In a strategic move that’s meant to further bolster digital payment transactions in the Philippines, Alipay+ has recently announced a partnership with GHL Systems Philippines Inc. (GHL Philippines), a subsidiary of GHL Systems Berhad.

This collaboration will enable local businesses to accept cross-border digital payments from leading Asian mobile wallets, enhancing face-to-face and e-commerce transactions.

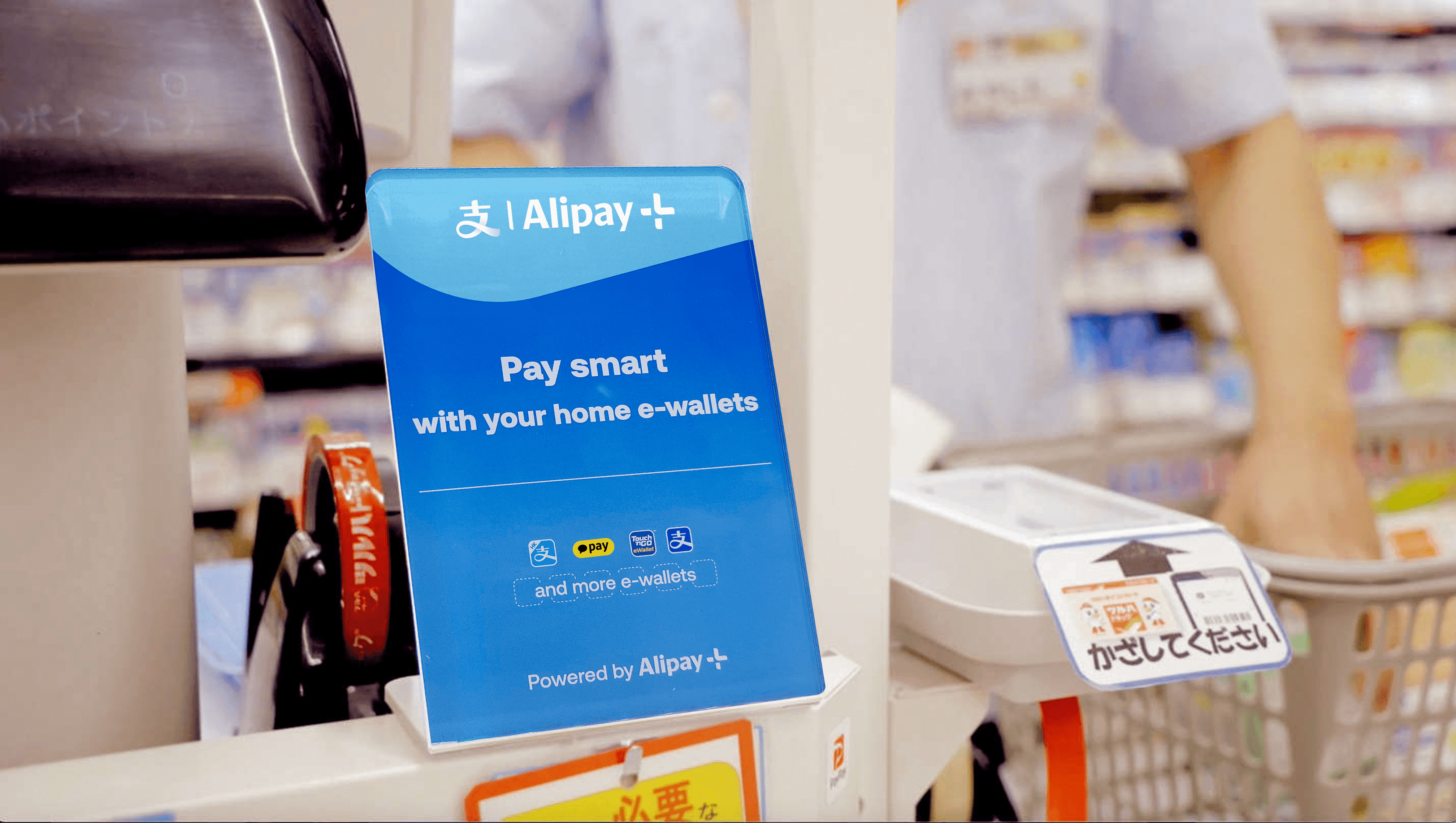

IMAGE CREDIT: https://www.alipayplus.com/

Seamless payment integration

According to the company’s press release, merchants across the Philippines can now effortlessly accept payments from prominent Asian mobile wallets such as AlipayHK (Hong Kong SAR), Kakao Pay (South Korea), Touch ‘n Go eWallet (Malaysia), and Alipay (Chinese mainland) through this partnership.

These wallets are the primary payment methods for many top inbound travellers to the Philippines. The integration allows visitors to use their local mobile wallets to make payments at a wider array of merchants, offering a more diverse range of payment options beyond traditional cash or foreign-issued credit and debit cards.

The collaboration between Alipay+ and GHL Systems aims to significantly improve the payment experience for travellers in the Philippines.

By enabling the use of home e-wallets at retail outlets powered by GHL, the partnership benefits a broad spectrum of local businesses, including those in retail, food and beverage, hospitality, and attractions.

This enhancement also comes at a critical time as tourist arrivals in the Philippines are forecasted to reach 8.21 million this year, a significant increase from tourist arrivals of 5.4 million recorded in 2023 and the 7.1 million recorded in 2019, the last full year before the pandemic.

Driving economic growth

Jay Tirona, CEO of GHL Philippines, highlighted the impact of the partnership, stating, “This collaboration signifies a significant leap forward in our mission to enhance the digital payment landscape in the Philippines.”

“Besides enabling local businesses to tap into a broader customer base, we are also reinforcing our commitment to providing innovative solutions that cater to the evolving needs of merchants and consumers. We are excited about the possibilities this partnership brings and the positive impact it will have on facilitating seamless cross-border transactions in the country,” Jay further stated.

Michael Hao, Ant International’s country manager for the Philippines, echoed this sentiment, saying, “We are excited about our partnership with GHL Philippines and the opportunities it presents to transform cross-border payments in the Philippines.”

“This collaboration underscores our commitment to providing innovative and seamless payment solutions to users worldwide. As tourists return to explore the beauty of the Philippines, we aim to empower more local merchants to benefit from the tourism growth and engage with global users more easily,” he added.

About Alipay+

Since its introduction by Ant International in 2020, Alipay+ has connected over 88 million merchants across 57 countries and regions to users of over 25 e-wallets and bank apps.

This extensive network allows consumers to travel and pay hassle-free globally while enabling merchants to enhance cross-border consumer engagement and digital marketing.

Beyond the Philippines, Alipay+ is now also widely accepted in other popular travel destinations, which include Singapore, Malaysia, Thailand, Japan, South Korea, Europe, and the Middle East.

As the Philippines prepares for a vibrant tourism year in 2024, the integration of various mobile wallets through Alipay+ and GHL Systems ensures that the country is well-equipped to meet the demands of modern, tech-savvy travellers.

This partnership not only supports local businesses but also enhances the overall visitor experience, reinforcing the Philippines’ position as a premier travel destination.