The Monetary Board has released its latest balance of payments (BOP) projections for 2024 and 2025, reflecting an optimistic outlook buoyed by global economic expansion and robust domestic demand.

These projections, approved during the board’s meeting earlier this week, incorporate the latest data and developments, signaling a cautiously positive external outlook for the coming years.

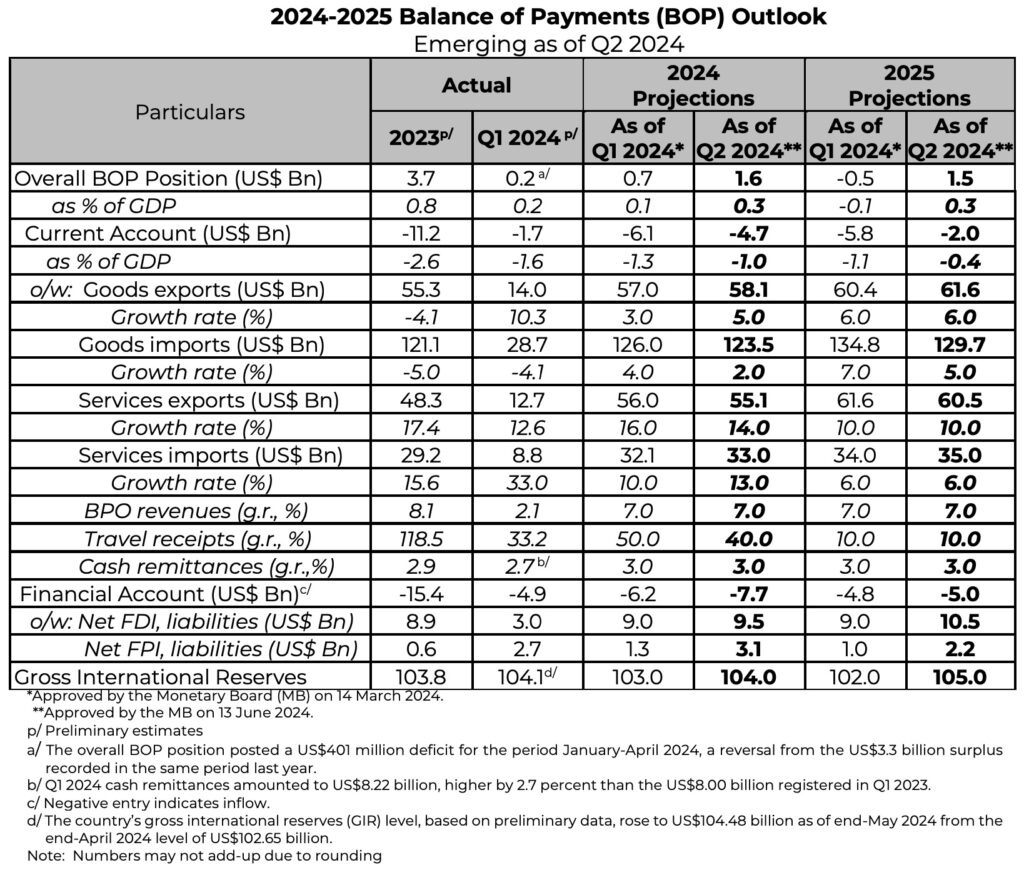

In a virtual briefing, BSP Department of Economic Research Director Sittie Hannisha Butocan announced that the central bank expects the balance of payments (BOP) to register a surplus of USD 1.6 billion this year, a significant increase from the earlier forecast of USD 700 million.

“This improvement is driven by a lower current account deficit and higher non-resident investment inflows. The reduction in the current account gap is primarily due to the narrowing merchandise trade deficit, with goods import growth projected to moderate to 2 per cent, partly because of the continued easing of international commodity prices,” Butocan explained.

She also noted that goods export growth has been revised upward to 5 per cent from the initial 3 per cent estimate, thanks to a better-than-expected performance in the first quarter, fueled by a robust recovery in global electronics demand.

“Additionally, the sustained expansion of travel receipts, projected at 40 per cent, will further support the current account, although this is lower than the previous forecast of 50 per cent due to base effects,” Butocan added.

Global and domestic economic dynamics

According to the Philippine Monetary Board, the global economy is set to grow at a slightly faster pace in 2024 than previously projected, driven by a stronger-than-expected performance from advanced economies, particularly the United States, which posted robust GDP growth in Q4 2023.

This growth is expected to counterbalance a slowdown in China, while forecasts for world trade in 2024 and 2025, though lower than earlier projections, still surpass 2023 levels. Overall, the global economic landscape remains stable, with balanced risks to growth.

Domestically, the Philippines is projected to sustain its growth momentum, supported by structural reforms, new bilateral trade deals, increased digitalization, and full local government devolution.

The recovery in electronics and semiconductor exports, coupled with steady growth in services trade, particularly in tourism and business process outsourcing (BPO), further boosts the trade outlook. Additionally, easing inflation is expected to enhance consumer and investment demand, reinforcing the positive domestic economic environment.

The Monetary Board’s BOP outlook

For 2024, the overall BOP position is expected to record a higher surplus than previously anticipated. This improvement is driven by a reduced current account deficit and increased non-resident investment inflows.

The narrowing trade gap, bolstered by recovering electronics and semiconductor exports, and the Regional Comprehensive Economic Partnership (RCEP) Agreement, which enhances market access and export competitiveness, are key contributors.

Travel receipts, BPO revenues, and steady remittances from overseas Filipinos also support the current account. Moreover, foreign direct investments (FDIs) and foreign portfolio investments (FPIs) are projected to yield higher net inflows, thanks to favorable first-quarter figures and the implementation of investment-friendly reforms.

In 2025, the BOP position is projected to remain in surplus, supported by a narrower current account balance and higher financial account inflows. While services trade receipts are expected to grow robustly, they may not fully offset the trade deficit due to substantial goods imports.

Non-resident investment flows are anticipated to remain positive, though modest, as investors navigate potential policy shifts with new political leaders taking office in over 50 economies. Geopolitical tensions, particularly between Russia and Ukraine and in the Middle East, continue to pose risks to the external sector outlook.

BSP’s vigilance on external developments

The Bangko Sentral ng Pilipinas (BSP) acknowledges the limitations of these forecasts amidst evolving external challenges. The BSP remains vigilant, closely monitoring emerging external sector developments and risks to ensure the fulfilment of its price and financial stability objectives.

As the global and domestic economic landscapes evolve, the Monetary Board’s latest BOP projections offer a cautiously optimistic view, underscoring the resilience and potential of the Philippine economy in the face of both opportunities and uncertainties.

Looking ahead, the BSP remains ready to adjust its monetary policy settings as necessary, in line with its primary mandate to safeguard price and financial stability.