Mocasa, a fintech company specializing in innovative credit payment services, is now authorized by the Credit Information Corporation (CIC) to access its credit database by successfully becoming an Accessing Entity (AE) of the CIC.

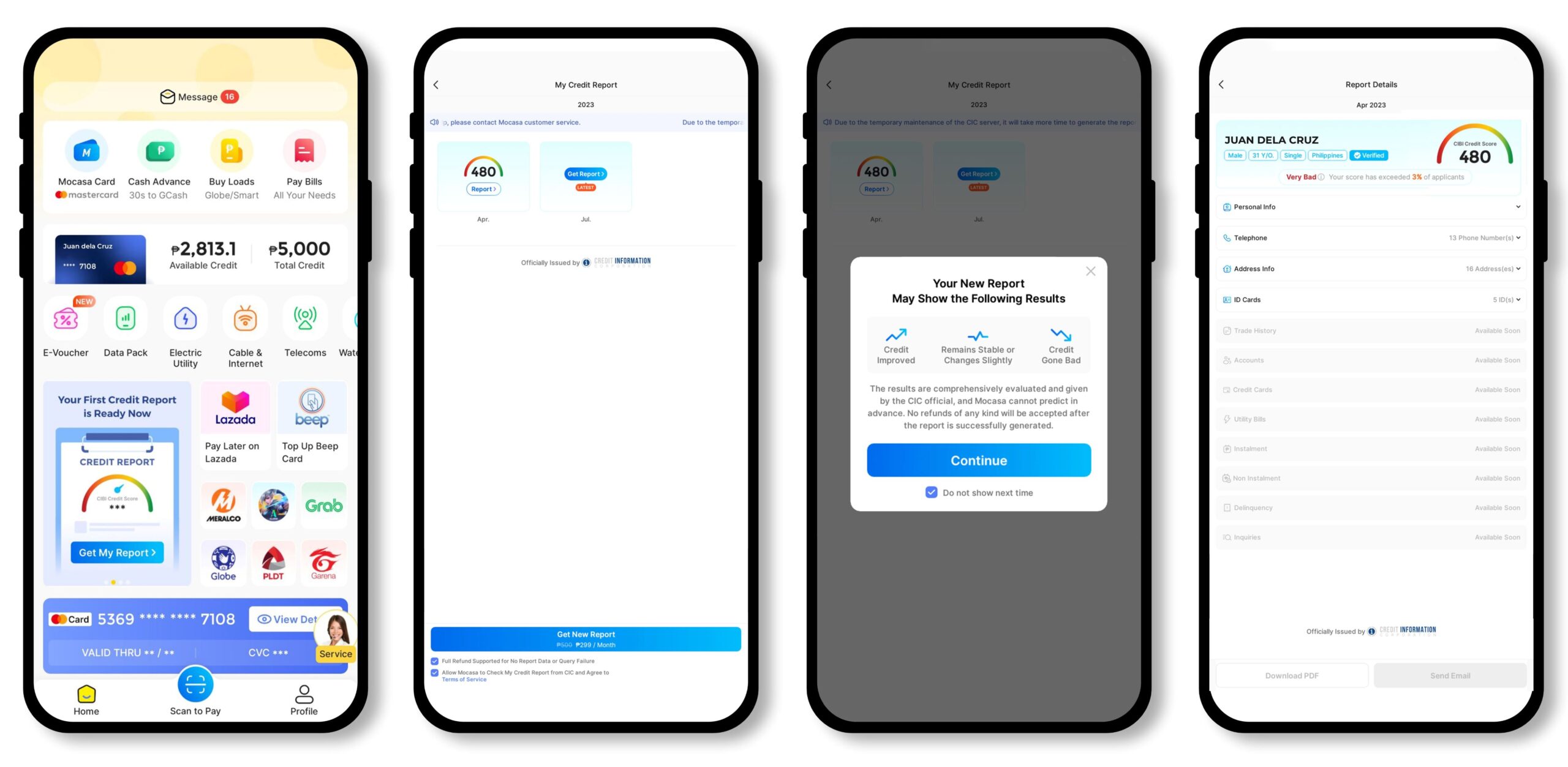

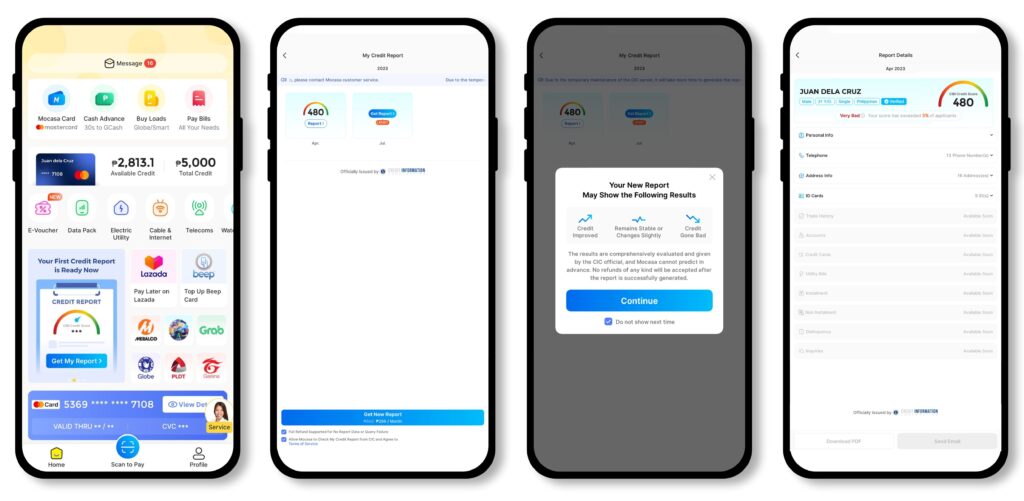

Accessing credit reports through the Mocasa app

Through this milestone, Mocasa aims to revolutionize the financial services industry by leveraging advanced technology and data analytics to offer enhanced credit and payment solutions to consumers.

This collaboration brings the expertise of an industry leader in financial technology together with the wealth of credit information in the sole public credit registry. Mocasa has been at the forefront of transforming the way people make credit payments, offering a seamless and secure platform that simplifies credit transactions.

On the other hand, the CIC is renowned for its comprehensive and diverse credit database covering 41.8 million individuals, or almost half of the Philippine adult population, from across 829 financial institutions of various industries.

By being an AE of the CIC, Mocasa users will soon gain access to a wide range of financial services, including personalized credit reports, credit scores, and credit monitoring.

The accessibility of borrowers’ credit data from the CIC within the Mocasa app will enable users to make informed financial decisions and manage their creditworthiness more effectively.

Additionally, Mocasa will leverage CIC’s strong data capabilities to develop advanced risk assessment models, resulting in enhanced fraud detection and prevention measures.

Harnessing the power of cutting-edge technology

