The Philippines’ booming fintech industry is facing a new wave of cyber threats as fraudsters deploy artificial intelligence to bypass traditional security measures. Appdome, a global leader in mobile app security, is stepping up to address this challenge with its AI-Native mobile app defense platform, which it says can provide the level of protection financial institutions now urgently require.

In an exclusive interview with FintechNewsPH, Jan Sysmans, Appdome’s Mobile App Security Evangelist, underscored the importance of safeguarding mobile users in one of Asia’s most mobile-first markets.

Jan Sysmans, Mobile App Security Evangelist at Appdome

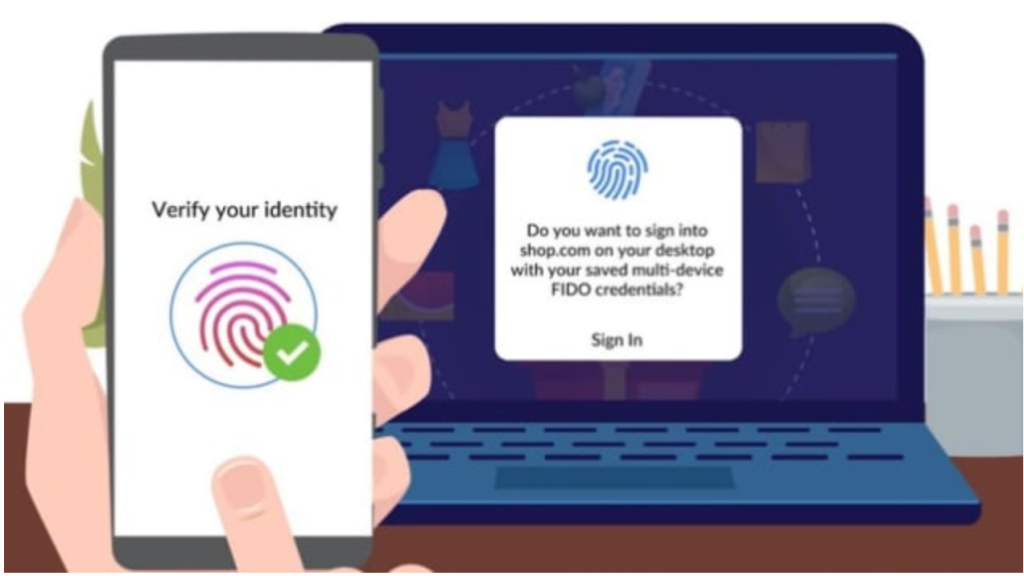

“AI has already defeated most of the ways people authenticate beyond passwords, including biometrics,” Sysmans said. “For a market like the Philippines, where e-wallet adoption is projected to surge to 63.4% this year, the stakes could not be higher.”

Rising threats to mobile finance

As more Filipinos embrace mobile banking, payments, and e-wallet services, criminals are weaponizing AI to create deepfakes and sophisticated bots that can mimic user behavior, spoof gestures, and even inject fake live video streams into authentication systems.

Sysmans pointed to real-world examples overseas: in China, deepfakes were used to defraud the government of millions of dollars, while in the UAE, attackers cloned a bank executive’s voice to authorize a fraudulent US$35 million transfer. In Indonesia, one bank reported over 1,100 deepfake fraud attempts in just three months, exposing it to potential losses of US$138.5 million.

“These are not hypothetical threats,” Sysmans warned. “They are happening right now, and the Philippines is not immune. Fraudsters are already using AI-enhanced voice phishing attacks, and with the country’s rapid digital transformation, fintechs need to be on the front foot.”

Appdome’s AI-native defense

To help financial institutions address these risks, Appdome’s platform integrates over 400 defenses directly into Android and iOS apps.

Unlike static tools that rely on signatures, Appdome uses continuous data analysis and machine learning to update protections dynamically, allowing apps to block threats like deepfake video injection, voice cloning, on-device API tampering, and AI-driven MobileBots before they compromise user accounts.

“Our approach is proactive,” Sysmans explained. “We place the defense inside the app itself, so threats are identified and blocked in real time. This makes a huge difference for banks, e-wallets, and any mobile-first financial service provider.”

Implications for Philippine fintech firms

The move comes at a time when regulators are tightening oversight of digital finance. The Bangko Sentral ng Pilipinas (BSP) has strengthened its IT risk management guidelines, while the recently enacted Anti-Financial Account Scamming Act (AFASA) reflects the government’s commitment to combat fraud.

Still, Sysmans believes fintech firms need to go beyond compliance. “Filipino consumers are very clear about their expectations,” he said. “In our 2024 survey, 76.3% of Filipinos said they would abandon a mobile brand that fails to protect their data. In such a competitive market, failing to secure your app is not just a regulatory risk — it’s a business risk.”

Securing trust in a mobile-first economy

The urgency is not limited to private-sector apps. The Philippines’ National ID system, which uses biometric authentication for millions of transactions, could also become a target if defenses against deepfakes are not reinforced. “Biometric authentication alone is no longer trustworthy,” Sysmans said. “You need a perimeter of defenses to ensure that the source integrity of the biometrics is preserved.”

Looking ahead, Sysmans sees AI both as a threat and an opportunity. “As attackers use AI to innovate faster than ever, defenders must also be AI-native. That’s why we built our platform this way. It’s the only way to stay ahead of evolving fraud.”

For Philippine fintech firms aiming to win customer trust while scaling their digital platforms, Appdome’s message is very clear: embedding security directly into mobile apps is no longer optional — it’s a business imperative.