According to the latest surveys by the Bangko Sentral ng Pilipinas (BSP), Philippine businesses turned more optimistic in the fourth quarter of 2025, buoyed by seasonal consumer spending and easing inflation, while Filipino households grew more cautious amid concerns over corruption, rising prices, and the impact of recent natural calamities,

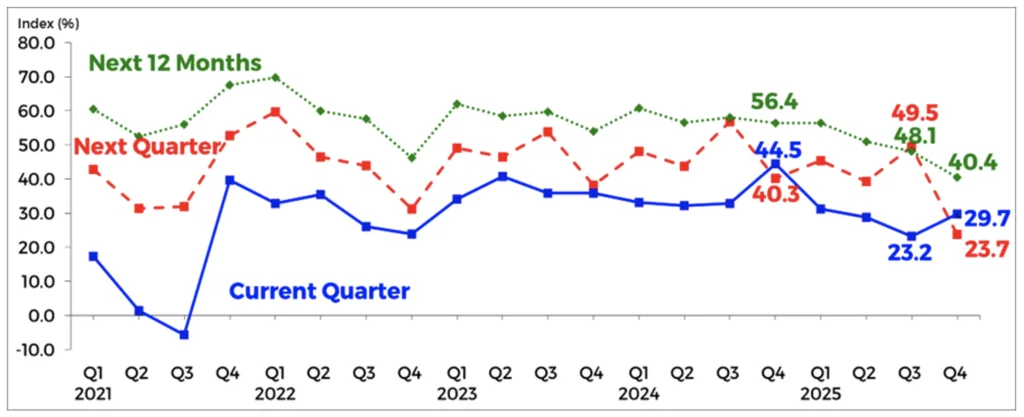

Results of the BSP’s Business Expectations Survey (BES) 1 showed that overall business confidence improved in Q4, with the confidence index rising to 29.7 percent, up from 23.2 percent in the previous quarter. A positive reading indicates that more firms are optimistic than pessimistic about economic conditions.

Based on the BSP study, businesses cited stronger consumer demand during the holiday season as a key driver of optimism, alongside improvements in firm productivity and operational efficiency, the rollout of new products and services, and a more favorable inflation environment.

However, the upbeat sentiment softened when firms looked beyond the current quarter.

Confidence for the first quarter of 2026 declined sharply, with the quarter-ahead confidence index settling at 23.7 percent, down from 49.5 percent previously. The year-ahead outlook also moderated to 40.4 percent from 48.1 percent.

BSP surveys show diverging business sentiment

According to the BSP, businesses pointed to the lingering effects of recent natural disasters and the negative impact of corruption allegations on investor and business sentiment as factors weighing on their outlook for the coming months.

Despite the tempered expectations, firms continued to project stable inflation over the next 12 months.

For the fifth consecutive quarter, businesses expect inflation to remain within the national government’s target range, an outlook that supports investment planning and job creation.

In contrast, Filipino consumers grew more pessimistic in the fourth quarter, highlighting a divergence between business sentiment and household confidence.

Consumer confidence dips, outlook remains cautiously positive

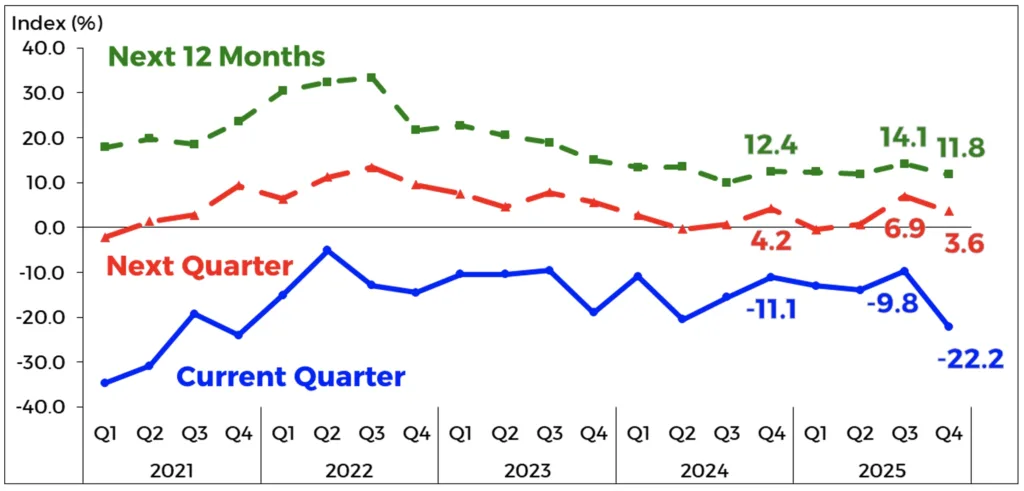

Meanwhile, latest data from the BSP’s Consumer Expectations Survey (CES) 2 showed that overall consumer confidence weakened further in Q4, with the index falling to -22.2 percent from -9.8 percent in the previous quarter. A negative reading means that pessimistic views outnumber optimistic ones.

Households cited concerns over graft and corruption, higher inflation, lower household income, and unfavorable weather conditions and natural calamities as the main reasons for their gloomier outlook.

Still, the BSP data showed that consumers remained cautiously optimistic about the near-term future. The confidence index for the next quarter stood at 3.6 percent, while the year-ahead outlook was 11.8 percent, both remaining in positive territory.

Similar to businesses, households also expect inflation to stay within the government’s target range over the next 12 months, suggesting that inflation expectations remain well anchored despite current pressures on household finances.

The BSP said both the BES and CES are key economic surveillance tools and serve as important inputs to monetary policy formulation.

Taken together, the latest survey results point to an economy where firms see opportunities in the near term, but consumers remain wary — a confidence gap that could shape spending, investment, and policy decisions heading into 2026.

—

[1] The Q4 2025 BES was conducted during the period 7 October – 13 November 2025. There were 1,521 firms surveyed nationwide, consisting of 581 companies in the NCR and 940 firms in AONCR, covering all 17 regions nationwide. Samples were drawn through stratified random sampling from the Bureau van Dijk (BvD) database of Top 7,000 Corporations based on total assets in 2017. The nationwide survey response rate for Q4 2025 was lower at 57.2 percent (from 61.0 percent in Q3 2025). The response rate was lower for both the NCR, at 55.8 percent (from 60.3 percent), and AONCR, at 58.1 percent (from 61.4 percent).

[2] The Q4 2025 CES was conducted from 1-13 October 2025. In the Q4 2025 CES, 5,552 households were identified as eligible, with 2,468 (44.5 percent) from the NCR and 3,084 (55.5 percent) from AONCR. Out of the identified sample size, 5,489 households participated in the survey, equivalent to a response rate of 98.9 percent (from 98.6 percent in the Q3 2025 survey). Respondents included 2,443 households in the NCR (with a 99.0 percent response rate) and 3,046 households in AONCR (with a 98.8 percent response rate). By income group, the high-income households comprised the largest share of respondents (41.8 percent), followed by the middle-income group (38.3 percent) and the low-income group (19.8 percent).