Fintech, decentralized assets, and fundraising seen as areas of convergence

Africa and ASEAN signed a landmark partnership agreement to promote digital economies, identifying fintech, decentralized assets, and fundraising as a focus for convergence. The historic signing was done at the seminal inclusive Fintech Forum in Kigali, Rwanda witnessed by regulators, association heads, and leading fintech and technology businesses across the two regions.

The partnership brings together ASEAN (via the GIFT- Global Impact Fintech ASEAN, the One ASEAN Fintech Movement – OAFM, and Digital Pilipinas) and Pan Africa via the Africa Fintech Network. This also sets the stage for the first ever Africa x ASEAN Digital Economies and Fintech month both happening on the week of October 2 to 6, 2023 in Manila, Philippines, and Nairobi, Kenya.

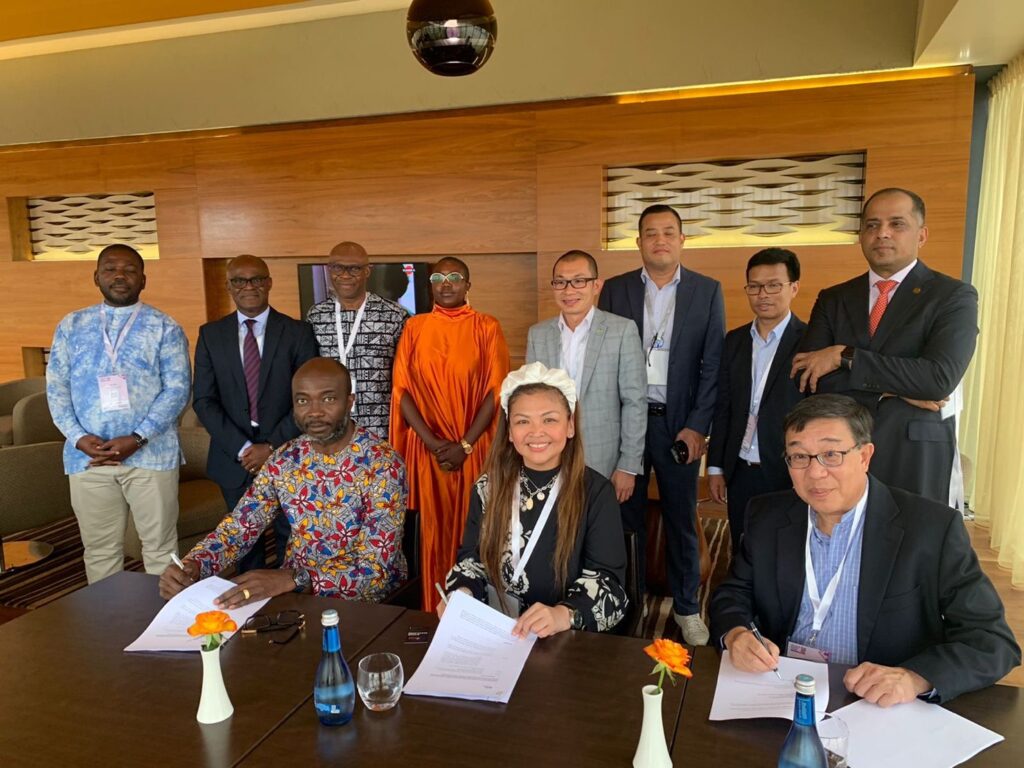

ASEAN, via Digital Pilipinas (DP), One ASEAN Fintech Movement (OAFM), Global Impact Fintech ASEAN (GIFT-ASEAN); Pan-Africa represented by Africa Fintech Network (AFN) and Global Fintech Institute (GFI) sign a tri-partite partnership as witnessed by leaders of ASEAN and the Pan African Fintech Network. Photo shows Amor Maclang (seated, center) of DP, OAFM, and GIFT-ASEAN together with Professor David Lee (3rd from left) of GFI, and Dr. Patrick Saidu Conteh (left) of AFN while signing the agreement.

Witnessing the signing on behalf of the Africa Fintech Network (AFN) were Dr. Patrick Saidu Conteh, CEO of AFN, and Dr. Segun Aina, President of AFN. Joining them were Mr. Premier Oiwoh, Managing Director and CEO at NIBSS/Nigeria; and the various officers of AFN, a 35-countries strong network of digital economies in Africa.

For its ASEAN counterpart, witnessing the partnership agreement signing were Mr. Sopnendu Mohanty of the Monetary Authority of Singapore (MAS) and Dr. David Lee of the Global Fintech Institute (GFI), Mr. Ouk Sarat, Head of Payment Service Department of National Bank of Cambodia, Mr. Remi Pell, Chair of Cambodia Fintech Association, and Ms. Amor Maclang of Digital Pilipinas, Philippine Fintech Association and GIFT/OAFM.

This landmark agreement begins a collaboration between the two regions in advocacy, fundraising, payments, lending, decentralized assets, start-up development, regulatory exchange, and education.

Africa and ASEAN are expected to grow exponentially in the digital economies space with global projections for ASEAN extending by 6 percent annually, reaching as high as US$1 trillion by 2030. Africa, on the other hand, is projected to top US$712 billion by 2050.

“Africa and ASEAN are uniquely placed to leapfrog digital economic development. The recent signing of a cooperation agreement with our various ASEAN partners as the One ASEAN Fintech Movement/GIFT/ Digital Pilipinas, and Africa Fintech Network is a demonstration of the strong emerging partnership among major digital finance stakeholders in the spirit of sharing innovative technologies, knowledge, and best practices to support the sustainable development of our countries,“ says Dr. Conteh.

Fintech industry leaders and ecosystem enablers from Pan Africa and ASEAN discuss opportunities from the recently signed partnership to unite fintech and the digital economy market participants in Africa and ASEAN Countries. Photo shows (from left:) Dr. Patrick Saidu Conteh, CEO of Africa Fintech Network (AFN); Amor Maclang, Convenor of Digital Pilipinas and Philippine Fintech Festival, Co-Founder of One ASEAN Fintech Movement, ASEAN Chair of Global Impact Fintech, and Executive Director of Fintech Philippines Association; Professor David Lee, Chairman of the Board at Global FinTech Institute; and Premier Oiwoh, Managing Director and Chief Executive Officer at NIBSS / Nigeria.

For his part, Professor David Lee, Co-Founder and Chairman of Global Fintech Institute, said, “By rolling out the Chartered Fintech Professional (CFtP) professional qualification program in collaboration with our partners, Digital Pilipinas and Africa Fintech Network, GFI is committed to leveraging on this partnership to empower and nurture future generations of fintech talents in ASEAN and Africa with a global mindset, a rigorous knowledge framework for continually keeping up with industry development and trends, and strong ethical standards.”

“This is just a humble beginning and leveraging on the inputs from our partners, we will roll out even more programs such as the ‘CFtP Lite’ and other digital literacy programs to empower policymakers, practitioners, and entrepreneurs,” he added.

“Africa and ASEAN have almost the same parallel journey in our digital economy and our commitment to take this side by side with our African Fintech Leaders ensures that engaging and investing in the combined population of 2 billion as a fintech market will be a primary agenda of many companies, countries and organizations,” says Maclang.

The Africa x ASEAN digital economies partnership also enjoins other interested groups and organizations to be part of the collaboration by reaching out to Dr. Patrick Conteh of the Africa Fintech Network or Amor Maclang of the One ASEAN Fintech Movement/Digital Pilipinas.