As artificial intelligence (AI) continues to blur the lines between real and fake, U.K.-based biometrics company iProov has achieved a global milestone: it is now the first and only vendor to meet the new biometric verification requirements under the latest U.S. National Institute of Standards and Technology (NIST) Digital Identity Guidelines.

The announcement marks a significant step forward in the global fight against AI-driven identity fraud, especially as deepfake and synthetic media threats rise across industries that rely on digital verification.

According to iProov, independent testing has confirmed that its Dynamic Liveness technology meets the strict new standards set out in NIST Special Publication 800-63-4, which now includes resilience against deepfakes and other AI-generated attacks.

The company’s compliance was validated through an ISO-accredited laboratory test against the CEN 18099 injection attack standard, alongside its FIDO Face Verification Certification and other accreditations covering accessibility, privacy, and cybersecurity.

The NIST 800-63-4 guidelines — the digital identity playbook used by U.S. federal agencies — serve as a global benchmark for governments and enterprises looking to enhance digital trust. The latest revision not only tightens the rules for biometric verification but also introduces new safeguards against emerging threats such as deepfakes, mandating phishing-resistant authentication for high-assurance scenarios (AAL3).

“iProov is the only vendor proven to deliver the highest level of protection against the full spectrum of real-world threats,” said Andrew Bud, founder and CEO of iProov. “This matters because biometric verification is becoming the root of trust for authenticity in the AI world — and Gen-AI-based attacks are now too sophisticated for legacy systems to stop.”

Bud added that the company’s Security Operations Center (iSOC) provides continuous monitoring to detect and neutralize threats, offering what he described as “protection purpose-built for today’s risk environment.”

Among iProov’s partners is ID.me, which provides secure access to digital government services in the U.S. “While NIST recognizes multiple verification pathways, biometric verification remains among the most secure and inclusive ways to confirm identity and prevent fraud,” said Blake Hall, ID.me founder and CEO. “iProov is a trusted partner in this mission, meeting rigorous NIST standards and staying ahead of increasingly sophisticated AI-driven threats.”

Rising deepfake threats in PH fintech landscape

As the Philippines rapidly embraces digital financial services, with over 50% of retail transactions now conducted through digital payments, a new and insidious threat looms: AI-driven deepfake attacks targeting digital identity systems.

These “digitally injected” forgeries, including a sophisticated variant known as “Grey Nickel,” are beginning to challenge the integrity of remote onboarding and Know Your Customer (KYC) processes — the backbone of the country’s fintech expansion.

In an exclusive interview with FintechNewsPH, Dominic Forrest, Chief Technology Officer at iProov, explained how these attacks can bypass conventional identity verification systems, particularly those reliant on single-frame “selfie” checks or static liveness tests.

Dominic Forrest, Chief Technology Officer at iProov

“The country’s mobile-first approach has created ideal conditions for sophisticated attacks like Grey Nickel to thrive,” Forrest said. “As more consumers are onboarded remotely via mobile devices, KYC systems have become a critical frontline defense. However, many existing systems struggle to keep pace with the speed and scale of digital onboarding, leaving vulnerabilities that advanced deepfake and injection attacks can exploit.”

The Philippines’ rapid fintech growth — fueled by the BSP’s Digital Payments Transformation Roadmap and an expanding base of virtual asset providers and digital banks — has made secure identity verification a national priority. Experts warn that without strong defenses, AI-generated fraud could undermine consumer trust and stall progress toward financial inclusion.

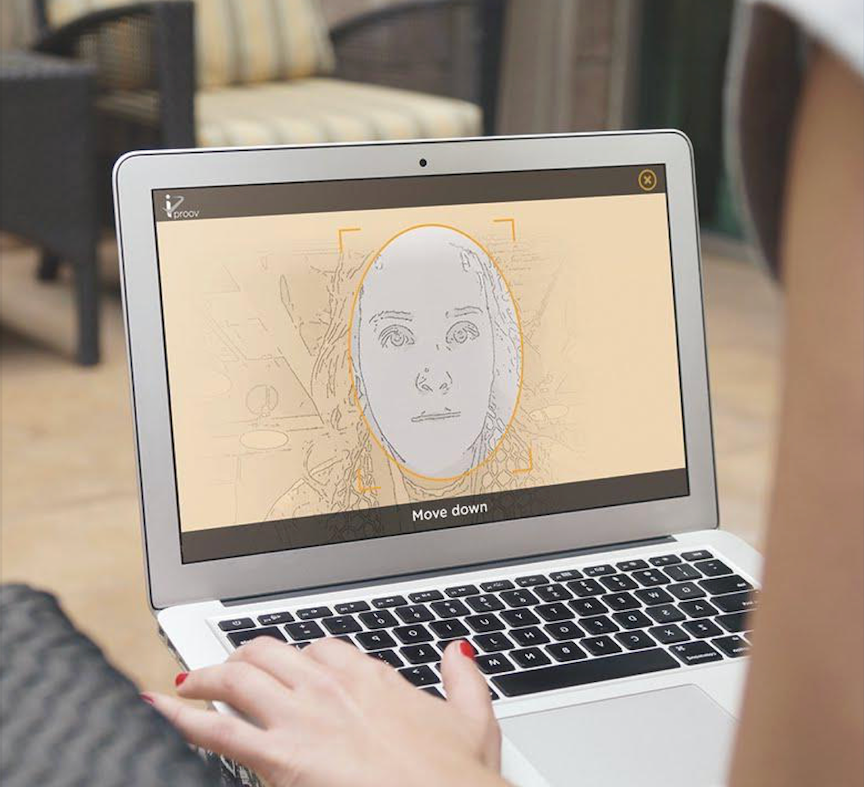

Forrest added that Dynamic Liveness, iProov’s patented facial authentication technology, could help local banks and fintech firms strengthen their verification systems. The technology detects genuine human presence in real time, ensuring that a live user — not a replayed or synthetically generated image — is accessing the system.

“Biometric verification is no longer just about convenience,” Forrest said. “It’s about protecting the digital economy from AI-driven fraud. As the Philippines scales its digital transformation, implementing standards-based, independently tested technology will be crucial for maintaining both trust and inclusion.”

Setting a global standard for digital trust

The company’s suite of certifications underscores its alignment with NIST’s updated framework:

- Injection Attack Detection (IAD): Passed CEN TS 18099 Level 2 (High) testing — the world’s first and only standard focused on deepfake and forged-media resilience — verified by ISO 17025-accredited Ingenium Biometrics in September 2025.

- Presentation Attack Detection (PAD): Certified under the FIDO Face Verification Certification Program, ensuring robustness against masks, photos, and replay attacks.

- High-Assurance Identity Proofing: Certified to eIDAS 2 Level of Assurance High, equivalent to the top NIST AAL3 standard.

- Information Security: Independently audited to SOC 2 Type II and CSA STAR Level 2.

- Accessibility and Privacy: Compliant with WCAG 2.2 Level AA and externally audited for GDPR adherence.

Trusted by the U.S. Department of Homeland Security, U.K. Home Office, GovTech Singapore, ING, and UBS, iProov’s latest achievement signals a new benchmark for biometric resilience — one that Philippine financial institutions may soon look to adopt as AI-generated fraud becomes an everyday reality.

As digital transformation accelerates across Southeast Asia, the message is clear: authenticity is the new frontier of security — and the Philippines, one of the world’s most dynamic fintech markets, must stay ahead of the curve to protect its digital future.