Travel has always been part of the Filipino spirit.

In 2024 alone, the Bureau of Immigration reported that 8 million Filipinos departed for international trips, while countless more explored local gems — from the powdery white sands of Boracay and Palawan to the cultural festivals of Vigan and Iloilo.

Whether it’s a quick beach getaway, a family road trip, or an overseas adventure, travel represents joy, freedom, and discovery. But behind the promise of new experiences lurk unexpected challenges: flight cancellations, accidents, sudden medical emergencies, or even lost luggage. These unwelcome surprises can quickly transform a dream vacation into a financial and emotional burden.

Recognizing this, the Palawan Group of Companies has launched Palawan ProtekTODO Travel Insurance, a payment-linked protection solution that helps Filipino travelers safeguard their trips while keeping costs affordable.

Payments and protection in one

At its core, ProtekTODO highlights how financial services and payments innovation are becoming more intertwined with daily life. Insurance — once considered a luxury or an afterthought — is now easier to access and pay for through digital wallets and online platforms.

Contrary to the belief that travel insurance is for big spenders, ProtekTODO plans start at just ₱39, yet coverage can go up to ₱1.5 million. Travelers are protected against trip delays and cancellations, medical emergencies, and logistical mishaps. That means with one small payment, a traveler can reduce the risk of major financial losses while abroad or in the provinces.

“We want every Filipino to feel secure and confident, no matter where they go,” said Karlo M. Castro, President and CEO of Palawan Group of Companies. “With Palawan ProtekTODO, we’re making travel insurance ‘mura, mabilis, at walang kuskos balungos’ (affordable, fast, and hassle-free). Every traveler deserves peace of mind and financial protection; that’s why we’re making affordable and dependable coverage accessible to everyone.”

Digital payments driving accessibility

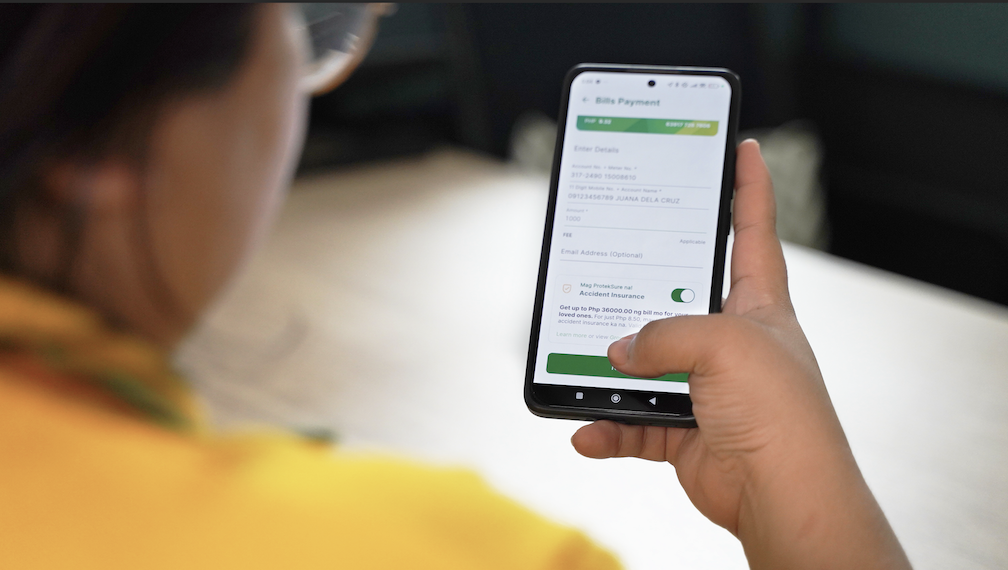

One of the strongest innovations of ProtekTODO is its payment accessibility.

Coverage can be purchased seamlessly through the PalawanPay App, a growing e-wallet with millions of active users, or at Palawan Pawnshop – Palawan Express Pera Padala branches nationwide. For online shoppers, the product is also available on Shopee and Lazada, integrating travel protection into the broader digital payments ecosystem.

This multi-channel approach bridges traditional and digital finance, making sure that whether someone is a frequent traveler booking online or a family planning a domestic trip, they can pay and secure insurance coverage in ways that suit their lifestyle.

The ease of payment is key, particularly as Filipinos increasingly adopt QR Ph payments, e-wallets, and online banking. By embedding ProtekTODO into these systems, Palawan is not just selling insurance — it is turning protection into a frictionless financial transaction.

Why it matters for travelers and payments growth

For Filipino travelers, ProtekTODO represents a mindset shift: insurance is no longer a luxury but an essential part of travel planning. Just as flights, hotel bookings, and tours are paid in advance, so too can protection now be integrated into the payment journey.

This is particularly relevant in a country where unexpected medical expenses or disruptions can strain household finances. With affordable premiums and seamless digital payments, Filipinos are empowered to travel smarter and safer.

Moreover, as more consumers embrace subscription-style services and recurring payments, ProtekTODO aligns with the broader fintech trend of embedding financial services into everyday experiences — whether that’s paying bills, topping up load, or securing travel coverage with just a few taps.

A brand trusted for almost four decades

The Palawan Group of Companies, long known for its pawnshop and remittance services, has expanded into microinsurance, e-wallets, and payments. With over 70,000 branches, outlets, and money shops nationwide, the group has built trust among millions of Filipinos, especially in underserved areas.

Its e-wallet, PalawanPay, extends this reach into the digital age, offering services like QR Ph payments, bill settlements, pawn renewals, jewelry purchases, and now, ProtekTODO insurance. By leveraging its deep market penetration, Palawan is transforming how Filipinos think about payments — from simple transactions to tools that enable security and peace of mind.

Travel smart, pay smarter

As travel continues to rebound, Palawan ProtekTODO Travel Insurance stands out as more than just an insurance product. It is a payments-driven innovation designed to give every Filipino traveler confidence and control over their journeys.

With affordable coverage, easy digital purchase options, and strong brand trust, ProtekTODO is helping redefine the travel experience: not just about where you go, but how well you’re protected when you get there.

Because in today’s fast-moving world, paying smarter means traveling safer.