It usually begins with a ping, a text message, a direct message on social media, a “job offer” in your inbox. Then suddenly, in just one click, your hard-earned bank balance evaporates.

For many Filipinos from overseas workers to retirees and young professionals, this digital intrusion is more than just an inconvenience. It’s a life-altering blow that exposes vulnerabilities in trust, technology, and personal security.

Online scams in the Philippines are so pervasive that over half of Filipino adults say they have been scammed at least once in their lifetime, a rate higher than the ASEAN average, and scam exposure is rising.

Caught off guard: Stories of sudden loss

For many victims, the financial hit is swift and devastating.

Take the case of Lexi, a young professional and overseas Filipino worker (OFW) based in New Zealand. Her savings disappeared after she responded to what she believed was a legitimate e-commerce job posting in the area where she lives abroad.

Within hours of clicking a link sent via SMS, her bank notifications lit up with unauthorized transfers. By the time she realized something was wrong, the money was gone and tracing it proved nearly impossible.

“I was waiting for a message at that time, then a notification popped up. I thought it was the one I had been expecting. When I checked my bank account, my savings were gone. Good thing I had only placed a small amount there, so not all of my money was taken,” Lexi said.

Kerwin, another young professional, had a similar experience and nearly fell victim to a scam after receiving a call from someone he believed was a legitimate buyer.

“Someone called me and said they were going to buy the item. They sent a link and told me to click it, saying it might allow a swap with an additional payment as a second option. When I clicked the link, my phone suddenly lagged and a number was being requested.”

“I didn’t enter anything right away because I’m aware of scams like that. Still, it’s alarming that this can happen even when you’re just trying to work honestly,” Kerwin added.

Such experiences are increasingly common in the Philippines.

A study by Global Anti-Scam Alliance (GASA) found that nearly 77% of Filipino adults encountered a scam attempt in the past year — equivalent to almost one scam exposure every two days per person surveyed.

Seniors are also being increasingly targeted through vishing (voice phishing) and deepfake impersonations that mimic relatives to extract money or personal information

Beyond the wallet: Emotional and social fallout

The hard figures are staggering: recent reports estimate that scams cost Filipino households collectively around ₱280 billion in just one year, with individual losses averaging about ₱11,896.

But the financial damage is only one part of the story.

Mental health professionals note that scam victims often suffer enduring psychological impacts. Stress, anxiety, guilt, and a profound sense of betrayal are common, with some victims withdrawing from online spaces entirely due to fear of further loss. Research shows that even exposure to scam attempts can heighten people’s anxiety about digital interactions.

For families, the effects ripple outward. Savings meant for education, homes, or retirement are depleted; trust between spouses can fracture when one feels responsible for the loss. Many victims report difficulty sleeping and persistent worry long after the incident recedes from public view.

A complex fight: Law enforcement and prevention

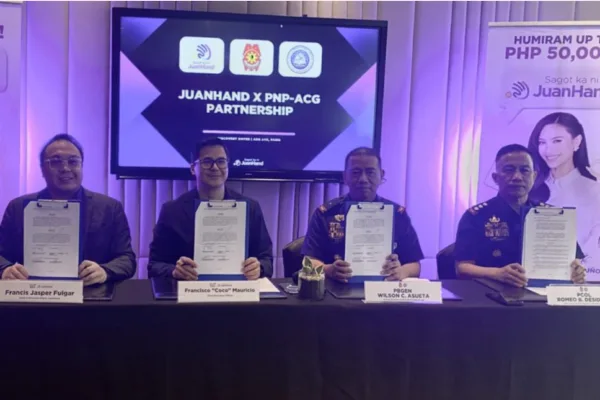

Authorities are responding with heightened vigilance. The Philippine National Police Anti-Cybercrime Group arrested over 5,000 suspects in various cybercrime cases in the first half of 2025, reflecting increased enforcement efforts.

Yet enforcement alone cannot stop scams. Digital fraud tactics evolve rapidly. Recent scam reports show that while traditional SMS and phone scams have decreased in some periods, URL-based scams and social media-driven fraud continue to proliferate.

Reporting remains a challenge. Many victims do not report scams either because they believe nothing will be done or because they did not lose money, despite interference in their digital lives. Studies indicate that only a minority of victims see any recovery of lost funds.

OFW like Lexi wants to see the actions from cybercrime groups to have a better solution from the crime like this “Hopefully they can make situations like this more secure, especially since digital and online platforms are expanding nowadays, which basically makes things riskier.”

“It’s really scary to think that everything we worked hard for could disappear in an instant. That’s why it would be better if they tightened security, so I wouldn’t have to worry every time I send money to my family,” Lexi added.

Preventing scams requires a multi-pronged approach that requires stronger public-private cooperation, better education about digital risk, more accessible reporting channels, and accountability from platform providers that host scam content.

As digital connectivity deepens in everyday life, the toll of scams extends far beyond stolen pesos. For victims and their families, the impact is lasting, complex, and deeply human — revealing vulnerabilities in both technology and trust.