Each time you use your credit card, you potentially expose yourself to a credit card skimmer – a devious device designed to steal your card’s data.

Criminals use skimmers to capture data such as the cardholder’s name, card number, and expiration date. This stolen data can be used for fraudulent purposes, such as making unauthorized purchases or creating counterfeit cards.

Credit card skimmers come in various forms, but they are typically disguised as legitimate card readers on ATMs, gas pumps, point-of-sale terminals, or even in-store card readers. When a person inserts their card into a compromised device, the skimmer records the card’s information, which the criminals later retrieve.

There are two main types of credit card skimmers:

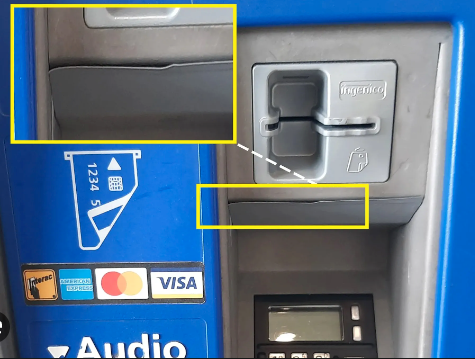

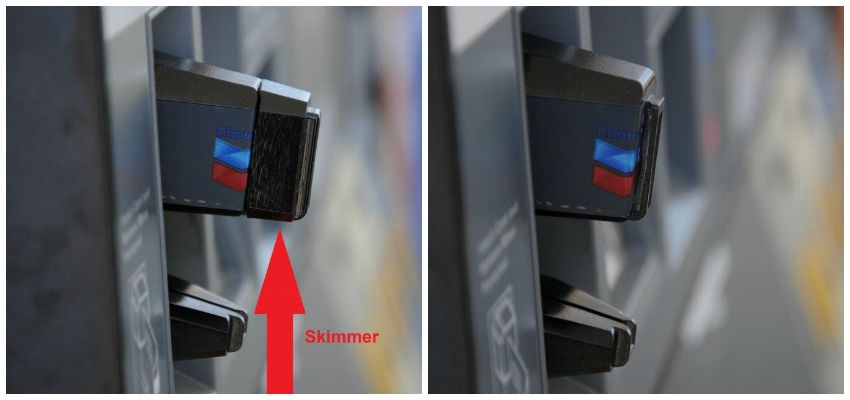

- External Skimmers: These are devices attached to the outside of the card reader. They often look like an extension or cover for the legitimate card reader. When a person inserts their card, the skimmer captures the card’s information in addition to the legitimate transaction.

- Internal Skimmers: These are more sophisticated and harder to detect. Internal skimmers are placed inside the card reader or the payment terminal. They intercept the card data as it passes through the legitimate reader.

How to Avoid Credit Card Skimmers

1. Examine card readers or ATMs for loose parts, signs of tampering, extra attachments, or anything that looks out of place.

2. Never let your card out of your sight. Always request for the POS terminal and personally swipe your credit, debit, or ATM card.

3. Cover your PIN with your hand or body to prevent potential hidden cameras from capturing your input.

4. Use EMV chip cards which provide an added layer of security compared to traditional magnetic stripe cards.

5. Regularly monitor your accounts for any suspicious activity.

6. Transact only on secure websites. Don’t share any details via email or phone.

7. Use contactless payment methods like mobile wallets.

8. Stay informed about the latest scams and fraud prevention tips.

Credit card skimming is a form of financial fraud, and those caught using skimmers can face criminal charges. Law enforcement agencies and financial institutions continuously work to detect and prevent skimming activities to protect consumers.

If you suspect that your credit card details have been skimmed or that your credit card may have been compromised, it’s important to take immediate action to protect yourself and your financial accounts. Here are the steps you should follow:

- Contact Your Bank or Credit Card Issuer: Call the customer service number provided on the back of your credit card as soon as you suspect a compromise. Inform them about your concerns and ask for guidance. They can help you assess the situation and take appropriate actions.

- Report Unauthorized Charges: If you notice any unauthorized or suspicious transactions on your account, report them to your bank or credit card issuer immediately. They will typically investigate the charges and, if confirmed as fraudulent, will work to reverse them.

- Cancel Your Card: If you believe your card has been compromised, ask your bank or credit card issuer to cancel your current card and issue a new one with a new account number. This step is crucial to prevent further unauthorized transactions.

- Change Your PIN: If you used your card with a PIN, change your PIN to prevent unauthorized ATM withdrawals or point-of-sale transactions.

- Monitor Your Accounts: Continuously monitor your bank and credit card statements for any unusual or unauthorized activity. Many financial institutions also offer mobile apps that provide real-time transaction alerts, which can help you stay on top of your account activity.

- File a Police Report: In some cases, it may be necessary to file a police report to document the incident, especially if you suspect criminal activity. The police report can be useful for assisting in investigations.

- Check Your Credit Report: Check your credit report for any signs of identity theft or other fraudulent accounts opened in your name. You can request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) annually.

- Consider a Fraud Alert or Credit Freeze: Depending on the severity of the situation and your level of concern, you may want to place a fraud alert or credit freeze on your credit reports. A fraud alert notifies creditors to take extra precautions when extending credit, and a credit freeze prevents anyone from accessing your credit reports.

Remember that acting promptly is essential to minimize potential financial losses and protect your identity. Financial institutions have processes in place to help you through the resolution process, and they will generally work with you to recover any fraudulent charges. Additionally, it’s a good practice to regularly review your accounts for any unusual or unauthorized transactions to detect potential issues early.

Ultimately, being safe falls squarely on one’s shoulders. The power to protect ourselves lies not just in the hands of technology or institutions but in our own vigilance and awareness.

Knowledge is our greatest defense. By staying informed about the latest fraud trends and remaining cautious in our transactions, we can effectively protect around our hard-earned money. Checking for irregularities in our bank statements, safeguarding our PINs, and being vigilant for suspicious card readers are our shields against the ever-present threat of skimmers.

The battle against credit card fraud is an ongoing one, where technology, legislation, and security measures must continually evolve. But it’s a battle that each of us can win through a combination of awareness and action.