As Filipino retailers gear up for the year’s busiest shopping months, digital wallet provider Coins.ph has introduced a new service aimed at helping merchants manage the surge in online transactions.

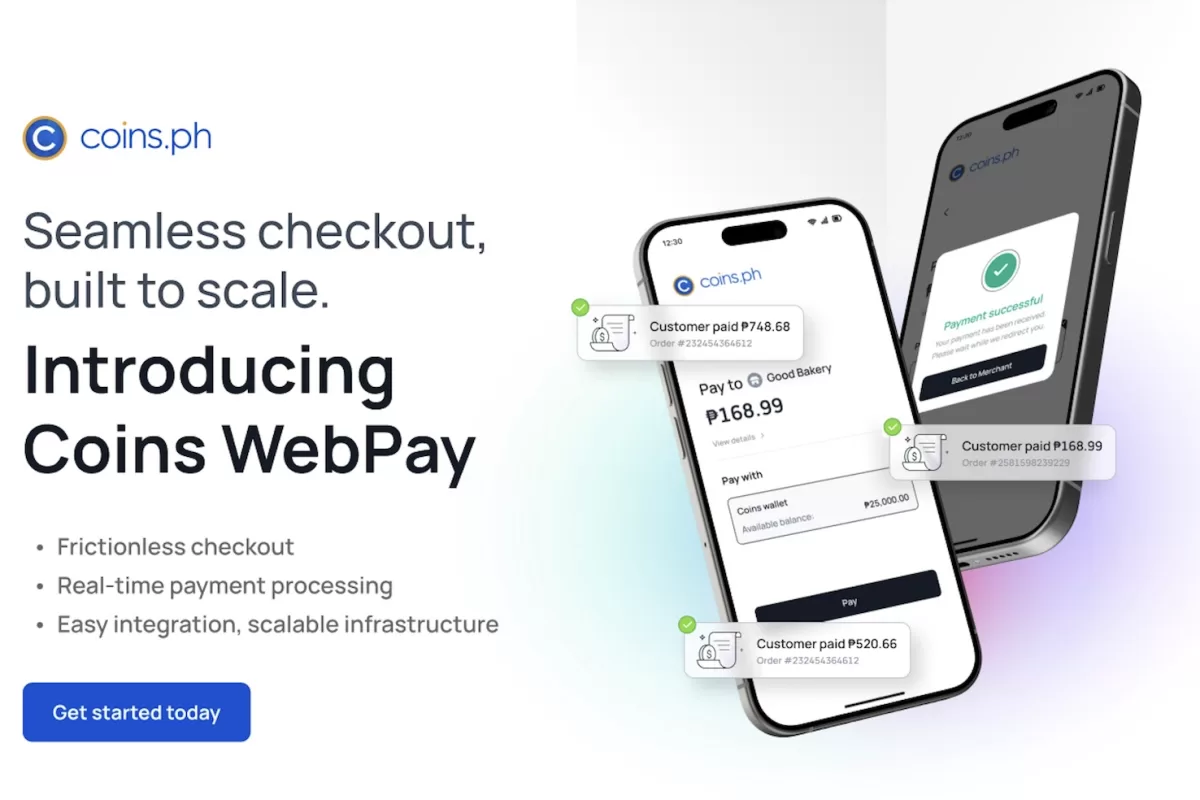

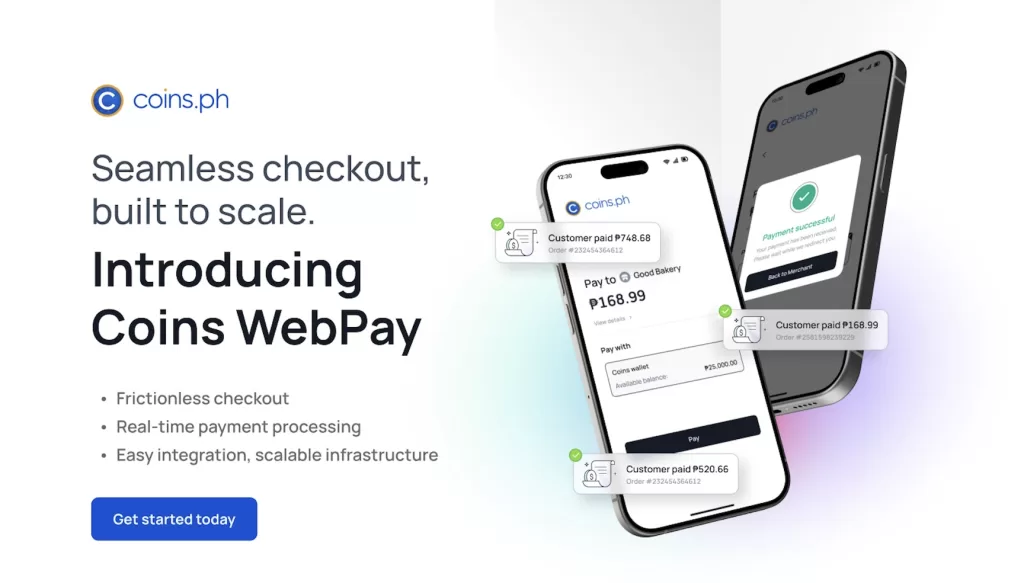

The company on Thursday announced the rollout of Coins.ph Webpay, a payment gateway that enables businesses to accept payments directly through the Coins.ph app. The launch comes at a critical time, with e-commerce activity expected to peak in the run-up to the Christmas season in the Philippines, when demand for reliable payment systems is at its highest.

Coins.ph Webpay launched for holiday shopping

With the “-ber months” in full swing, businesses from small online sellers to large-scale enterprises are under pressure to provide a seamless and secure checkout experience for millions of shoppers.

To encourage adoption, Coins.ph is waiving transaction fees for the first three months for qualified merchants. The company said the move is intended to give businesses additional breathing room during a period when competition for online sales is most intense.

Focus on scale and settlement

“Coins Webpay isn’t just a payment solution; it’s a platform built for merchant success,” said Wei Zhou, Coins.ph Chief Executive Officer. “By offering higher daily limits and competitive fees, Coins.ph ensures businesses can scale without constraints. We are committed to delivering more features to help our merchant partners thrive and grow.”

The service supports high-volume transactions, with daily limits starting at ₱50 million.

This offer allows businesses to maximize their revenue during the crucial holiday period while tapping directly into the massive, built-in user base of the Coins.ph digital wallet. Higher per-transaction limits also enable customers to make larger, high-value purchases with greater convenience.

Addressing cash flow pain points

Webpay also features real-time settlements, meaning funds from a customer’s purchase are credited to the merchant’s account immediately.

