GoTyme Bank, one of the leading digital banks in the Philippines, has forged a strategic partnership with the Bangko Sentral ng Pilipinas (BSP) to provide a seamless way for Filipinos to convert their loose change into savings.

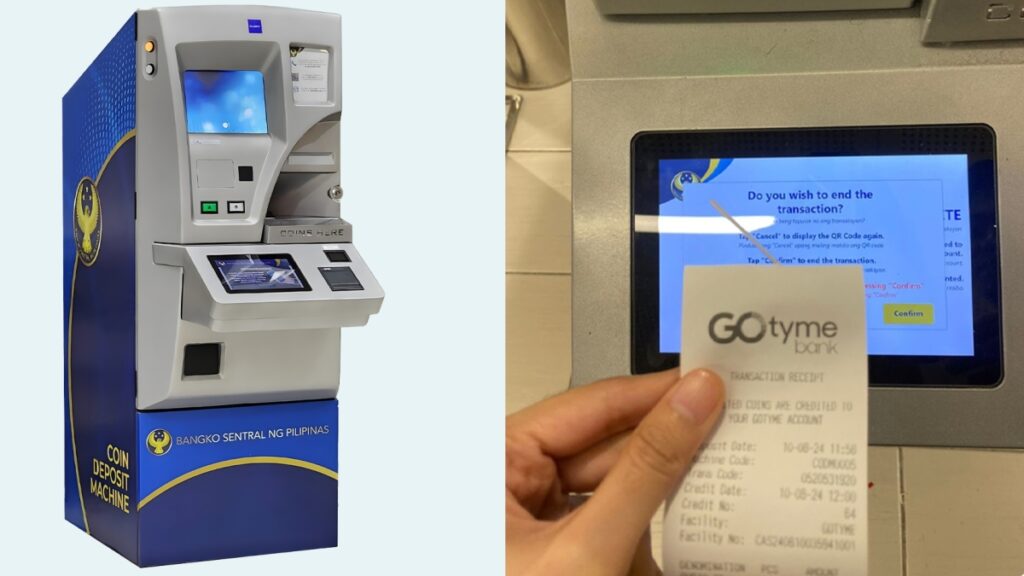

The bank is the first financial institution to integrate with the BSP’s innovative coin deposit machines (CoDMs), launched to help combat the country’s artificial coin shortage and encourage coin recirculation.

In 2023, the BSP launched a campaign encouraging Filipinos who have accumulated idle coins to convert them into e-wallet credits or shopping vouchers by using Coin Deposit Machines (CoDM). These CoDMs were installed in key locations within the Greater Manila Area: two in SM Mall of Asia, Pasay City; and one each in SM City North EDSA in Quezon City, SM City Fairview, also in Quezon City; SM City San Lazaro in Manila; SM City Bicutan in Parañaque; SM City Bacoor in Cavite; SM Megamall in Mandaluyong City; SM City Grand Central in Caloocan; SM City Marilao in Bulacan; SM City Taytay in Rizal; and SM Hypermarket FTI in Taguig City.

GoTyme Bank and BSP partnership to further financial inclusion

This partnership marks a significant milestone for both GoTyme Bank and BSP, furthering financial inclusion by making it easier for individuals to deposit their coins, which often go unused.

Customers of GoTyme can now conveniently use these CoDMs to deposit their coins and have the amount credited directly to their GoTyme savings account.

GoTyme Bank customers can take advantage of the CoDMs at select locations to deposit coins of various denominations. The process is designed to be straightforward and user-friendly.

After depositing the coins into the machine, users are provided with a barcode, which they can scan using the GoTyme app to credit the amount into their savings account.

Alternatively, customers may manually enter the code provided by the machine.

Addressing the artificial coin shortage

This partnership aims to make the handling of small amounts of money more efficient and accessible. The integration of GoTyme into the BSP’s CoDM initiative presents a sustainable, long-term solution to the accumulation of idle coins in homes and businesses, facilitating their return to circulation.

“The ability to deposit coins directly into a savings account is a game-changer for Filipinos who want to make the most of every centavo. It’s a simple yet powerful way to encourage savings and support the recirculation of coins, which are crucial to our economy,” said a spokesperson from GoTyme Bank.

The BSP launched the CoDM project on June 20, 2023, in response to the ongoing issue of artificial coin shortages in the Philippines. According to the BSP, the perceived shortage is largely due to coins being hoarded, left idle in households, or simply underutilized in daily transactions.

The introduction of CoDMs provides an effective mechanism to put these coins back into circulation, alleviating the shortage while promoting savings behavior among Filipinos.

BSP Governor Eli Remolona stated that the coin deposit machines are a vital part of the central bank’s efforts to ensure efficient currency circulation in the country. “The CoDM initiative addresses two key issues at once: it mitigates the artificial coin shortage while encouraging the public to utilize even their smallest denomination of currency,” he explained.

Promoting financial inclusion

The partnership between GoTyme Bank and BSP aligns with the government’s broader objective of promoting financial inclusion across the country.

GoTyme, known for its digital-first approach, is committed to providing accessible financial services to Filipinos, many of whom are still unbanked or underbanked.

By allowing customers to deposit coins directly into their savings accounts, GoTyme Bank is making banking services more inclusive, especially for those who might not have access to traditional banking institutions or who have limited means of saving.

This collaboration also highlights the potential of digital banking to expand the reach of financial services and improve financial literacy among the population.

How CoDMs Work

The CoDMs are specially designed to accept coins in various denominations, from centavos to pesos.

Once deposited, the machine counts the total value of the coins and issues a receipt with a unique barcode. Users can then scan this barcode using the GoTyme app, instantly crediting their account with the deposited amount. Alternatively, users can manually input the code on the app.

With this technology, BSP and GoTyme Bank hope to make the process of dealing with loose change more convenient and efficient, ultimately encouraging more Filipinos to engage in regular saving habits, no matter how small the amount.

As the first bank partner to be integrated into the BSP’s CoDM initiative, GoTyme Bank is setting the stage for other financial institutions to follow suit. This partnership exemplifies the potential for innovative collaborations between digital banks and the central bank to address everyday financial challenges while fostering a culture of saving and financial responsibility.

The BSP plans to expand the deployment of CoDMs across various locations in the Philippines, enabling more Filipinos to take advantage of the service and contribute to the overall goal of enhancing currency circulation in the country.