Cashback promotions from credit card companies are no longer just marketing hooks — they’ve evolved into strategic tools that banks use to influence spending behavior, foster card loyalty, and accelerate digital payments adoption.

Using RCBC’s multi-tiered cashback campaigns as a case study, this report examines how Filipino consumers respond to reward-driven finance, the economics behind cashback offers, and whether such incentives truly promote financial inclusion or simply encourage short-term consumption.

Cashback rewards: A growing trend

In recent years, cashback reward programs have become a defining feature of the Philippines’ consumer landscape.

According to PayNXT360, spending on these programs reached USD 953.78 million in 2023 and is projected to climb to USD 2 billion by 2029.

This growth signals that cashback rewards are no longer occasional perks for many consumers. They are becoming a core part of everyday financial habits, shaping how people spend, promoting card loyalty, and driving the adoption of digital payment methods.

However, cashback programs primarily benefit consumers with disposable income, leaving lower-income individuals largely excluded.

These incentives can also encourage spending beyond one’s means. This underscores the importance of financial literacy, enabling all consumers to manage finances wisely.

Understanding cashback reward programs

At its core, a cashback reward program allows customers to earn a small percentage back on qualifying purchases. The mechanics, however, vary depending on the program structure.

Some common models include:

- Percentage-based cashback: Customers earn a fixed percentage of their purchase amount, credited as store credit, cash, or points.

- Threshold-based cashback: Rewards require a minimum spend to qualify.

- Instant vs. delayed rewards: Instant rewards can be redeemed immediately, while delayed rewards are credited later.

Cashback can be claimed through statement credits, direct deposit, checks, or gift cards, depending on the program.

Case study: RCBC’s cashback model

Rizal Commercial Banking Corporation (RCBC) is among the Philippines’ largest universal banks. Its credit card division has grown rapidly, with receivables rising 44% from 2024 to 2025 and 1.326 million active cards as of March 2025, marking a 22% increase in active cardholders.

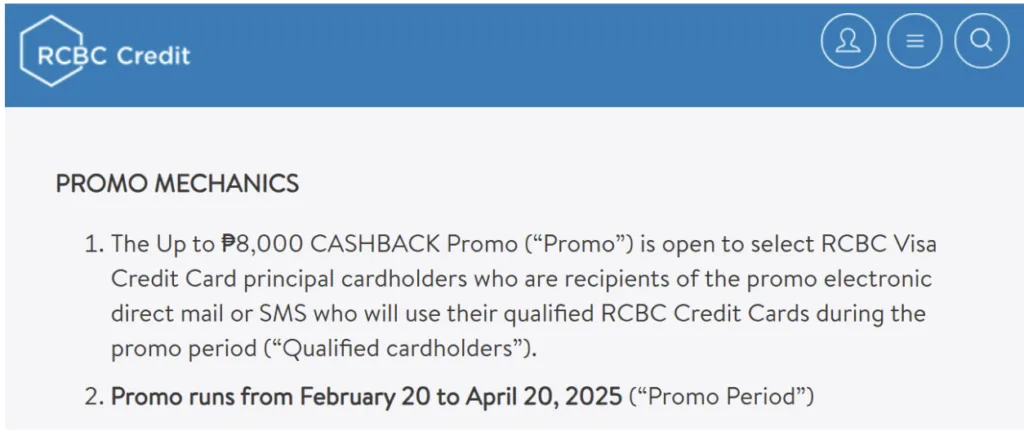

A notable example is RCBC’s EXCLUSIVE: Up to ₱8,000 CASHBACK promo. Analysis of this promotion reveals how tiered cashback structures are designed to shape consumer behavior.

Limited-time promotions

RCBC’s cashback offer ran from February 20 to April 20, 2025, creating a sense of urgency and exclusivity. Limited-time windows leverage fear of missing out, motivating consumers to engage with the promotion quickly.

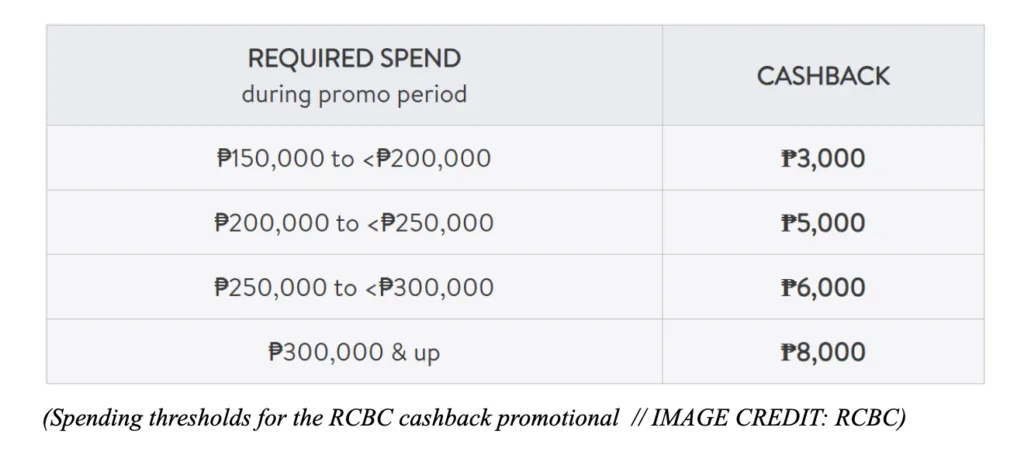

Tiered spending rewards

The bank uses a threshold-based model, incentivizing higher spending by increasing cashback rewards per tier. Research from Loyalty Works shows tiered structures are more engaging, offering a sense of progress that encourages consumers to spend more — a phenomenon known as the goal-gradient effect.

Everyday transaction incentives

By applying cashback to everyday purchases, RCBC encourages cardholders to use their credit cards consistently.

This strengthens card loyalty, promotes cashless payments, and accelerates digital spending, making the card more relevant for day-to-day and online transactions.

Accessible, but not always inclusive

Cashback programs are often praised for accessibility: cardholders can earn rewards with minimal requirements and redeem them easily.

Yet, the reality is that most loyalty programs benefit those with higher disposable income. Rewards are structured to give more to those who spend more, inadvertently reinforcing income gaps.

Additionally, spending thresholds can push cardholders to stretch finances to maximize cashback rewards. This highlights the need for financial literacy, ensuring consumers engage with these programs responsibly and consider their long-term financial well-being.

Looking at the bigger picture

Cashback reward programs are more than marketing tools.

They have the power to influence spending behavior, foster card loyalty, and promote digital payments — but they also come with potential risks.

For consumers, understanding how these programs work and using them wisely is key to turning rewards into meaningful financial benefits.