The Philippine banking sector is entering 2026 with a stance of “cautious optimism.”

According to the latest Senior Bank Loan Officers’ Survey (SLOS) 1, 3 released by the Bangko Sentral ng Pilipinas (BSP), the majority of the country’s banks and financial institutions intend to maintain steady credit standards 2 for both businesses and households through the first quarter of the year.

This stability comes as the central bank projects January 2026 inflation to settle within a manageable range of 1.4% to 2.2%, providing a relatively calm backdrop for credit activity despite lingering upward price pressures.

Credit standards: A shield of stability

For fintech observers and traditional lenders alike, the “modal approach” 4 of the survey indicates a preference for consistency.

- Enterprise lending: 87.7% of banks expect to keep credit standards unchanged — a slight increase from 86.0% in the previous quarter.

- Household loans: 79.5% of banks plan to retain current standards, though this is a dip from 82.5% in Q4 2025, suggesting a slight uptick in volatility for consumer credit.

While the majority favor the status quo, the Diffusion Index (DI) 5, 6 indicates a “net tightening” sentiment.

A net 8.8% of banks expect to tighten business loan requirements, while 5.1% foresee tighter household lending norms.

This suggests that while most banks aren’t changing their rules, those that are moving are leaning toward stricter risk management rather than aggressive easing.

Surge in loan demand

According to the BSP, despite the lean toward tighter standards, the appetite for credit is surging.

The survey, which gathered insights from 58 universal, commercial, thrift, and rural banks, highlights a significant jump in demand:

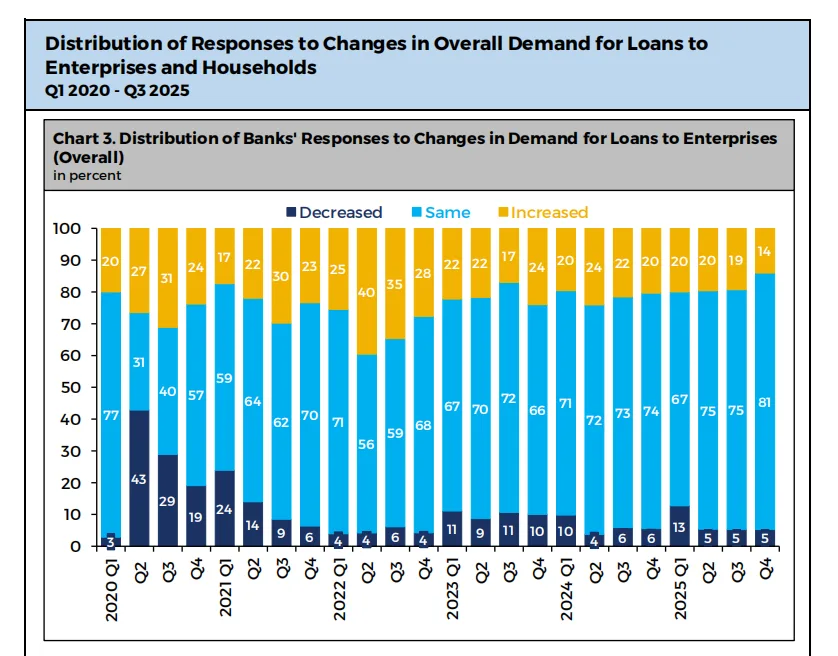

- Business appetite: 28.1% of banks expect an increase in loan demand from enterprises, doubling the 14.0% recorded last quarter.

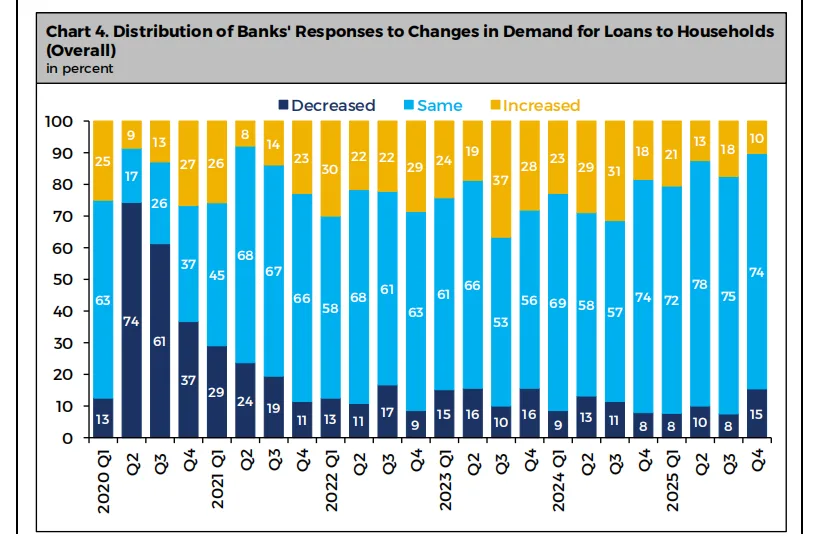

- Consumer appetite: 30.8% of respondents anticipate a rise in household loan demand, signaling healthy consumer confidence as the year begins.

The inflation backdrop: Headwinds vs. tailwinds

The BSP’s January inflation forecast of 1.4% to 2.2% provides the essential context for this credit outlook. While the headline figure is low, the central bank warned of several “upward price pressures” that could impact the purchasing power of borrowers:

- Cost drivers: Higher prices for rice and fish, rising domestic fuel costs, and the annual excise tax adjustments for alcohol and tobacco.

- Infrastructure and utility hikes: Increased water rates, toll fees, and the impact of a depreciating peso.

These pressures are expected to be mitigated by lower electricity charges in Meralco-serviced areas and the stabilization of vegetable prices.

The “data-dependent” path forward

As the Philippine fintech and banking sectors navigate the start of 2026, the BSP remains in a “watch-and-see” mode.

The central bank emphasized its data-dependent approach, closely monitoring both domestic shifts and international developments to ensure monetary policy remains aligned with growth targets.

For lenders, the message is clear: while the demand for capital is accelerating, the “rules of the game” (credit standards) will remain firm as the industry keeps a close eye on inflationary risks and currency fluctuations.

—

[1] Q4 2025 Senior Bank Loan Officers’ Survey (SLOS).

[2] Credit standards refer to the rules banks use when giving loans—like interest rates, loan size, collateral, loan conditions, and repayment terms.

[3] The SLOS consists of questions on loan officers’ perceptions relating to the overall credit standards of their respective banks, as well as to factors affecting the supply of and demand for loans to both enterprises and households. The responses for the Q4 2025 SLOS were gathered from 27 November 2025 to 16 January 2026 with a total of 58 respondent banks out of 60 surveyed banks or a 96.7 percent response rate.

[4] For the Modal Approach: categorical response such as “tighten,” “loosen,” and “unchanged” are used.

[5] Based on the diffusion index (DI) method: a positive DI for credit standards indicates that the proportion of respondent banks that have tightened their credit standards exceeds those that eased (“net tightening”), whereas a negative DI for credit standards indicates that more respondent banks have eased their credit standards compared to those that tightened (“net easing”).

[6] In terms of loan demand, the three choices for modal approach are either 1) increasing, 2) decreasing, or 3) unchanged demand for credit from businesses and from consumers. Meanwhile, an unchanged loan demand in the DI approach notes that the proportion of the respondent banks that have reported an increase in loan demand is equal to those that indicated a decrease in demand for loans.