The Philippines’ e-commerce boom is no longer just a pandemic-era spike — it is becoming a structural shift in how Filipinos shop, pay, and do business online, underpinned by rapid growth in digital payments and fintech adoption.

According to a recent Statista report, the country’s e-commerce market has expanded by nearly 400 percent over the past five years, making the Philippines the second-fastest-growing e-commerce market globally.

What began as a convenience-driven trend in the early 2010s has accelerated into a mainstream channel for retail, fueled by rising internet penetration, improved digital infrastructure, and some of the highest average daily internet usage rates in Southeast Asia.

Marketplaces dominate, but challengers are emerging

The local e-commerce landscape continues to be led by major marketplaces. Shopee remains the dominant player, accounting for roughly half of total web traffic and gross merchandise value (GMV) in 2023.

Lazada, its closest competitor, held about 30 percent of GMV, with Shopee finding strength in electronics and accessories, while Lazada carved out a niche in home and living categories.

But the market is becoming increasingly competitive.

Fashion-focused platform SHEIN, which entered the Philippine market in 2016, saw a surge in app downloads beginning in 2020 and, by 2023, overtook Lazada to become the second most downloaded shopping app in the country.

Meanwhile, Temu, the newest entrant offering deeply discounted consumer goods, has quickly gained traction, recording around 1.33 million downloads since its Philippine launch in August 2023.

Beyond traditional marketplaces, social commerce is also gaining ground. With Filipinos among the world’s most active social media users, embedded shopping features on platforms like Facebook, Instagram, and TikTok are increasingly shaping purchasing behavior, especially among younger consumers and micro-entrepreneurs.

Digital payments power online shopping growth

The rapid expansion of e-commerce has gone hand in hand with the country’s shift away from cash.

Data from the Bangko Sentral ng Pilipinas (BSP) shows that in 2024, digital payments accounted for 57.4 percent of retail transaction volume and 59 percent of transaction value, up from 52.8 percent and 55.3 percent, respectively, in 2023.

This marks a steady climb from just 1 percent of transaction volume in 2013 and reflects the long-term impact of policy reforms, fintech innovation, and growing consumer trust in digital financial services.

Merchant payments were the biggest driver of this growth, making up 66.4 percent of monthly digital payment volume, followed by person-to-person (P2P) transfers at 20.6 percent and business-to-business (B2B) supplier payments at 6.2 percent.

Collectively, these use cases accounted for more than 93 percent of all digital transactions.

For e-commerce, the implications are clear. Mobile wallets such as GCash and Maya have become the preferred payment methods for online shoppers, particularly Millennials, overtaking card-based payments.

Cash-on-delivery, once a cornerstone of Philippine e-commerce, has steadily declined and now represents only 15 percent of total online payment methods.

Buy now, pay later (BNPL) options are also gaining traction, with services like Grab PayLater and global players such as Klarna offering flexible payment schemes that appeal to price-sensitive consumers.

Fintech, policy, and inclusion converge

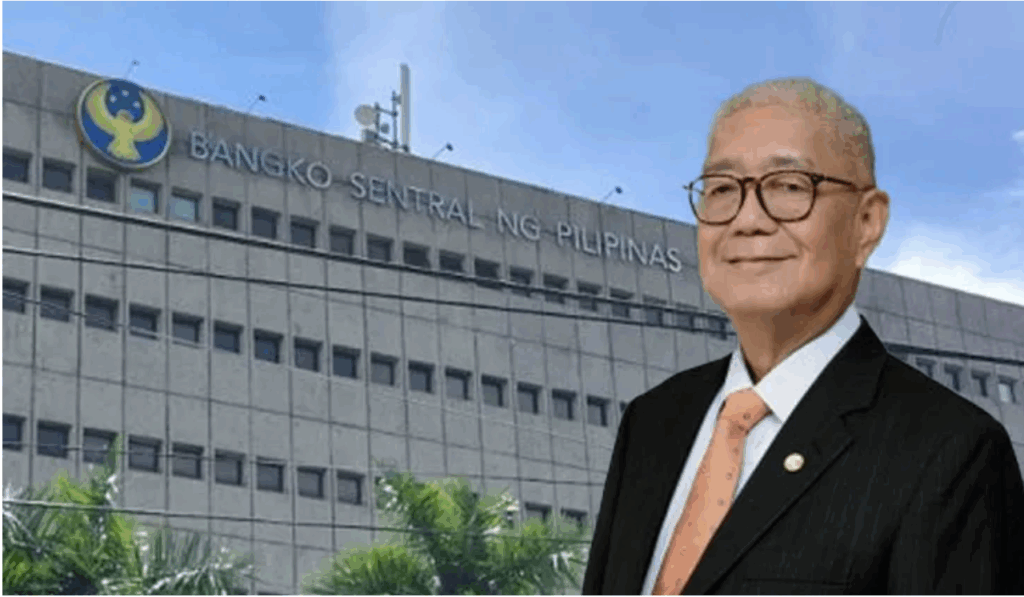

The BSP has positioned digital payments and fintech as central to broader financial inclusion goals. In its latest report, the central bank noted that the growing use of digital payments for e-commerce purchases, bill payments, and electronic fund transfers aligns with findings from its Consumer Expectation Survey.

Merchant adoption has followed suit. The number of businesses accepting QR Ph surged by 148.7 percent year-on-year in 2024, expanding access to digital payments for micro and small enterprises.

“The BSP continues to pursue its vision of harnessing technology and finance not only to connect markets but also to ensure that every Filipino becomes part of the formal financial system,” BSP Governor Eli M. Remolona said, adding that the regulator aims to empower banks and fintech firms to design more responsive and inclusive financial products.

What this means for PH fintech

For fintech players, the convergence of booming e-commerce, rising digital payment usage, and supportive regulation presents both opportunity and pressure.

The ecosystem is maturing quickly, and competition — among marketplaces, wallets, BNPL providers, and payment rails — is intensifying.

As online shopping continues to scale and social commerce reshapes how transactions happen, fintech solutions that are interoperable, affordable, and trusted will play a crucial role in sustaining growth.

At the same time, regulators are walking a careful line — encouraging innovation while reinforcing consumer protection and system resilience.

With digital payments already surpassing cash and e-commerce adoption accelerating, the Philippines’ digital economy appears to be entering its next phase — one where fintech is no longer just an enabler, but a core pillar of how commerce works.