This eliminates the long waiting periods often associated with traditional processors, giving businesses the liquidity they need to manage inventory, marketing, and day-to-day operations more effectively.

Once integrated into an online store or mobile app, the system enables customers to pay instantly using their Coins.ph wallet, transforming what is often a clunky checkout process into a smoother, more reliable experience.

Roadmap for merchant tools

Coins.ph has also confirmed a robust roadmap for the platform.

A user-friendly merchant portal is set to be launched soon, which will provide businesses with a comprehensive dashboard to review transactions, manage settlement preferences, and assign role-based permissions for team members.

Also in the pipeline are features for simple, hassle-free refunds and expanded payment acceptance, including major credit cards, other mobile wallets, in-store options, and cryptocurrency payments.

This positions Coins.ph Webpay not just as a current solution, but as a future-proof platform ready to evolve with the market and meet changing consumer expectations.

Boosting the digital economy

Established in 2014 and licensed by the Bangko Sentral ng Pilipinas (BSP), Coins.ph has long been a pillar of the nation’s digital finance ecosystem. By leveraging its deep market penetration and trusted brand, the launch of Coins.ph Webpay signals a significant move to empower the next generation of Filipino entrepreneurs.

Businesses interested in integrating Coins.ph Webpay and taking advantage of the three-month fee waiver are encouraged to contact the company directly at payments-business@coins.ph.

The platform is an all-in-one financial app for millions, seamlessly fusing traditional finance with digital assets. Established in 2014, it stands as the Philippines’ premier cryptocurrency exchange. Licensed as both a virtual asset marketplace and a mobile wallet, the platform empowers users to trade, invest, and execute payments all in one secure place.

To know more, visit https://www.coins.ph/en-ph.

NOTE: Eligibility for the three-month fee waiver is subject to applicable terms and conditions.