The Philippines’ external position continues to reflect growing investor confidence and stronger financial linkages with the rest of the world, as the country posted higher levels of both foreign direct investments (FDI) and overall foreign financial assets in mid-2025 — a sign that the economy remains resilient amid shifting global conditions.

Latest data from the Bangko Sentral ng Pilipinas (BSP) show that the country’s International Investment Position (IIP)— a key indicator of the value of financial assets and liabilities between residents and nonresidents — registered a net external liability of US$68.3 billion as of June 2025, marking a 44.1% increase from a year earlier.

This rise was largely driven by sustained inflows of FDI, which expanded by 2.7% to US$325.2 billion, outpacing the Philippines’ own investments abroad, which grew by just 0.9% to US$256.9 billion.

In simpler terms, more foreign capital continues to enter the country than flow out — reflecting optimism in the country’s medium-term economic prospects.

According to the BSP, the IIP is a crucial measure of the country’s external health, showing what the Philippines owns versus owes internationally. A growing IIP reflects deeper global participation, helping policymakers and investors assess both vulnerabilities and resilience in the face of global economic shifts.

Japan and the U.S. lead FDI inflows

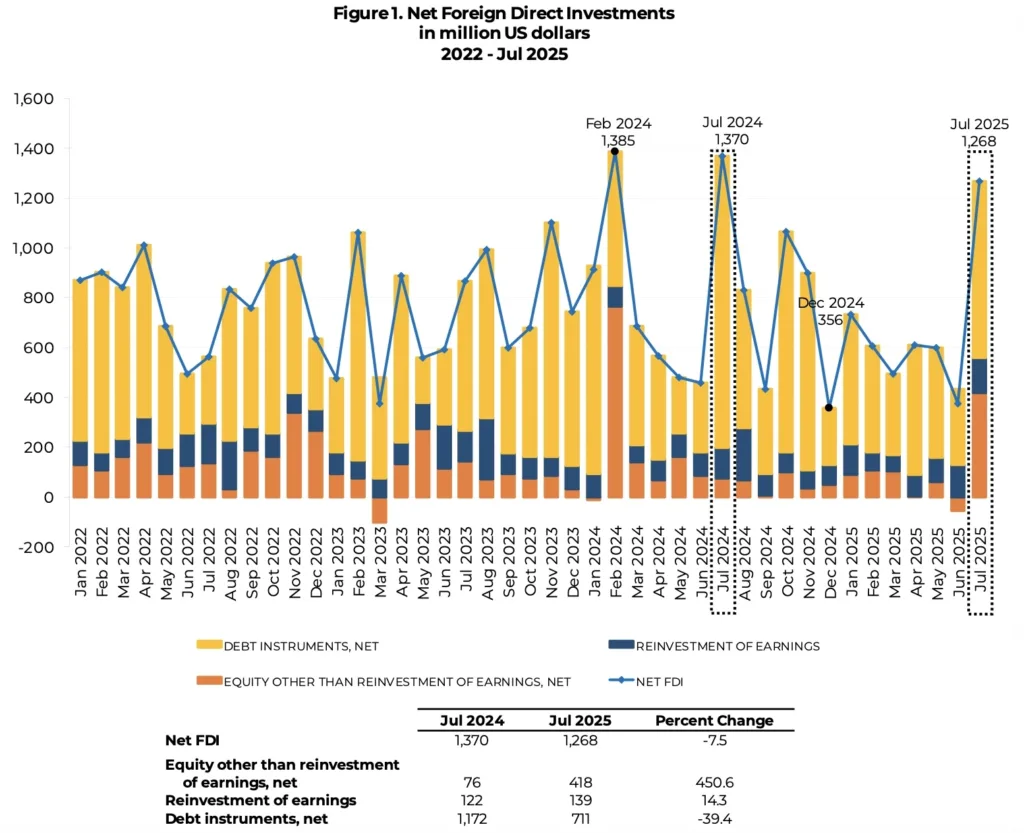

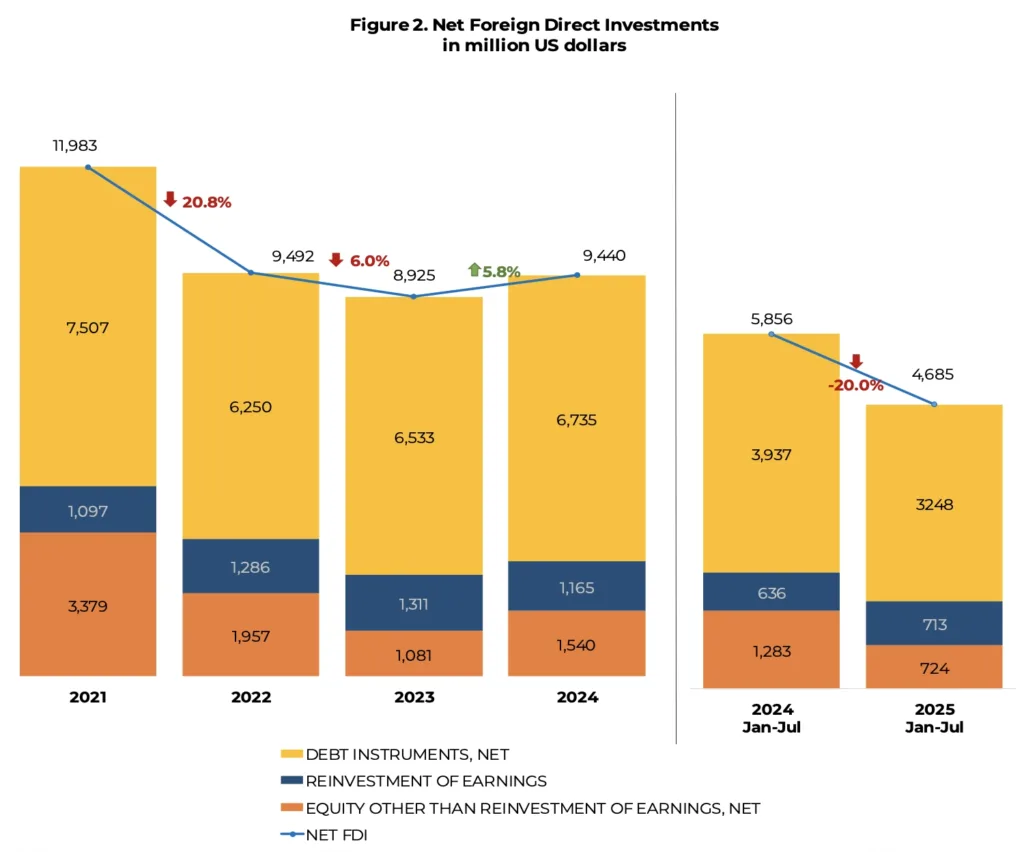

Complementing the broader IIP growth, net foreign direct investments (FDI) in the Philippines also remained solid, hitting US$1.3 billion in July 2025 1 — led by inflows from Japan and the United States.

While this represented a slight 7.5% decline from the US$1.4 billion recorded a year earlier, 2 the details tell a more nuanced story. Equity capital investments, excluding reinvested earnings, surged by 450.6% to US$418 million from just US$76 million a year ago, signaling strong long-term investor confidence.

Reinvestment of earnings likewise rose 14.3% to US$139 million, showing that existing foreign companies in the country are doubling down on their Philippine operations. The modest decline in the overall FDI figure was mainly due to a slowdown in nonresidents’ net investments in debt instruments, which fell by 39.4% as global interest rates remained elevated. 3

