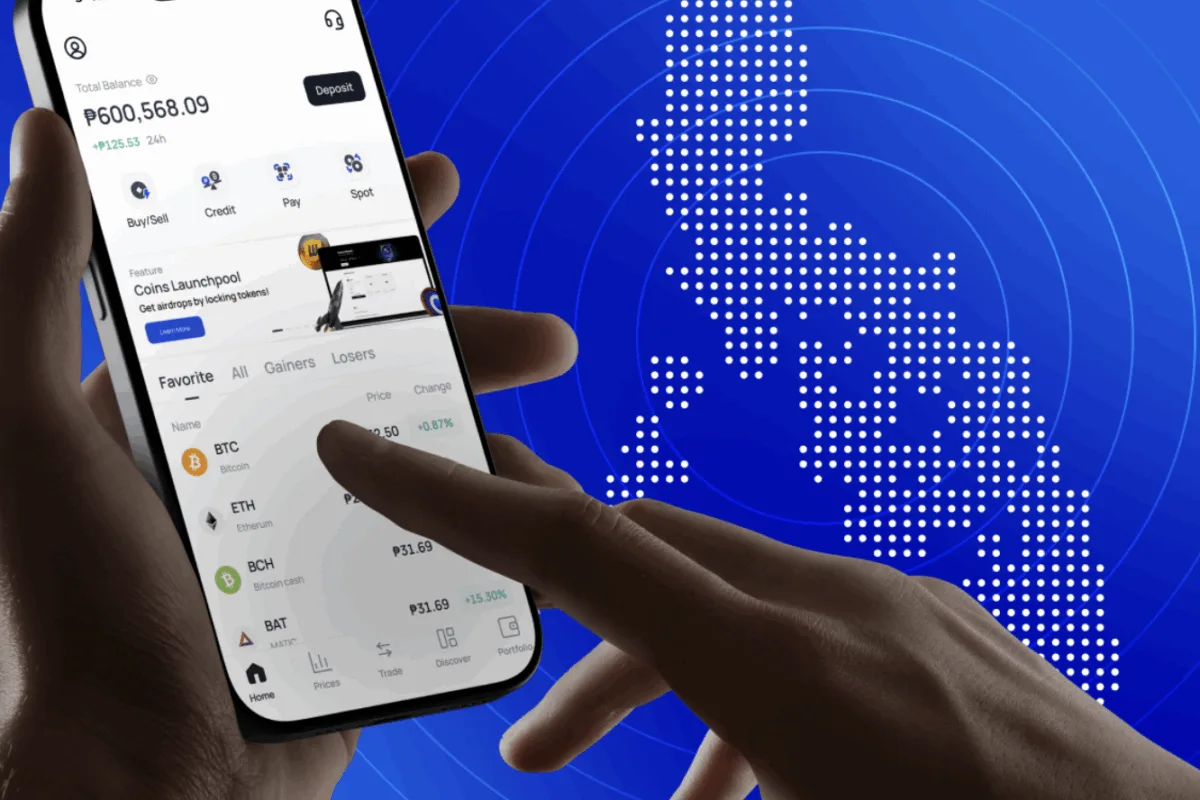

Filipino-led remittance platform BCRemit kicks off 2026 with a QR-payment collection feature in partnership with Coins.ph, enabling faster, cheaper cross-border transactions.

With over 1 million transactions processed and a $600M transaction value to date, the company is eyeing an all-in-one financial superapp to serve OFWs, SMEs, and global migrant communities.

Building on its success in retail remittances, BCRemit has expanded to 23 countries and announced plans to broaden its offerings beyond overseas Filipino workers. The platform will introduce cross-border payment solutions tailored for small and medium-sized enterprises (SMEs), Business Process Outsourcings (BPOs), freelancers, and other major migrant markets including India, Mexico, and China.

“Our mission has always been to show that Filipino-led innovation can offer transformative solutions to the world,” said Oliver Calma, Founder and CEO of BCRemit. “By expanding beyond our core community, we aim to serve as a global financial partner built on Filipino values, ready to support the world’s most dynamic economies.”

The newly launched QR-payment collection feature with Coins.ph strengthens BCRemit’s existing integrations with major e-wallets, streamlining outbound remittances and complementing the country’s booming remittance economy, which reached $2.91 billion in November 2025 alone.

Filipino-led fintech expands global QR remittance reach

BCRemit CEO and founder Oliver Calma

Looking ahead, BCRemit also envisions evolving as an all-in-one financial platform, diversifying its product offerings to introduce loans, e-wallets, stablecoin, and investments.

Currently, BCRemit has processed over 1 million transactions since its launch, amounting to over $600 million in transaction value, underscoring the platform’s robust capability to seamlessly facilitate high-volume cross-border settlements.

BCRemit is leveraging its strategic partnership with Circle Internet Financial to harness technology in overcoming the challenges of traditional remittances. By utilizing blockchain technology and USDC stablecoins, the platform has successfully reduced transaction costs to approximately 1%, a stark contrast to the global average remittance cost of 6.4%.

This infrastructure allows for near-instant settlements, bypassing the 3-5 day delays typical of traditional banking channels and ensuring that funds reach their destination at their highest possible value.

Blockchain-powered remittance platform evolves into superapp vision

BCRemit was established in 2015 by Oliver Calma and his son, Gio, inspired by their own family’s history. Drawing from Oliver’s years as an overseas worker and the family’s reliance on his sent funds, they built the platform to solve the real-world delays they faced firsthand and ensure other families wouldn’t face the same hurdles.

Their mission is rooted in the belief that overseas workers deserve to ‘send money back home faster,’ a principle that remains the heartbeat of the company’s 2026 expansion.

BCRemit Co-founder and Director Gio Calma

“We saw firsthand the impact of financial delays on our own family growing up, and that drives our commitment to innovation today,” said Gio Calma, Co-Founder and Director of BCRemit.

“We understand that for our customers, remittances aren’t just transactions, they’re a lifeline. As we expand, we remain focused on creating a trusted financial gateway that serves every Filipino from around the world,” he added.

Operating under the regulatory oversight of the Bangko Sentral ng Pilipinas (BSP), the UK’s Financial Conduct Authority (FCA) and His Majesty’s Revenue and Customs (HMRC), Banco de España, and Bank of Canada, BCRemit remains committed to maintaining the highest standards of compliance to serving over 10.8 million overseas Filipinos across the world with seamless, secure financial services made by Filipinos, for Filipinos.

For more information, you may visit https://www.bcremit.com/ or follow their Facebook page.