Special Report by Edielyn Mangol, Reporter

GCash, the Philippines’ dominant fintech platform and celebrated “double unicorn,” is barreling toward one of the country’s most anticipated initial public offerings (IPO). Yet, as excitement builds for what could be a defining moment for the nation’s startup ecosystem, a dark cloud now hangs over its ambitions: a massive cache of alleged user data has surfaced for sale on a dark-web forum.

If confirmed, the alleged breach would mark one of the largest data exposures in Philippine fintech history, threatening not only GCash’s credibility but also investor confidence in the broader digital finance sector.

As the company prepares to prove itself on the global stage, questions are mounting about whether the country’s biggest fintech success story can withstand this sudden test of trust.

What happened: The alleged GCash data leak

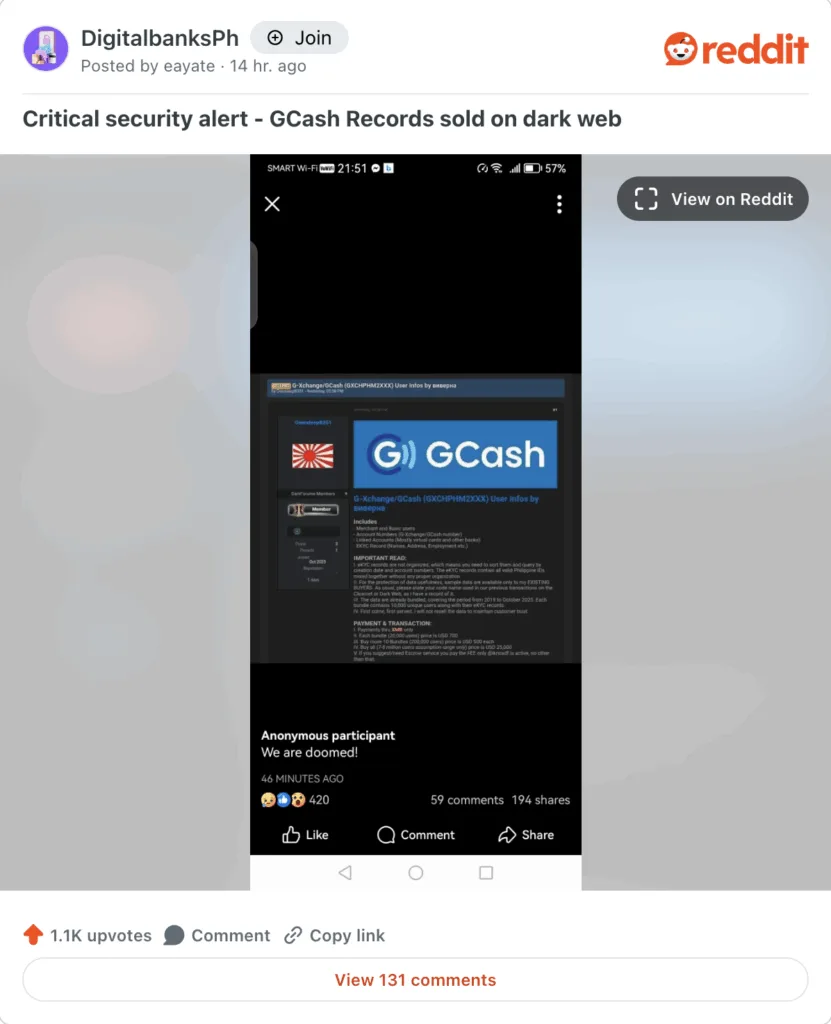

The controversy began when a dark web user going by the handle “Oversleep8351” posted a listing claiming to possess GCash user data spanning from 2019 to October 2025. The seller alleged that the trove contained sensitive information such as eKYC (Know Your Customer) records, linked bank accounts, GCash wallet numbers, and other personal identifiers.

According to the listing, both merchant and regular user accounts were affected. The files reportedly included names, addresses, employment histories, and even scanned copies of valid Philippine IDs. The seller claimed the full database covered around seven to eight million users and was being sold in bundles priced up to £20,800 (about US $25,000), payable exclusively in Monero (XMR) — a cryptocurrency favored for its privacy features.

Adding to the intrigue, the seller described the dataset in a post as “unorganized,” meaning buyers would need to manually sort and categorize the information. They also stated that only “existing buyers” from previous dark web transactions would be allowed to purchase, suggesting this was not a one-off leak but part of a recurring pattern of illicit data trade.

If authenticated, the breach would represent a massive cybersecurity failure for a company whose brand is synonymous with digital trust and financial innovation in the Philippines. For GCash, which processes billions in transactions and has become the go-to mobile wallet for millions, the reputational stakes could not be higher.

