The Philippine economy continued to benefit from steady inflows of cash sent home by overseas Filipinos (OFs), with remittances reaching US$3.18 billion in July 2025, according to data from the Bangko Sentral ng Pilipinas (BSP). This figure marked a 3 percent increase from the US$3.08 billion recorded in the same month last year.

The rise underscores the resilience of remittances — one of the country’s largest sources of foreign exchange — despite ongoing global uncertainties. July’s inflows not only supported household consumption but also reinforced the peso’s stability amid external headwinds.

Land-based workers drive the bulk of remittances

Breaking down the numbers, land-based OFs continued to account for the lion’s share of cash remittances. They sent home US$2.59 billion in July, reflecting a 3 percent increase year-on-year. Meanwhile, sea-based workers contributed US$585 million, up by 3.1 percent from the same period in 2024.

While sea-based remittances remain a smaller portion of the overall inflows, their growth highlights the steady demand for Filipino seafarers, who remain a crucial part of the global shipping and logistics industry.

Cumulative growth in 2025

From January to July 2025, total cash remittances climbed to US$19.93 billion, up 3.1 percent compared to the US$19.33 billion posted in the same period last year. The consistent increase suggests that remittances remain on track to meet the government’s full-year growth targets, which typically hover around 3 to 4 percent annually.

Personal remittances — which include cash transfers coursed through banks, informal channels, and remittances in kind — also rose. These reached US$3.53 billion in July, 3.1 percent higher than the US$3.43 billion recorded a year earlier.

For the first seven months of 2025, cumulative personal remittances hit US$22.21 billion, up from US$21.53 billion in the same period in 2024.

On a seasonally adjusted month-on-month basis, personal remittances also edged higher by 0.3 percent, showing steady momentum even during a traditionally slower mid-year period.

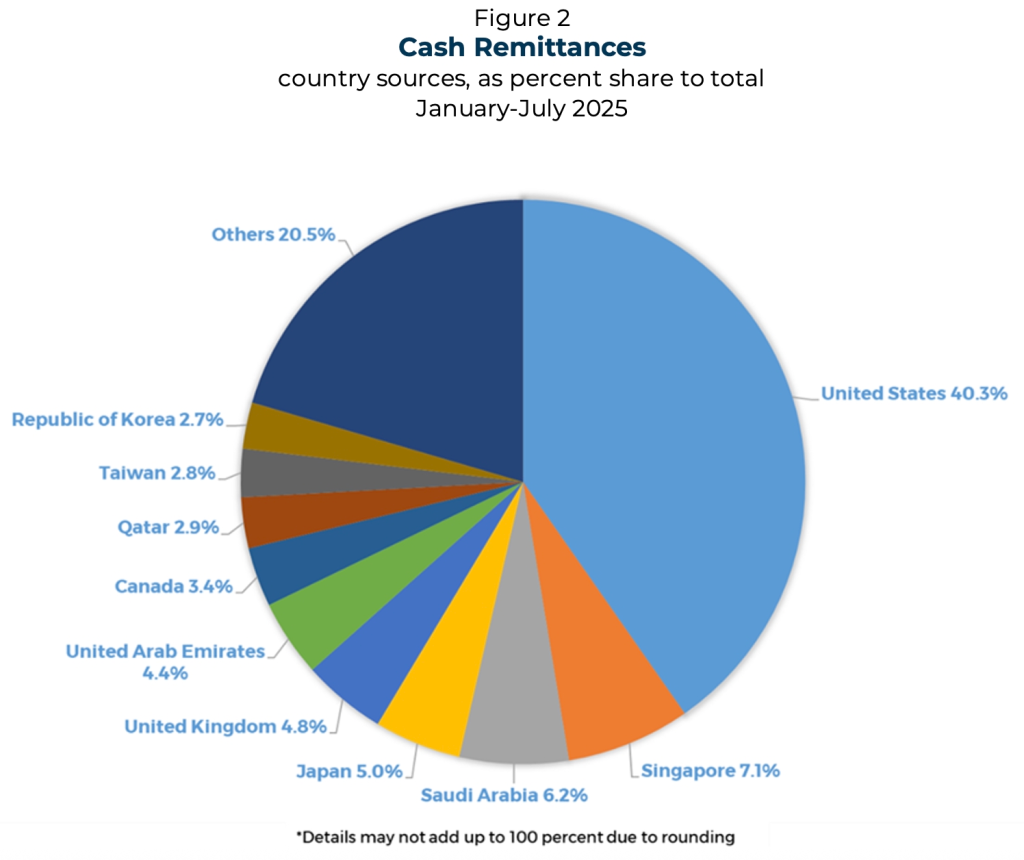

United States tops sources of remittances

The United States remained the leading source of remittances for the Philippines during the January to July 2025 period, followed by Singapore and Saudi Arabia.

However, BSP noted that the data has limitations due to how remittances are routed. Many overseas transfers are funneled through correspondent banks, most of which are located in the U.S. As a result, inflows from various countries often appear consolidated under U.S. data, even when the actual source is elsewhere.

Similarly, funds coursed through money couriers are attributed to the country where their main offices are based — again inflating U.S. figures.

Nevertheless, the dominance of the U.S. reflects the strong presence of Filipinos in North America and the region’s continued role as a key driver of foreign inflows. The Middle East and Southeast Asia also remain vital contributors, underscoring the global footprint of Filipino workers.

Economic impact and outlook

Remittances have long been a cornerstone of the Philippine economy, accounting for about 9 percent of gross domestic product (GDP). They provide crucial support for millions of households, fueling consumption and driving demand in sectors ranging from retail to real estate.

The July figures reinforce the importance of remittances as a stabilizing force amid global challenges such as fluctuating oil prices, geopolitical tensions, and currency volatility. Strong remittance inflows bolster the country’s foreign reserves and help cushion the peso against external shocks.

Looking ahead, the BSP is expected to maintain a cautious outlook. While growth in remittances has been steady, it also depends on global labor demand, particularly in shipping, healthcare, and information technology sectors where Filipino workers are prominent.

With cumulative inflows already nearing the US$20 billion mark in the first seven months of the year, analysts believe the Philippines is on track to surpass 2024’s remittance levels, ensuring continued support for both household spending and macroeconomic stability.

A lifeline that keeps giving

For millions of families across the Philippines, these billions of dollars translate into school tuition, medical expenses, groceries, and even small business capital. Each dollar remitted helps sustain livelihoods, making OFWs not just “modern-day heroes” in name but in measurable economic impact.

As the July data shows, their contributions remain vital in powering both the resilience of Filipino households and the overall growth trajectory of the Philippine economy.