MariBank has rolled out a broad set of updates to its consumer-facing services this January 2026, expanding free transfers, payment-linked rewards, debit card cashback, and overseas spending features.

The changes reflect a continued shift among Philippine digital banks toward transaction-driven engagement, as pressure builds across the sector to show sustainable usage beyond headline deposit growth.

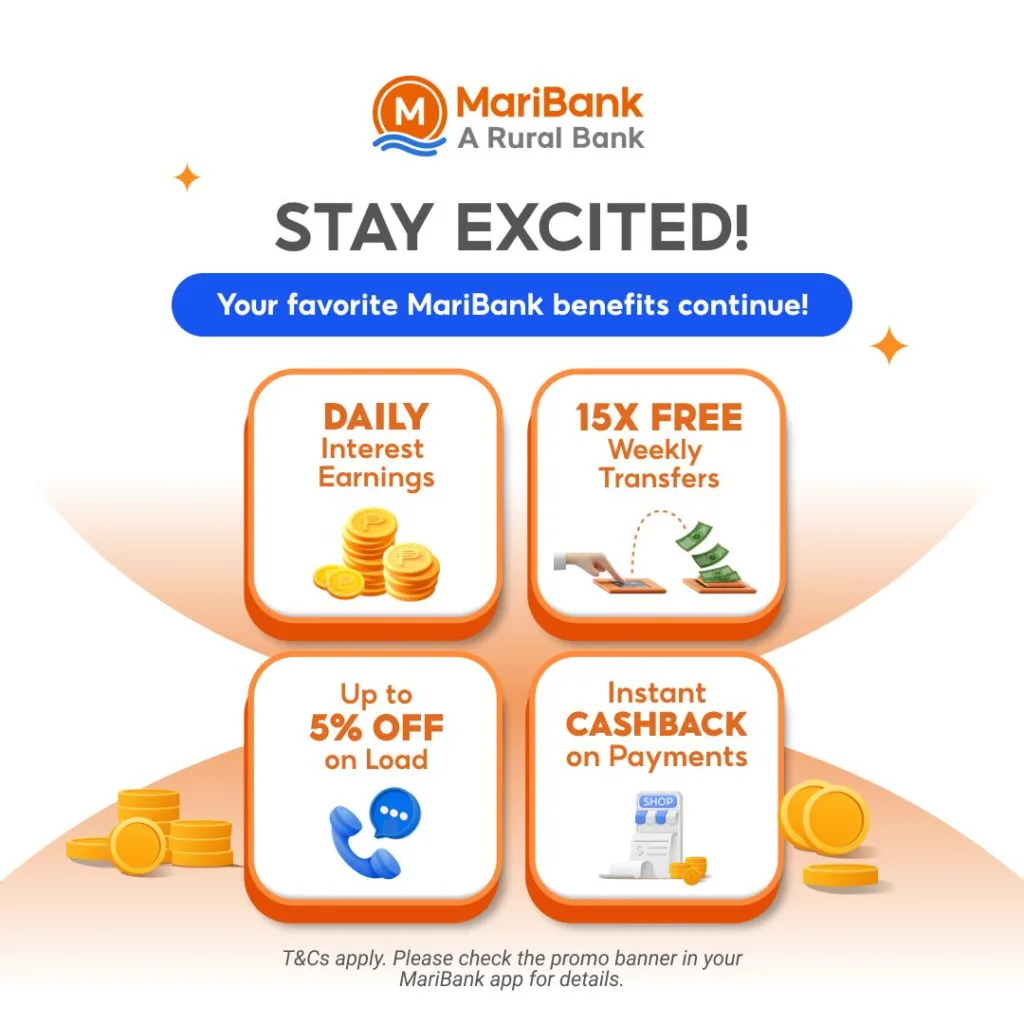

Photo Credit: MariBank Philippines, Inc. (A Rural Bank)’s LinkedIn Post

Rather than introducing a single flagship product, MariBank’s January updates span multiple everyday banking touchpoints — payments, transfers, card usage, and travel-related spending—signaling a strategy focused on increasing activity frequency within its existing user base.