“We are excited with this development as we would be able to harness the power of cutting-edge technology and comprehensive credit data,” said Robin Wong, Chief Executive Officer of Mocasa.

“This effort actually represents a great step towards our vision of empowering Filipinos with better financial solutions. By enabling our users to conveniently access their credit data from the CIC within our app, we aim to provide our users with actionable insights to help them better manage their credit responsibly and unlock new opportunities for financial growth,” he added.

CIC Senior Vice President Valdimir Hubert H. dela Cruz also expressed CIC’s support to Mocasa, saying, “By being an Accessing Entity of the CIC, Mocasa extends the reach of credit information services to consumers and fosters responsible borrowing. Furthermore, they can now use CIC data to formulate data-driven credit-decisioning, calibrate better risk management, improve their credit portfolio, and increase access to credit for Filipino borrowers.”

The successful registration of Mocasa as an AE of the CIC marks a significant milestone in the evolution of the Philippine financial services landscape.

By combining their strengths and expertise, the two entities are poised to revolutionize credit management and payment solutions, driving financial empowerment and inclusivity.

Mocasa is a financial technology company duly licensed and regulated by the Securities and Exchange Commission (SEC). To learn more about the latest updates from Mocasa, visit www.mocasa.com or its Facebook, Instagram, and Tiktok accounts. Customers are encouraged to download the app in Google Play or App Store to know more about its services and latest promos.