Coins.ph, showcased its latest product developments and long-term vision at a recent company event, positioning itself as an everyday all-in-one financial app built to support payments, remittances, and digital assets for both consumers and businesses in the Philippines.

The event highlighted how the BSP-licensed platform — best known as the country’s pioneering regulated cryptocurrency exchange — is expanding beyond crypto trading to power everyday financial transactions, merchant payments, and cross-border money movement.

Amira Alawi, Global Marketing Director at Coins.ph

Coins.ph, one of the Philippines’ fastest-growing mobile wallets, said it is addressing long-standing pain points in money management by offering a unified all-in-one financial app that brings everyday payments, transfers, and digital financial tools into a single, seamless platform — designed to keep pace with real-life needs.

“Filipinos deserve a financial experience that’s as fast and intuitive as the rest of their digital lives,” said Amira Alawi, Global Marketing Director at Coins.ph. “Most people don’t think about financial infrastructure — they just want money that works.”

“Whether you’re picking up groceries, sending funds home, paying bills, or running a small business, everything should flow naturally from one app. That’s what we’ve built with Coins.ph: a secure and reliable all-in-one financial app that gives people more freedom, more time, and more control — without compromise,” she added.

From crypto onboarding to everyday finance

Wei Zhou, CEO of Coins.ph

For his part, Coins.ph CEO Wei Zhou shared during a year-end media briefing that the company’s 2026 strategy reflects how both the market and user expectations have changed over time. “We’re really happy to showcase what we’ve accomplished in 2025 and, at the same time, what we’ve prepared for 2026,” he said in his opening remarks.

Since the current management team took over in 2022, Zhou noted that Coins.ph has remained “at the forefront of crypto and fintech here in the Philippines,” while steadily broadening its scope. He explained that while many users initially began their crypto journey with Coins.ph through Bitcoin, the platform’s role has expanded significantly.

“The markets have evolved, and our business has evolved,” Zhou said. “Blockchain is now at the core of our service offerings — not just within financial services, but also in terms of transparency and broader use cases.”

As reported in TechTravelMonitor, Zhou shared that the roadmap centers on serving Overseas Filipino Workers (OFWs), supporting local entrepreneurs, and positioning blockchain as a practical partner for both the public and private sectors.

A major focus moving forward is stablecoins, which Zhou described as the next phase of global crypto adoption. Coins.ph currently supports major US dollar–denominated stablecoins across multiple blockchains, with free deposits and withdrawals aimed at improving user experience.

“One of the major use cases we’re pushing into 2026 is enabling Filipinos working and living overseas to send and receive remittances cheaply, efficiently, and 24/7 using stablecoins,” Zhou further stated.

Powering merchant payments with Coins WebPay and QR Ph

Andrew Garcia, Sales Lead (Local Payments) at Coins.ph

Beyond consumer finance, Coins.ph also detailed its expanding merchant payments infrastructure through Coins WebPay, QR Ph, and a newly launched business portal.

Andrew Garcia, Sales Lead for Payments at Coins.ph, outlined how the platform is helping merchants digitise transactions using the national QR Ph standard.

“This enables merchants to collect real-time payments from any local bank or e-wallet,” Garcia said, adding that funds are settled instantly into a Coins wallet and available 24/7.

Garcia noted that Coins.ph supports both static and dynamic QR codes, making the solution suitable for physical stores, online payments, and checkout counters. Transaction limits can also be customised beyond the standard QR Ph cap for partner merchants.

Coins WebPay, meanwhile, allows businesses to accept payments from Coins.ph’s more than 18 million registered users and can be integrated into websites and mobile applications. “Soon, we’ll be rolling out more payment methods under Coins WebPay,” Garcia said, pointing to additional features currently in development.

The new business portal gives merchants a consolidated view of collections, disbursements, and transaction performance — including crypto activity — while enabling access controls and approval workflows for larger organizations.

Making cross-border transfers faster and cheaper

Sophia Deveraia, Account Manager for International Sales, Coins.ph

Stablecoin remittances were another key focus of the event.

