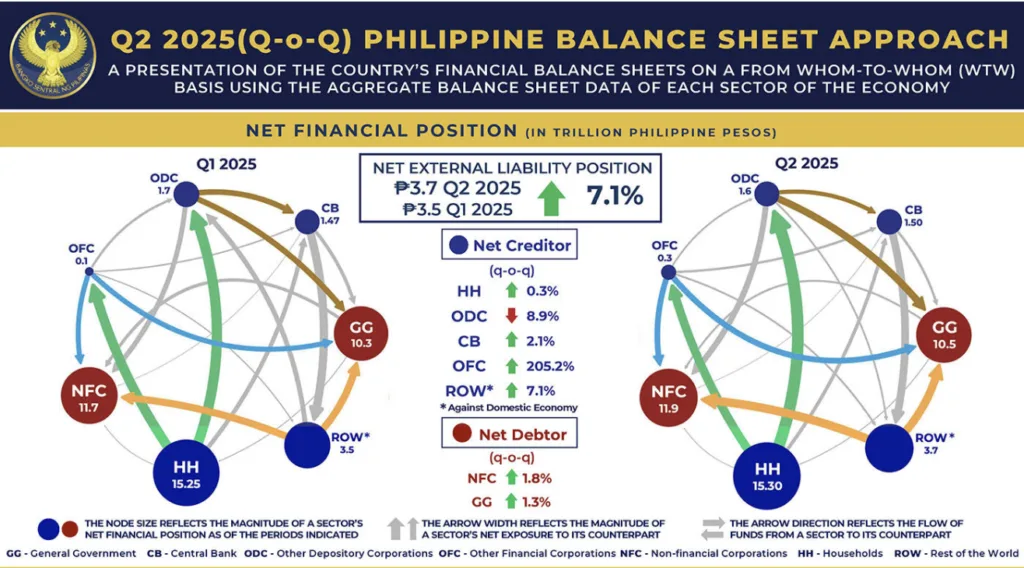

The improvement in Q3 follows a period of mounting external liabilities earlier in the year. Preliminary Balance Sheet Approach (BSA) data show that in Q2 2025, the Philippines’ net external liabilities expanded by 7.1 percent, rising from ₱3.5 trillion in Q1 to ₱3.7 trillion.

The domestic economy’s increased net liabilities to the rest of the world was driven by the rise in non-financial corporations’ external financing in the form of equity and investment fund shares, as well as growth in loans owed by the general government to the rest of the world. [1], [2], [3]

At the same time, the BSP’s investments in debt securities issued by nonresidents declined, contributing to the wider net debtor position. [2]

Non-financial corporations saw their net debtor position rise as equity security liabilities to nonresidents and other financial corporations increased. Loans remained the sector’s primary funding instrument, followed by equity securities, with funding largely sourced from the rest of the world and domestic banks. [4]

Government debt structure offers buffer

The general government’s net external position also widened in Q2, reflecting increased holdings of government securities by nonresidents and financial institutions, as well as higher loans owed to foreign creditors.

However, authorities noted that 70.1 percent of government obligations remained denominated in domestic currency, providing a degree of insulation from exchange rate volatility and helping mitigate balance sheet risks.

The BSA, developed by the International Monetary Fund, complements traditional flow-based analysis by focusing on the outstanding stock of assets and liabilities across economic sectors. It is used by central banks and regulators to identify potential financial stability risks arising from sectoral imbalances and interconnected exposures.

Resilience amid shifting conditions

Taken together, the Q2 and Q3 data suggest a dynamic external position shaped by financing needs, capital flows, and portfolio adjustments.

While corporate expansion and government funding requirements drove higher external liabilities earlier in 2025, the subsequent narrowing of the country’s net external liability points to improving resilience and prudent balance sheet management.

As global financial conditions continue to evolve, policymakers and market participants are expected to closely monitor both the IIP and BSA indicators to assess the sustainability of external financing and the economy’s ability to withstand external shocks.

—

[1] The rest of the world comprises nonresidents, defined as entities whose main economic activities and interests are based outside the economic territory of the Philippines. Typically, they refer to individuals or entities staying in the Philippines for less than one year.

[2] Equity and investment fund shares are financial instruments which represent claims on the residual value of a corporation, usually evidenced by shares and/or stocks.

[3] The general government consists of institutional units that, in addition to fulfilling their political responsibilities and their role of economic regulation, produce goods and services for individuals or collective consumption mainly on a non-market basis, and redistribute income and wealth.

[4] Other financial corporations include trust entities, private and public insurance companies, pre-need companies, holding companies, government financial institutions (specifically government corporations engaged in financial intermediation), non-MMFs covering unit investment trust funds and investment companies, and other financial intermediaries and auxiliaries (consisting of non-banks without quasi-banking functions). Meanwhile, other depository corporations are composed of universal and commercial banks, thrift banks, rural and cooperative banks, digital banks, non-banks with quasi-banking functions, non-stock savings and loan associations, money market funds (MMFs), and offshore banking units.