IPO in jeopardy: A critical moment for Philippine fintech

The timing of the alleged data breach could hardly be worse. GCash’s much-awaited IPO is widely viewed as a “game-changer” for the Philippine startup scene—a symbolic moment that could define the country’s tech ambitions for years to come.

Paulo Campos III, founding managing general partner at Kaya Founders, underscored the importance of successful exits like GCash’s in inspiring future entrepreneurs. “We need to encourage founders and investors that there is an exit potential—that their investment of time or capital in startups can lead to outcomes that benefit everyone,” he said.

GCash’s parent company, Globe Fintech Innovations, Inc. (Mynt), achieved “double unicorn” status in 2021 after a £250 million ($300 million) funding round that boosted its valuation beyond £1.67 billion ($2 billion). Now, the company is eyeing an IPO valuation of around £6.67 billion ($8 billion)—a milestone that would mark the Philippines’ most valuable public tech listing to date.

But in the wake of the dark web claims, investors may question whether the company’s cybersecurity and governance frameworks can withstand the scrutiny of public markets. Even a hint of a data integrity issue could spark compliance reviews, regulatory intervention, or delays in the IPO timeline.

For users, the implications are equally serious. A breach involving KYC data and bank-linked information would expose millions to risks such as identity theft, phishing, and unauthorized financial access.

With GCash serving as a lifeline for both urban and rural users — from gig workers to small business owners —trust is not merely a brand asset; it is the foundation of its business model.

Why the GCash IPO matters to the Philippines

Industry leaders describe GCash’s IPO not merely as a corporate milestone but as a turning point for Philippine innovation.

Rene Cuartero, founder and CEO of venture capital firm AHG Lab, described it as a “game-changer” that could open new pathways for startup growth and regulatory evolution. “The IPO will show proof of a pathway for our startups in the Philippines toward listing in the market,” Cuartero said. “It will also serve as an excellent test case for what regulations might need to be adjusted to accommodate both large and smaller tech companies.”

The company’s IPO readiness reflects a typical 10-year startup trajectory.

Since its inception in 2004, GCash has grown into a financial super app with over 94 million registered users. Its growth surged during the pandemic, when digital payments became a necessity for households and businesses.

Today, GCash’s services are available in 16 international markets, including the US, UK, Australia, and Japan — a footprint that positions it as a potential global fintech contender.

Oscar Enrico A. Reyes, Jr., president and CEO of G-Xchange, Inc., which operates GCash, has emphasized the IPO’s broader importance. “It’s very important that it becomes a successful IPO,” he said. “If that happens, the whole investment community will start seeing the Philippines as a potential tech hub.”

He added that a successful public debut could ignite confidence across the ecosystem: “This is something homegrown. If we can be one of the biggest and most successful startups to go public, it will encourage more investors to look at the Philippines for opportunities.”

What regulators and the industry might do next

The Philippines has made significant progress in fintech oversight, with the Bangko Sentral ng Pilipinas (BSP) and the National Privacy Commission (NPC) enforcing strong frameworks for data protection and financial security. These agencies set strict rules on how electronic money issuers and fintech firms manage sensitive information, especially in the age of digital payments.

Following the alleged breach, both regulators are expected to intensify their scrutiny. This could include requiring independent cybersecurity audits, mandating transparency reports, or tightening enforcement under the Data Privacy Act of 2012.

If the claims prove accurate, authorities may also introduce stricter governance measures — such as mandatory encryption standards, cybersecurity certifications, and real-time breach notifications — to ensure user data remains secure across platforms.

For GCash, decisive and transparent action will be essential. The company must verify the claims, communicate clearly with users, and reinforce its systems to the highest international standards. Strengthening encryption, deploying multifactor authentication, and collaborating with regulators on real-time monitoring will be crucial steps to regaining confidence.

Restoring trust in a digital future

The alleged GCash data leak is more than a cybersecurity concern — it’s a test of leadership and resilience in a time when trust defines the fintech industry. For millions of users who rely on the app for daily transactions, investments, and remittances, assurance of safety is non-negotiable. Yet, every crisis carries an opportunity.

If GCash handles this challenge with transparency and speed — showing that it can confront risks head-on — it could transform the incident into a proof point of maturity. The company has the scale, talent, and resources to turn vulnerability into strength, setting a new standard for how Philippine fintechs respond to emerging threats.

Ultimately, how GCash moves forward will send a message that extends beyond its IPO. It will determine how the world views the Philippines as a rising tech hub — and whether the country’s fintech giants can uphold global standards of security and trust while driving digital innovation for millions of Filipinos.