Sophia Deveraia of Coins.ph walked attendees through how the platform supports international money movement, often using crypto as a backend layer without requiring end users to directly engage with digital assets.

“For users who still prefer traditional fiat, that’s possible,” Deveraia said. “The sender uses their local currency, the receiver gets Philippine pesos, and the stablecoin conversion happens completely behind the scenes.”

She explained that Coins.ph’s ability to operate its own exchange order book and liquidity pools allows the company to offer competitive FX rates and lower conversion costs—one of the most expensive components of traditional cross-border transfers.

“Our goal is really simple,” Deveraia said. “To make cross-border transfers quicker, cheaper, and more accessible for everyone.”

Building infrastructure, not just features

Throughout the event, Coins.ph executives emphasised that the company’s focus extends beyond adding new features to building financial infrastructure that works quietly in the background.

“The goal isn’t for users to think about blockchain or technology,” Zhou said. “It’s for infrastructure to disappear, so people simply experience money that works.”

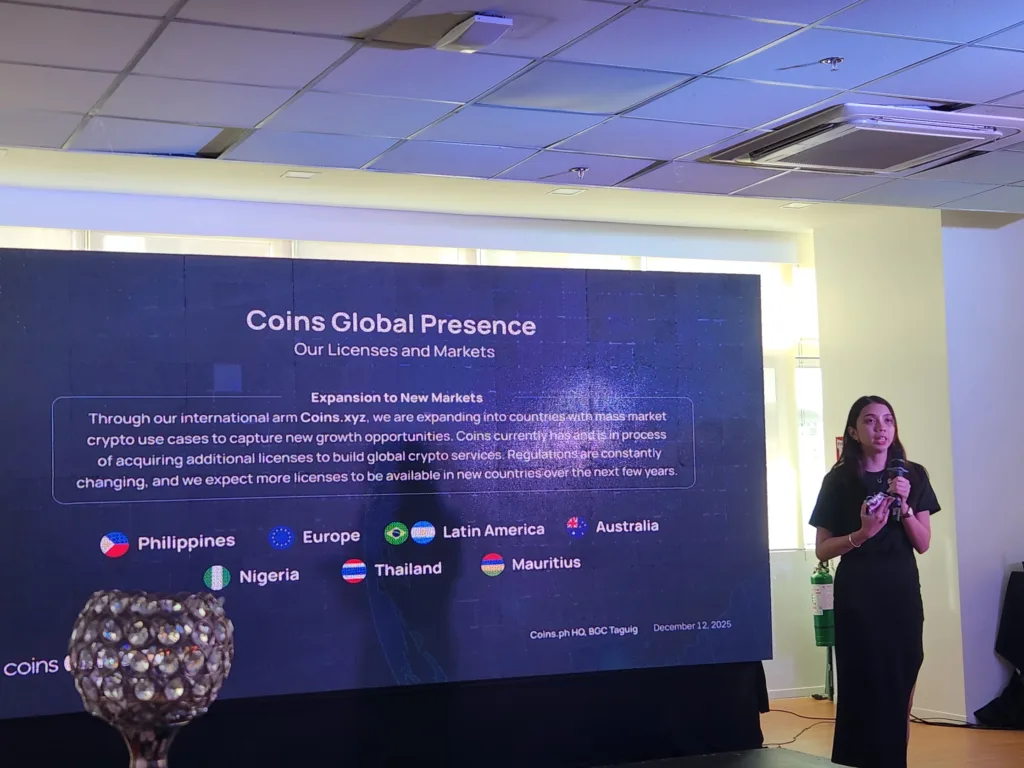

As the company expands its footprint beyond the Philippines into markets such as Brazil, Australia, Thailand, and parts of Africa, Zhou said Coins.ph aims to bring Filipino-built financial technology to a global audience.

“At its core, Coins is a Filipino company,” he said. “And we want to serve not just Filipinos here at home, but users around the world.”