More and more Filipinos are now looking at insurance as an important financial tool because by getting insured, they can prepare for anything that could happen in the future — be it for hospitalization, illness, retirement, or even death.

But to be able to make a claim, there are usually five tedious processes you need to undertake. These steps include connecting with a broker, starting a claim investigation, reviewing the policy, and conducting a damage evaluation before finally arranging the payment terms.

Leveraging its strong foothold in Southeast Asia, Etiqa Philippines has vowed to change all these as it strives to streamline traditional processes by introducing innovative digital touchpoints. The goal is to enable members to access insurance services such as policy inquiries, claims processing, and general assistance with a single click.

Etiqa has vowed to streamline traditional insurance processes by introducing innovative digital touchpoints

Etiqa is an insurance company with international experience, operating across Southeast Asia, mainly in Singapore, Indonesia, Malaysia, and the Philippines.

Leveraging the power of technology

Rico Bautista, Etiqa Philippines President and CEO, expressed, “In our six decades of providing insurance solutions, we have witnessed firsthand the power of technology in streamlining the insurance acquisition process for millions of Filipinos. We are dedicated to simplifying the insurance journey for all, aligning with our core mission to contribute to making the Philippines a better place.”

As one of the few insurance companies in the country holding a composite license, Etiqa Philippines further simplifies the insurance process by presenting a consolidated range of life and non-life insurance products under a single brand.

To address the various insurance needs of every Filipino, Etiqa Philippines provides a comprehensive range of insurance solutions that can easily be availed through the Etiqa website, Smile PH 3.0 App, HR and Provider Portals, and the Doctor’s App.

