The Philippines is bracing for a more challenging external environment over the next two years, with the country’s balance of payments (BOP) expected to slip into deficit territory in 2025 and 2026 — just as signs of cooling emerge in the domestic property market.

From a modest surplus in 2024, the BOP is projected to turn negative as persistent global headwinds weigh on trade, investments, and services exports.

The shift reflects a widening current account shortfall, driven largely by a sustained trade-in-goods deficit and softer services receipts, according to latest assessments.

Trade and services lose steam amid rising costs

Merchandise trade is expected to remain subdued amid weaker global demand, easing commodity prices, and slower domestic growth momentum.

While exporters received a temporary boost in early 2025 due to frontloaded shipments ahead of anticipated US tariff adjustments, this is unlikely to offset longer-term structural challenges.

Logistical bottlenecks, skills mismatches, and elevated input costs continue to dampen the country’s export competitiveness.

At the same time, growth in services exports — long a bright spot for the economy — is expected to moderate. Rising costs in the business process outsourcing sector, including higher rentals, utilities, and wages, are narrowing the Philippines’ cost advantage relative to regional peers.

Tourism-related services are facing similar pressures, with higher prices for meals and accommodations potentially tempering growth.

Remittances steady as investments, property growth cool

One source of stability remains overseas Filipino (OF) remittances, which are projected to stay resilient. Strong global labor demand and the continued use of formal transfer channels are expected to cushion inflows, with the proposed US tax on remittances seen to have minimal impact.

Foreign direct investments (FDI), however, are likely to soften from 2024 levels amid cautious investor sentiment and heightened global financial volatility.

Modest gains could materialize over the medium term, supported by recently passed and pending reforms such as the CREATE MORE law, the Capital Markets Efficiency Promotion Act, the Investors’ Lease Act, and the Enhanced Fiscal Regime for Large-Scale Metallic Mining Act, alongside digital infrastructure initiatives like the Konektadong Pinoy Act.

Their impact, analysts note, will hinge on timely and effective implementation.

Despite these pressures, the country’s external buffers remain intact. Gross international reserves are expected to stay at adequate levels, while early warning system indicators on currency and debt sustainability suggest the Philippines remains resilient to external shocks as of the fourth quarter of 2025.

These broader economic dynamics are unfolding alongside a visible moderation in the property market.

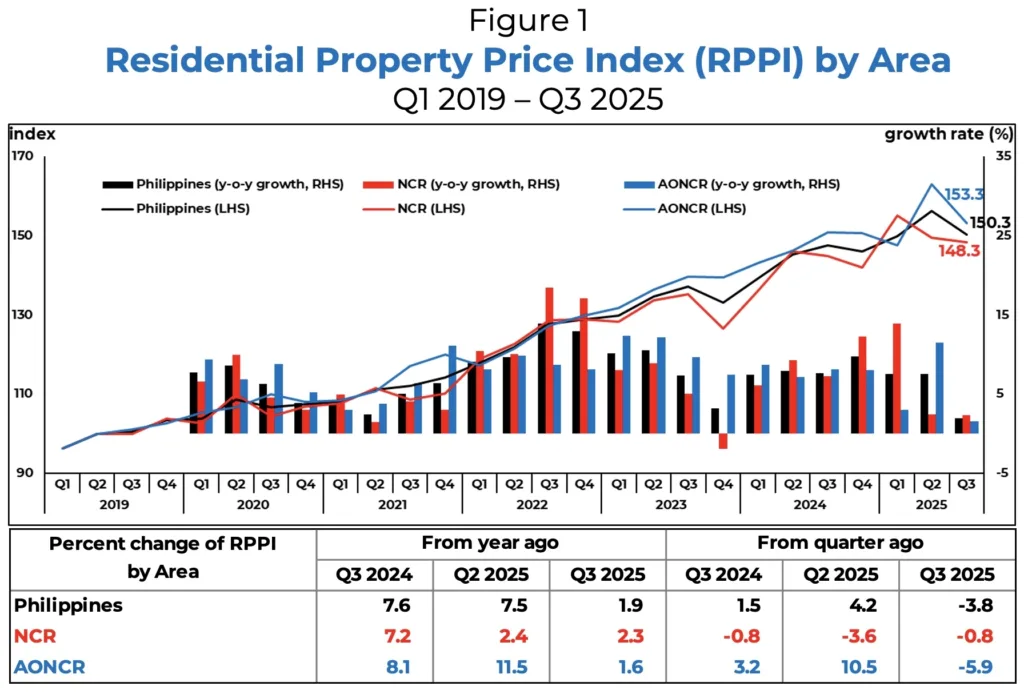

Data from the Bangko Sentral ng Pilipinas (BSP) show that residential property prices grew by 1.9 percent year-on-year in the third quarter of 2025, a sharp slowdown from the 7.5-percent increase recorded in the previous quarter.

Property prices cool as economic caution builds

Price growth in the National Capital Region led the market at 2.3 percent, while areas outside the NCR posted a more modest 1.6-percent increase.

By housing type, prices of houses — including single-detached units, townhouses, and duplexes — rose by 1.9 percent, significantly slower than the double-digit growth seen in Q2.

Condominium prices, meanwhile, rebounded slightly, posting a 1.4-percent increase after contracting in the previous quarter.

The Residential Property Price Index, which is based on banks’ data on actual housing loans, is among the key indicators monitored by the BSP to assess real estate and credit market conditions. (You can view the full report here).

Taken together, the softening pace of property price growth and the expected deterioration in the external accounts point to a more cautious economic environment ahead.

While the Philippines remains fundamentally resilient, policymakers face the challenge of navigating global uncertainty while sustaining domestic growth — a balance the BSP says it will continue to support through proactive engagement and close monitoring of emerging risks.