The Philippine economy is entering the latter half of 2025 on a mixed but encouraging note, with households showing signs of renewed optimism while firms adopt a more measured stance amid global and seasonal headwinds.

Latest survey results from the Bangko Sentral ng Pilipinas (BSP) reveal a nuanced outlook: consumer confidence improved in the 2nd half of 2025, while business sentiment moderated.

Both groups, however, share an expectation that inflation will remain within government targets over the next 12 months — a critical factor underpinning growth, investment, and job creation.

Consumers find new reasons for optimism in PH economy

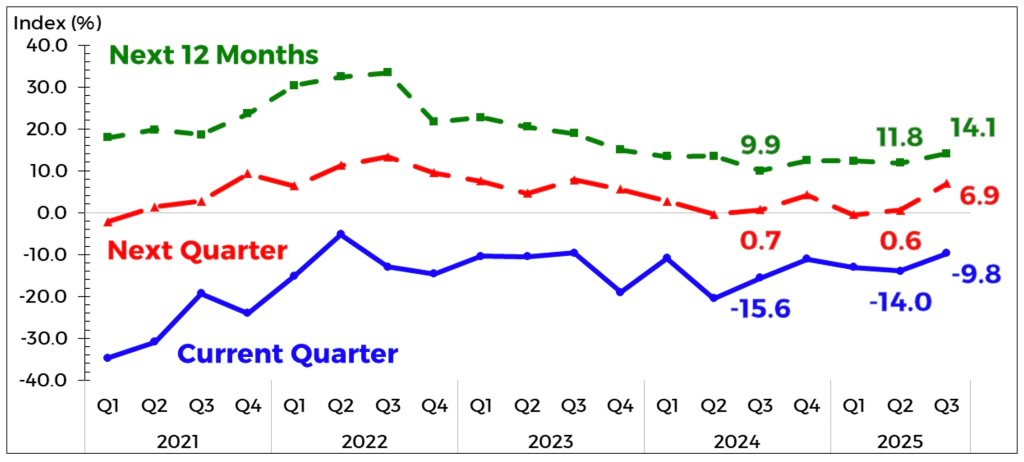

Filipino households were less pessimistic in Q3 2025, with the overall consumer confidence index (CI) climbing to -9.8 percent from -14.0 percent in the previous quarter.

While still negative — meaning more consumers remain pessimistic than optimistic — the upward shift signals that households are gradually regaining confidence.

The Consumer Expectations Survey (CES) 1 attributed the brighter outlook to new income sources, higher earnings, and more working family members, reflecting both resilience and adaptability among Filipinos in an evolving job market.

Looking ahead, consumers anticipate stronger conditions in the next quarter and over the next 12 months, underscoring confidence that household incomes and employment opportunities will continue to improve.

More importantly, survey respondents expect inflation to stay within the government’s 2–4 percent target range in the coming year — an encouraging sign that rising costs are unlikely to dampen consumption.

“Less downbeat household sentiment suggests that consumer demand, a key growth driver of the Philippine economy, may remain steady,” noted BSP officials in a statement. “Well-anchored inflation expectations provide additional support for spending and investments.”