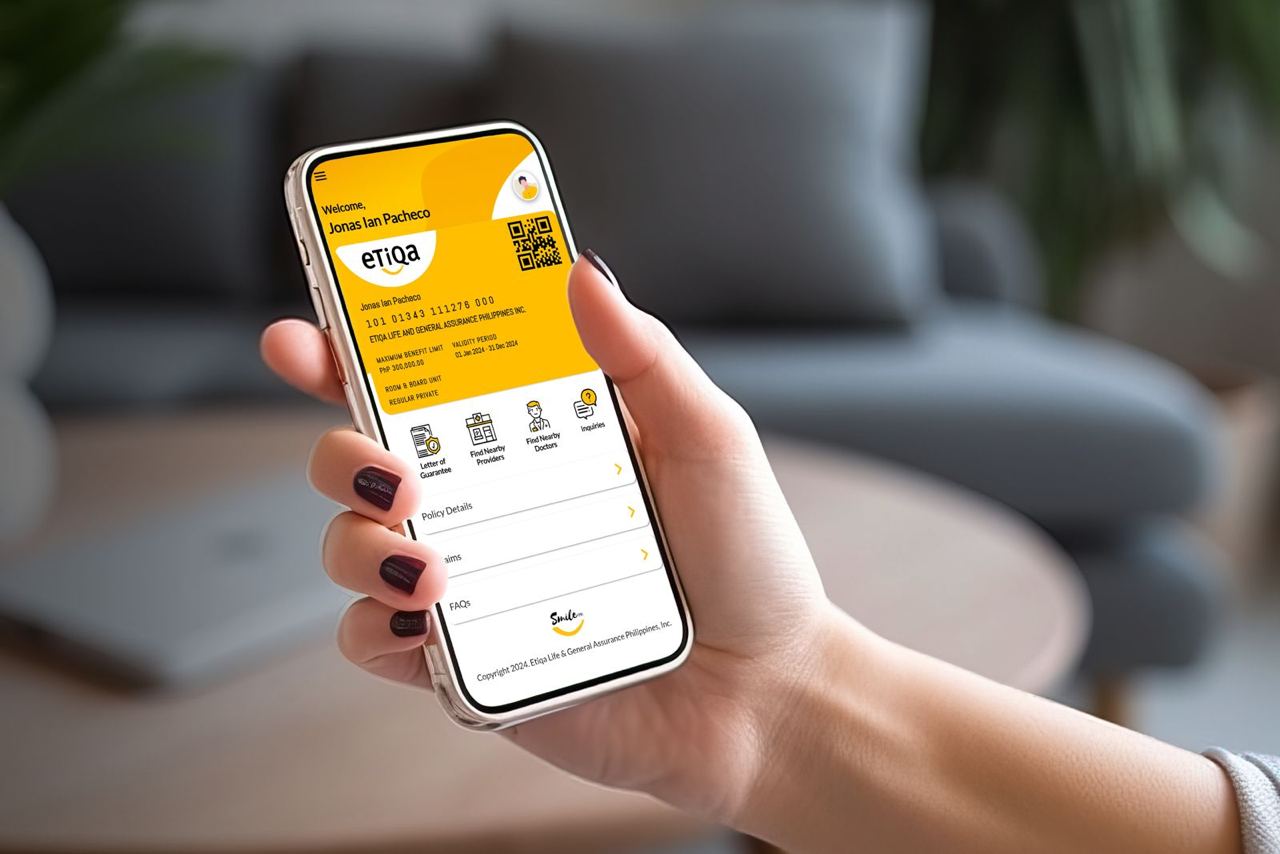

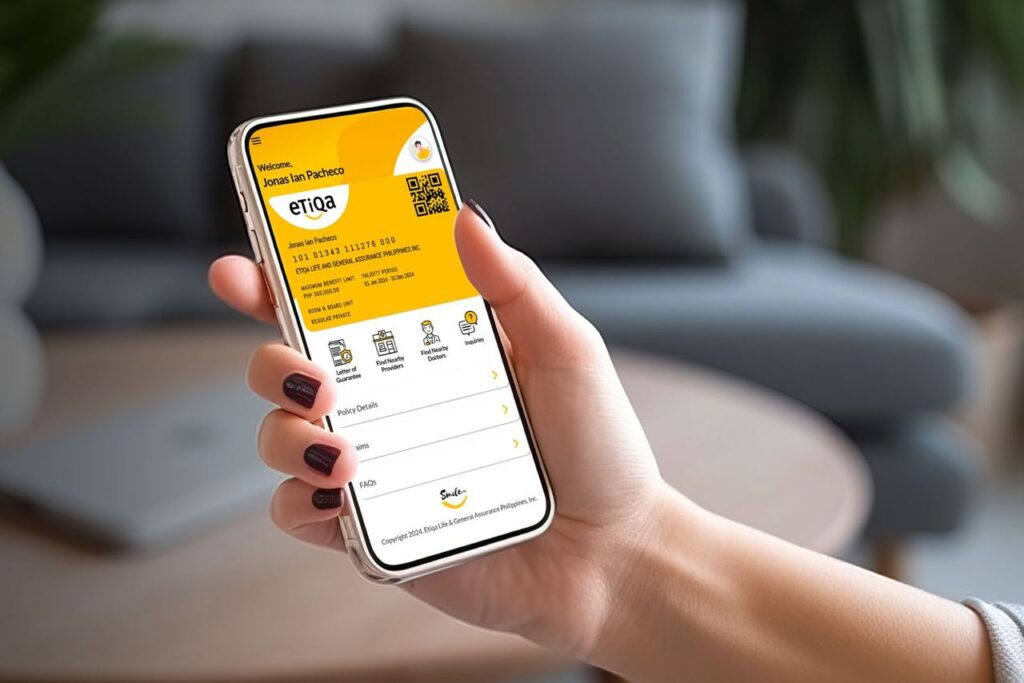

Etiqa Philippines’ upgraded Smile PH 3.0 App is a unified omnichannel app that makes the insurance process faster. Designed for both Group Medical and Retail Insurance clients, it provides convenient app-based access to basic plan and policy details, as well as facilitating seamless transactions such as requesting for Letter of Guarantee (LOG) and viewing policy details.

This unified omnichannel app can be easily and quickly downloaded from the Google Play Store and App Store.

Serving as the web version of the Smile PH app, the Etiqa Member Portal was specifically designed for Group Medical plan members who prefer a web-based portal to a mobile application. It offers the same comprehensive features as the Smile App, with the only distinction being its web-based accessibility.

Enhancing the partnership experience

To further enhance the partnership experience, Etiqa Philippines also introduced its Provider Portal, an exclusive web-based application for partner hospitals and clinics. This platform offers secure and convenient business interactions. It provides features such as requesting Letters of Guarantee, viewing and monitoring payments, and downloading Certificates of Withholding Tax (BIR 2307) 24/7.

Currently in beta launch, Etiqa Philippines’ Doctor’s App serves as a specialized tool for over 15,000 partner doctors. This application enables them to seamlessly request Letters of Guarantee, file claims or billings, monitor payments, and obtain Certificates of Withholding Tax.

Etiqa Philippines’ HR Portal, which is set to be launched soon, is a web-based platform designed for HR Heads and Admin personnel to help them manage employee benefits better. This portal enables HR partners to upload employee files and monitor the utilization of life or health benefits.

The Etiqa Philippines website functions as an online shop, offering a convenient platform for purchasing a range of general and non-life products such as travel, dengue, pneumonia, and auto insurance, as well as individual medical products like MyLife+. For quick and convenient access to insurance services, Etiqa Philippines launched the Eriqa chatbot, an always-on virtual assistant available 24/7 through the company website. The virtual assistant is easy to use and can be accessed from any device with Internet connectivity.

Recognizing the ever-changing needs of healthcare consumers, Etiqa Philippines offers teleconsultation services that allow clients to effortlessly seek medical advice remotely. Dra. Malu Castillo-Mamaril, Etiqa Philippines Medical Operations Division Vice President and Medical Director, emphasized, “Etiqa’s teleconsultation service is a game-changer in the healthcare industry. We provide individuals the freedom to access medical advice anytime and anywhere for a truly convenient and personalized healthcare experience.”

Currently, Etiqa Philippines is in partnership with Doctor Anywhere, Konsulta MD, e-Konsulta, Home Health Care and other providers to offer this online service. Through Etiqa Philippines’ teleconsultation services, customers can engage with healthcare professionals, obtain medical guidance, and address their health concerns from the comfort of their homes or any location of their choice.

This initiative reflects Etiqa Philippines’ commitment to utilizing technology to enhance the overall well-being and healthcare accessibility for its clientele.

Etiqa Philippines prioritizes customer convenience by offering a wide range of payment methods to fit individual budgets and preferences. Whether customers favor digital transactions or traditional in-person payments, Etiqa Philippines aims to provide a hassle-free and smooth experience.

These payment methods include credit and debit card payments, Philippine-issued ATM cards, E-wallets (GCash, GrabPay, Maya), online banking (BPI Online and Unionbank Online), Billease’s Buy Now, Pay Later program, and QR Ph for QR payments.