As online lending scams continue to spread across the country, the partnership between fintech lender JuanHand and the Philippine National Police Anti-Cybercrime Group (PNP-ACG) sends a clear message to the rest of the fintech sector that fighting cybercrime requires collective action, not isolated efforts.

The collaboration focuses on public awareness, responsible borrowing education, and coordinated initiatives designed to help Filipinos identify legitimate lending platforms and avoid predatory schemes.

Beyond its immediate objectives, the partnership highlights how cooperation between law enforcement and fintech companies can strengthen consumer trust in digital finance.

Collaboration, not competition, is key to fighting cybercrime

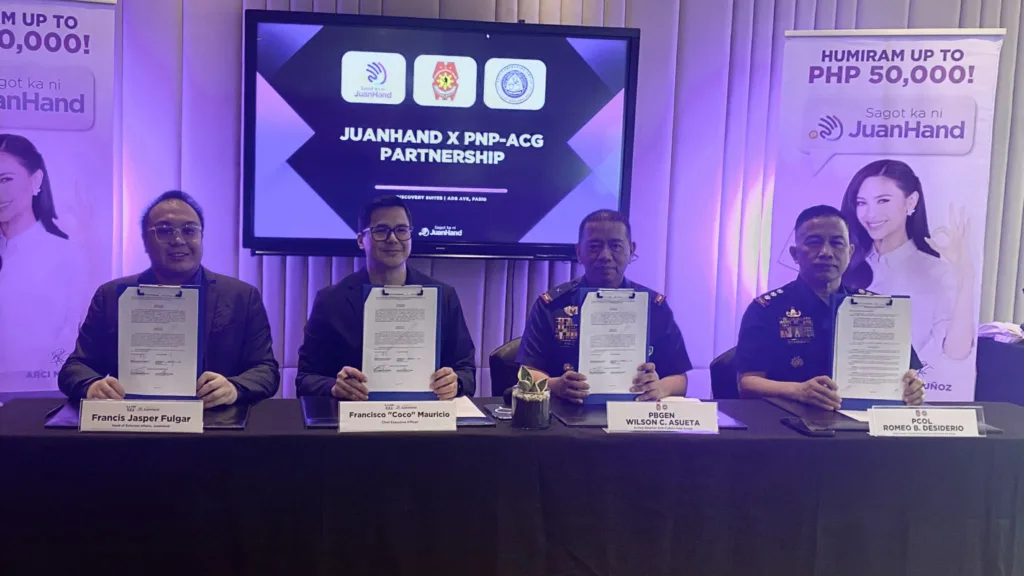

During the MOA-signing and press briefing, JuanHand CEO Francisco “Coco” Mauricio emphasized that fintech is a broad and rapidly expanding space, covering online lending, payments, and digital financial services.

As the industry grows, so do the opportunities for cybercriminals to exploit gaps in security and consumer awareness.

JuanHand shared that from the start, PNP-ACG leaders pushed for partnerships with as many legitimate fintech players as possible. The goal is to create a scam-free digital environment by setting shared standards for cybersecurity and responsible operations.

“What other fintech companies can learn from this partnership is the importance of collaboration,” Mauricio said. “PNP-ACG is open and willing to work with all fintech players that operate legitimately. This approach allows the industry to provide secure fintech transactions at scale and protect consumers nationwide.”

Law enforcement and fintech share responsibility in consumer protection

PNP-ACG Acting Deputy Director for Operations, PCOL Romeo Desiderios stressed that protecting consumers requires active participation from both public and private sectors. Colonel Romeo of the PNP-ACG explained that the agency has already started working with multiple fintech communities and continues to expand collaboration with banks, digital platforms, and government institutions.

“This collaboration is not limited to one company,” Colonel Romeo said. “We began these efforts last year, and we continue to build partnerships across the fintech industry. We learn from our partners, and they also receive support in protecting their platforms and their customers.”

He added that fintech companies play a crucial role in safeguarding user data and transactions, while PNP-ACG provides intelligence, enforcement capability, and guidance on emerging cyber threats. Together, they can respond more quickly and effectively to scams and fraudulent activities.

A unified approach strengthens trust in digital finance

Mauricio said that the partnership reflects the company’s long-term commitment to responsible lending and cybersecurity.

“Our partnership with PNP-ACG reinforces JuanHand’s commitment to protecting Filipinos in the digital lending space,”

“Through education and collaboration, we aim to help consumers avoid scams and borrow safely from legitimate platforms” he added.

JuanHand has extended more than ₱85 billion in loans and recorded over 20 million registrations. As digital lending continues to drive financial inclusion, both JuanHand and PNP-ACG stressed that security must remain a priority.

PNP-ACG reiterated that it welcomes partnerships with reputable fintech companies that uphold transparency, compliance, and consumer welfare. The agency said sustained collaboration will help build a scam-free digital lending environment that supports financial empowerment and contributes to a stronger Philippine economy.