Businesses pull back amid seasonal and global pressures

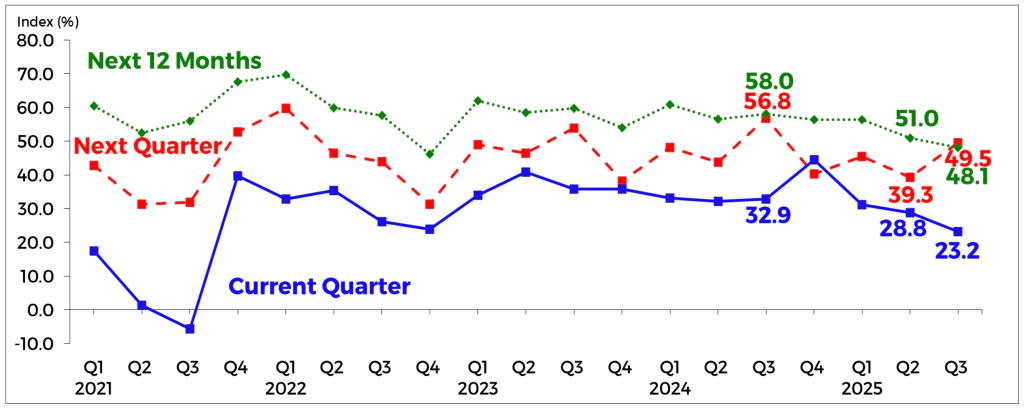

While households are cautiously optimistic, Philippine businesses struck a more conservative tone in Q3 2025. The Business Expectations Survey (BES) 2 showed the overall business CI slipping to 23.2 percent from 28.8 percent in the second quarter.

Firms cited several reasons for the dip: weaker demand during the so-called “ghost month” 3 in August, reduced consumer activity during the rainy and typhoon season, and mounting global challenges such as higher US tariffs, geopolitical tensions, and softer foreign demand.

Despite these concerns, businesses are not retreating from their growth plans. The outlook for Q4 2025 rebounded strongly to 49.5 percent, suggesting that firms expect a seasonal pickup in demand during the holiday period.

For the next 12 months, the CI moderated to 48.1 percent, but it remained firmly positive, showing that companies are still betting on a generally favorable operating environment.

Like consumers, businesses also expect inflation to stay manageable over the next year, a key factor that could support capital expenditures, hiring, and expansion plans.

A balancing act for policymakers

Together, the CES and BES provide a snapshot of the Philippine economy at a crossroads. Households are now beginning to feel relief from rising incomes and stable inflation. Meanwhile, businesses — though still cautious — see brighter prospects in the near term.

For the BSP, these findings are more than just numbers. The central bank uses both surveys as key economic surveillance tools and as important inputs for monetary policy formulation. By understanding how households and firms perceive the economy, the BSP can better calibrate policies that balance growth and stability.

What it means for the economy

The contrast between cautious optimism among consumers and tempered confidence among businesses highlights the importance of sustaining both demand and investment. As households regain purchasing power, firms will need to match it with goods, services, and jobs that keep the growth cycle intact.

Analysts say the coming quarters will test whether domestic resilience can offset external uncertainties. “The consumer is coming back, but businesses are wary of global risks,” one market watcher observed. “The challenge is ensuring that confidence on both sides reinforces each other.”

As 2025 draws to a close, the message from both households and businesses is clear: optimism exists, but it is conditional on stability, resilience, and continued support from policymakers.

—

1 The Q3 2025 CES was conducted from 1-12 July 2025. In the Q3 2025 CES, 5,493 households were identified as eligible, with 2,475 (45.1 percent) from the NCR and 3,018 (54.9 percent) from AONCR. Out of the identified sample size, 5,416 households participated in the survey, equivalent to a response rate of 98.6 percent (from 98.3 percent in the Q2 2025 survey). Respondents included 2,427 households in the NCR (with a 98.1 percent response rate) and 2,989 households in AONCR (with a 99.0 percent response rate). The high-income group comprised the largest percentage of respondents (41.0 percent), followed by the middle-income group (36.8 percent) and the low-income group (22.2 percent).

2 The Q3 2025 BES was conducted during the period 4 July – 17 August 2025. There were 1,523 firms surveyed nationwide, consisting of 580 companies in the NCR and 943 firms in AONCR, covering all 17 regions nationwide. Samples were drawn through stratified random sampling from the Bureau van Dijk (BvD) database of Top 7,000 Corporations based on total assets in 2017. The nationwide survey response rate for Q3 2025 was slightly lower at 61.0 percent (from 61.2 percent in Q2 2025). The response rate was marginally lower for both the NCR at 60.3 percent (from 60.5 percent) and AONCR at 61.4 percent (from 61.7 percent).

3 People who observe the “ghost month” typically postpone big or costly decisions like opening a business, entering partnerships, investing in new ventures and stocks, etc.