by Alexis Tuble, Correspondent

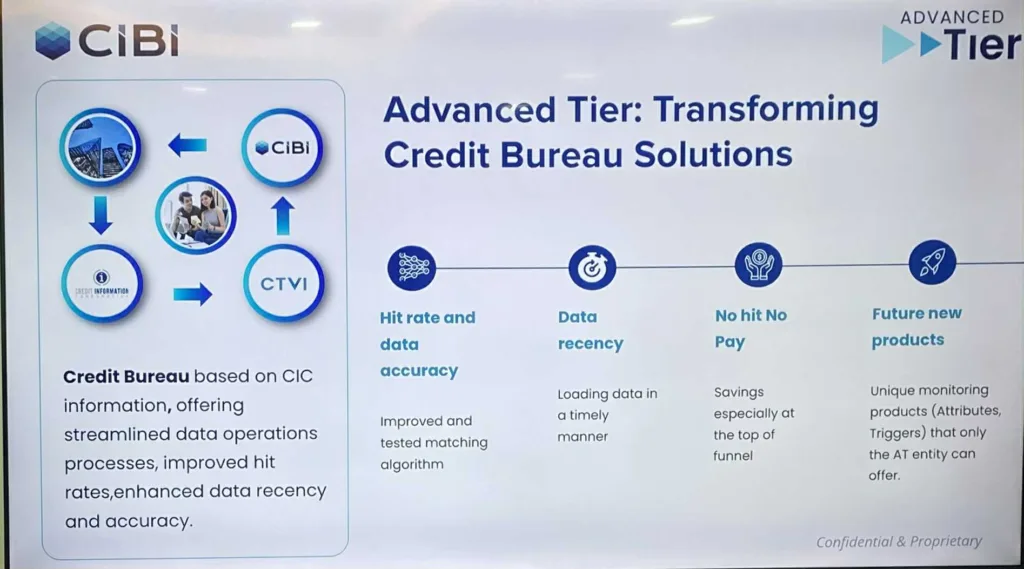

CIBI Information, Inc. (CIBI) — the country’s first and only Filipino-owned credit bureau — hosted its first-ever media roundtable at its Makati headquarters recently to introduce its newest innovation, the Advanced Tier Solution, a data-driven system designed to promote financial inclusion and empower both lenders and borrowers across the Philippines.

The roundtable gathered business journalists and fintech writers to discuss CIBI’s evolution from a traditional credit bureau into a full-fledged fintech enabler.

During the discussion, Pia Arellano, CIBI’s President and CEO, said the company’s mission has always been to build a more inclusive financial ecosystem by equipping banks and financial institutions with reliable, comprehensive credit data. She explained that the Advanced Tier Solution provides a unified, complete view of every Filipino’s credit behavior, helping lenders make informed decisions while reducing risk.

From credit bureau to fintech enabler

CIBI has played a central role in the country’s financial infrastructure for more than four decades. The company began in 1982 as a unit under the Bangko Sentral ng Pilipinas (BSP), created to manage the Philippines’ first credit information exchange system.

After its privatization in 1997, CIBI expanded into background verification and identity validation services.

In 2016, it reached a major milestone when it became the first Filipino-owned credit bureau accredited by the Credit Information Corporation (CIC) — the government agency mandated to collect and consolidate credit data from banks and lending institutions.

Backed by Creador, one of Southeast Asia’s leading private equity firms, CIBI has since transitioned into a fintech enabler that leverages data analytics, artificial intelligence, and machine learning to support the financial industry.

Through its Advanced Tier access to CIC’s raw data files, CIBI now provides partner banks and fintech companies with real-time, advanced insights into consumer credit activity.

Arellano described this innovation as a significant step toward the company’s goal of advancing financial inclusion by transforming complex data into actionable insights that help financial institutions make sound, data-driven decisions.

How the system works

During the roundtable, Jasmine Gonzalez, Chief Product, Partnerships, and Innovation Officer, and Harley Chan, Chief Analytics Officer, outlined the step-by-step process behind CIBI’s Advanced Tier system, showing how data is collected, processed, and transformed into useful financial intelligence.