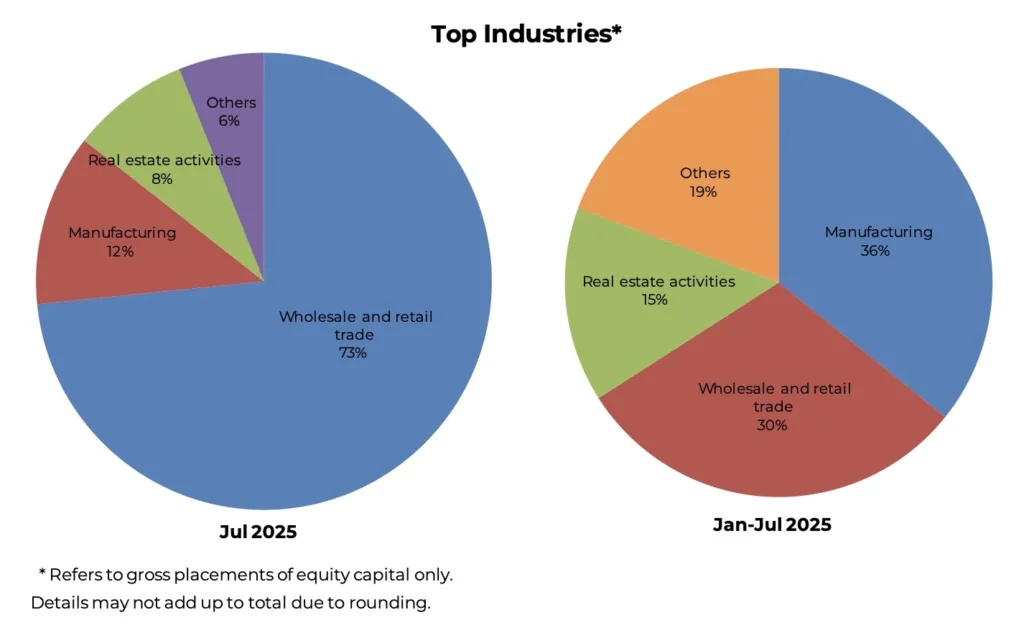

The wholesale and retail trade, manufacturing, and real estate sectors were among the top beneficiaries of these inflows — highlighting continued expansion in industries tied to both domestic demand and infrastructure growth.

On a cumulative basis, FDI net inflows reached US$4.7 billion from January to July 2025, a 20% dip from the US$5.9 billion posted during the same period in 2024. Analysts note, however, that despite the decline, inflows remain substantial given the high global borrowing costs and cautious sentiment among multinational firms.

Investor optimism amid global uncertainty

The combined data from the IIP and FDI reports suggest a cautiously optimistic picture: while external liabilities are growing, they are backed by rising foreign participation in local assets and expanding equity commitments.

Economists view this trend as a sign that the Philippines continues to attract long-term, productive funding even as short-term capital flows fluctuate. The BSP has emphasized that sustained inflows help support the peso, enhance external buffers, and fund key sectors such as infrastructure, energy, and manufacturing.

With reforms in financing regulations, improved ease of doing business, and the ongoing digitalization of financial systems, the Philippines is positioning itself as a competitive investment hub in Southeast Asia.

The challenge moving forward lies in maintaining this momentum while ensuring that foreign capital contributes to inclusive and sustainable growth — particularly as the global economy navigates uncertainties in interest rates, trade tensions, and technology-driven shifts.

A balancing act for the economy

As 2025 progresses, the country’s growing IIP and steady FDI inflows paint a story of resilience and integration — an economy that, despite global headwinds, continues to find strength in its expanding financial connections.

The key will be in balancing openness with stability, ensuring that as foreign investors deepen their stakes in the Philippines, the local economy also gains in productivity, innovation, and competitiveness.

If current trends continue, 2025 could be remembered as the year the Philippines solidified its role as one of Asia’s most dynamic emerging markets — where foreign capital meets local opportunity.

—

1 BSP statistics on FDI are compiled based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). FDI includes investment by a nonresident direct investor in a resident enterprise, where the equity capital in the latter is at least 10 percent. It also includes investment made by a nonresident subsidiary or associate in its resident direct investor. FDI can be in the form of equity capital, reinvestment of earnings, and borrowings.

2 BSP FDI statistics are different from the investment data of other government sources. BSP FDI covers actual investment inflows. In contrast, the approved foreign investments data published by the Philippine Statistics Authority (PSA) are sourced from Investment Promotion Agencies (IPAs). These represent investment commitments, which may not necessarily be fully realized in a given period. Furthermore, the PSA data are not based on the 10-percent foreign ownership criterion under BPM6. Additionally, the BSP’s FDI data are presented in net terms (i.e., equity capital placements less withdrawals). On the other hand, the PSA’s foreign investment data do not account for equity withdrawals.

3 Net investments in debt instruments consist mainly of intercompany borrowing and lending between foreign direct investors and their subsidiaries or affiliates in the Philippines. The remaining portion of net investments in debt instruments are investments made by nonresident subsidiaries or associates in their resident direct investors. This is known as reverse investment.