For most mobile users, the moment a banking app blocks a transaction due to “detected malware” is met with pure frustration. You know there’s a threat, but you have no idea how to find it or kill it.

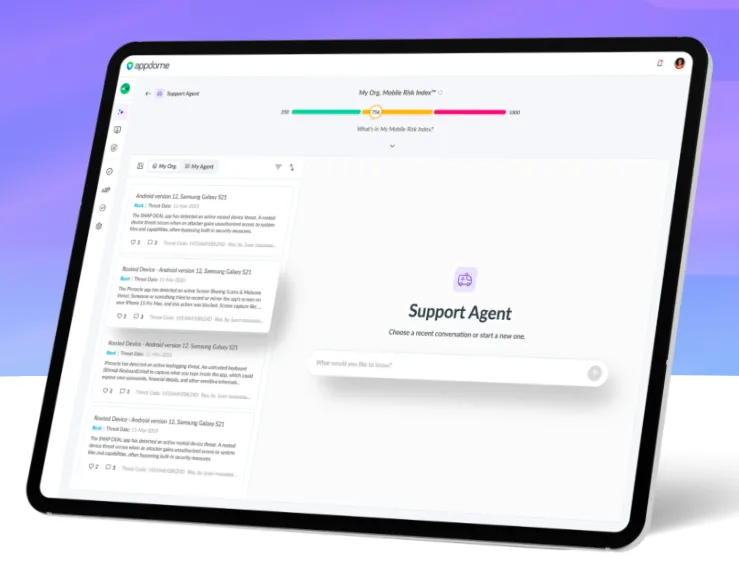

Appdome is looking to change that. Fresh off its debut at Black Hat Europe, the mobile security giant has launched “Support Agent,” an Agentic AI-powered tool designed to help mobile brands and their customers fix security threats in real time.

Instead of just telling a user their phone is “compromised,” the new AI agent acts like a high-level cybersecurity consultant living inside the app. It provides step-by-step, conversational instructions on how to remove specific trojans, malware, or fraudulent tools — tailored exactly to the user’s specific device and OS version.

Appdome: Moving beyond “detect and block”

In the Philippines, where “scam capital” headlines have become a daily occurrence, the traditional approach to mobile security is failing the user experience. Usually, if a threat is detected, the app simply shuts down, leaving the customer stranded.

“Cybersecurity, fraud, and network teams can’t simply detect and prevent attacks; they have to address the end-user impact,” said Tom Tovar, CEO and co-creator at Appdome. “Support Agent allows users to interact with the AI to understand and remove the threat fast.”

This is a massive shift for fintech support teams. Typically, when a user calls a helpdesk because their app won’t open due to a security flag, the support agent is often as “blind” as the user.

Appdome’s new tool deciphers a unique ThreatCode™ — a digital fingerprint of the specific attack — and translates it into a plain-English remediation workflow.

Why “Agentic AI” is the new fintech standard

Unlike basic chatbots that simply scan a database for FAQ answers, Appdome’s Agentic AI is designed to reason.

If a user follows an instruction to disable a malicious accessibility setting and it doesn’t work, they can “challenge” the AI. The Agent can then re-evaluate the device environment and provide a different path. It effectively replaces the manual, back-and-forth investigation that usually bogs down cyber and fraud teams.

Chris Roeckl, Chief Product Officer at Appdome, noted that these instructions are hyper-localized to the incident. “It’s tailor-made to fit the specific attack scenario, including the device type, OS version, and the source of the attack.”

For Philippine fintechs — where social engineering and disguised malware are rampant — this tool offers three major wins:

- Lower churn: Users are less likely to uninstall an app if they are guided through a fix rather than just being blocked.

- Reduced support costs: Automated AI workflows handle the “how do I fix this?” questions that usually flood call centers.

- Real-time trust: It transforms a scary security event into a transparent, helpful interaction.

Privacy first: No “learning” from your data

In an era of AI skepticism, Appdome is taking a hard line on governance. Unlike generic LLMs (like ChatGPT) that might “learn” from user inputs, Support Agent operates within a secure, enterprise-grade environment.

The company employs a No-Learning and No-Retention policy.

No Personally Identifiable Information (PII) is sent to public models, and all reasoning stays within Appdome’s governed context. This ensures that while the AI is smart enough to kill a trojan, it isn’t eavesdropping on the user’s private data.

As mobile brands in the Philippines continue to battle AI-driven deepfakes and sophisticated social engineering, Appdome’s move suggests that the future of mobile security isn’t just about building higher walls — it’s about giving users the tools to clean up their own digital backyard.