- Data collection

Under the Credit Information System Act (CISA), all banks, cooperatives, microfinance institutions, and digital lenders are required to submit their borrowers’ data to the Credit Information Corporation (CIC). This includes details such as credit cards, salary loans, mortgages, and even Buy Now, Pay Later (BNPL) transactions from e-commerce platforms. - Processing by CTVI

The CIC then authorizes CTVI, a wholly owned subsidiary of CIBI, to process this data. CTVI cleans, verifies, and structures the raw information into standardized formats. This ensures data integrity and prevents duplication. - Integration and product creation

Once processed, CIBI uses this data to create several financial tools including credit reports, credit scores, and analytical models that help lenders evaluate potential borrowers. The Advanced Tier Solution integrates multiple data sources to give a complete financial profile of each individual or business. - Delivery to financial institutions

Banks and fintech companies use these tools for credit pre-screening, risk scoring, fraud detection, and income estimation. CIBI operates under a “no-hit, no-pay” policy, which means that banks are only charged when a borrower’s record is successfully matched. This makes the system efficient, cost-effective, and scalable. - Consumer empowerment

Through a partnership with the local financial app Lista, individuals can now access their own credit reports directly from CIBI. This feature helps Filipinos understand their credit standing, develop responsible borrowing habits, and improve their financial literacy.

Promoting smarter lending

The Advanced Tier Solution enables CIBI to combine multiple data points from different institutions into a single, cohesive financial profile. With this system, lenders gain a 360-degree view of a borrower’s financial behavior, from small online purchases to major loans, allowing them to assess risks accurately and extend credit responsibly.

Its internal data shows a significant increase in small-value loans from 2023 to 2025, particularly in the ₱5,000 to ₱25,000 range. This growth reflects the impact of fintech companies that have simplified credit access for millions of Filipinos through mobile platforms.

Approximately 68.4 million individuals and 468.3 million trade lines are now recorded in the CIC’s database, indicating that more Filipinos are entering the formal credit system.

However, the company also emphasized that non-performing loans (NPLs) remain higher among smaller loan segments.

According to Gonzales, this trend only highlights the need for continuous financial education to help borrowers manage their obligations responsibly. By analyzing these trends, CIBI helps lenders adjust their strategies, design more inclusive financial products, and guide first-time borrowers toward better credit management.

CIBI: Building a culture of credit confidence

CIBI executives emphasized that borrowing, when managed responsibly, is a path to opportunity rather than debt. Arellano said the company’s mission extends beyond providing credit data — it also seeks to educate Filipinos on the importance of maintaining a strong credit footprint.

A positive payment history, she explained, allows borrowers to move progressively from small BNPL transactions to credit cards, and eventually to car or housing loans. CIBI’s role, she said, is to make these transitions smoother by providing the data infrastructure that helps lenders identify trustworthy borrowers.

Gonzales added that through portfolio monitoring and analytics, banks can identify customers with good payment behavior, adjust credit limits, and even reward loyalty. At the same time, lenders can detect early signs of delinquency and intervene before debts escalate.

This proactive approach supports both consumer empowerment and financial system stability.

Protecting data, promoting trust

CIBI operates under strict regulations set by the National Privacy Commission (NPC) and the Bangko Sentral ng Pilipinas (BSP) to ensure consumer protection.

Borrowers must grant explicit consent before their data is processed, and CIBI maintains strong security and anonymization protocols to prevent misuse.

Through these safeguards, the company aims to ensure that information remains a force for good — driving inclusion without compromising privacy.

The road ahead: Enabling growth through data

As of 2025, an estimated seven out of ten Filipinos remain unbanked. CIBI’s Advanced Tier Solution seeks to close that gap by connecting more people to the formal financial system.

By turning raw credit data into actionable insights, CIBI enables financial institutions to lend with greater confidence and accountability.

Under Arellano’s leadership, the company continues to champion a vision where financial inclusion, innovation, and integrity work hand in hand.

With data as its foundation, CIBI is now helping build a future where every Filipino has access to opportunity — and where responsible credit becomes the cornerstone of sustainable economic growth.