Expanded transfer and bills payment features

MariBank continues to waive fees on select outbound transfers, allowing users to make up to 15 free transfers per week to other banks and e-wallets. The move comes as several digital banks have begun reintroducing transfer fees amid rising operating and compliance costs.

Photo Credit: MariBank Philippines, Inc. (A Rural Bank)’s Facebook Post

In parallel, MariBank has retained cashback incentives tied to bills payment activity. Users paying bills worth at least ₱500 may receive ₱5 cashback per transaction, capped at ₱50 per month, subject to eligibility rules.

While modest in value, these features are designed to anchor MariBank as a primary transactional account rather than a passive savings wallet.

Payments-led incentives through QR and ecosystem use

MariBank has also expanded incentives linked to QRPh-enabled payments, offering small cashback rewards for Scan & Pay transactions above a minimum spend. Eligible users may receive ₱2 per transaction, with a monthly transaction cap.

Photo Credit: MariBank Philippines, Inc. (A Rural Bank)’s Instagram Post.

The bank’s integration with ShopeePay further reinforces its ecosystem-led approach. Users paying through ShopeePay while selecting MariBank as the funding source may receive discounts of up to 25%, depending on the specific campaign and merchant.

Industry observers note that such cross-platform incentives allow ecosystem-backed banks to stimulate activity without relying solely on balance sheet-driven products such as high-yield deposits.

Mobile load and micro-transaction engagement

MariBank has refreshed its Mari Mega Load feature, offering discounts of up to 10% on selected prepaid load products on specific days of the week.

Photo Credit: MariBank Philippines, Inc. (A Rural Bank)’s Instagram Post.

Although small in ticket size, prepaid load remains a high-frequency transaction category in the Philippines. Digital banks increasingly use these micro-transactions to encourage habitual app usage and position themselves as daily financial tools rather than occasional banking alternatives.

Higher debit card cashback limits

Among the more notable January updates is the increase in MariBank’s monthly debit card cashback cap, which has been raised to ₱3,000, from ₱1,000 previously.

The higher ceiling applies to qualifying card transactions and aligns with a broader industry trend of repositioning debit cards as everyday spending instruments — particularly as credit card penetration in the Philippines remains relatively low.

By incentivizing debit card use, digital banks can drive interchange-linked revenue while deepening customer reliance on their platforms.

Overseas spending and travel-related updates

MariBank has also expanded features tied to international usage of its physical debit card, an area where digital banks have increasingly sought differentiation.

The bank no longer charges its own fees for international ATM withdrawals, though users may still incur charges imposed by overseas ATM operators. In addition, MariBank has removed foreign transaction fees on in-store card purchases made abroad.

Complementing these changes are cashback incentives for overseas spending, including cashback on international in-store purchases and on select travel-related bookings made through global travel platforms.

These updates position MariBank’s debit card as a lower-friction option for users traveling or spending overseas, at a time when Filipino outbound travel continues to recover.

Physical debit card fee rebate

For newly issued physical debit cards, MariBank is offering a card fee rebate tied to in-store usage. Users who complete a set number of in-store transactions within a defined period after card activation may receive a refund of the card issuance fee.

Such incentives are commonly used to encourage physical card activation and transition users from virtual-only to card-based transactions.

A payments-first strategy under pressure to scale

Taken together, MariBank’s January 2026 updates point to a clear operational focus: increasing transaction volume across payments, cards, and everyday financial activity, rather than competing aggressively on deposit rates alone.

This approach mirrors a broader recalibration across the Philippine digital banking sector, where early-stage user acquisition has given way to questions around engagement quality, unit economics, and long-term sustainability.

For MariBank, whose roots lie in payments and commerce-linked financial services, the emphasis on transfers, QR payments, and card usage only underscores a bet that scale and frequency — rather than yield — will define the next phase of digital banking competition.