Christmas in the Philippines is no longer just about crowded malls—it’s increasingly about crowded payment rails. Visa Philippines expects holiday spending to continue climbing, fueled by card-based and digital transactions during the country’s busiest shopping season.

Data from a recent Visa study show December remains the peak spending month, with domestic transactions typically peaking on December 23.

The study highlights not only higher consumption but also a growing reliance on digital payment infrastructure as more Filipinos shift their holiday purchases onto cards and mobile wallets.

Fresh insights from Visa Consulting and Analytics (VCA) reinforce this trend, showing that active card payment volumes rise sharply in December compared to the rest of the year.

Drawing from card-present transactions — where both the cardholder and physical card are at the point of sale — VCA data underscore the powerful cultural and economic influence of Christmas on Filipino consumer behavior.

Cards and digital channels drive the trend

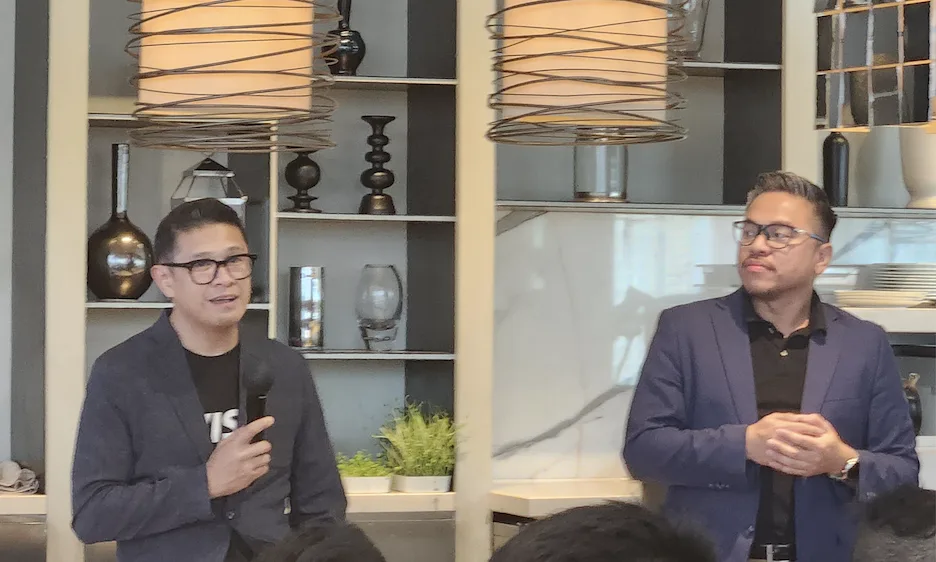

Josh Bosiños, Visa executive and a recognized expert in data science and AI

“From what we’ve seen in our December 2023 and 2024 data, peak spending grew by about 8 percent annually,” said Josh Bosiños, a Visa executive and recognized expert in data science and AI. “Filipinos are spending more during the holidays, and the growth trend has been consistent year after year.”

Bosiños noted that these findings point to a broader shift: holiday spending is increasingly driven by convenience and digital accessibility. Contactless and mobile wallet options, including Google Pay, are gaining traction, reflecting a population that relies heavily on smartphones for everyday payments.

Visa’s data analysis shows that Filipinos start shopping early for Christmas. Local card transactions rise steadily throughout December, with notable spikes every weekend, before reaching their peak on December 23—the last full shopping weekend before Christmas Eve.

Spending then eases as consumers travel to their hometowns and shift focus from shopping to celebrations.

Cross-border spending picks up after Christmas

Spending patterns vary slightly for overseas travelers. Visa data show Filipinos traveling abroad record their highest transaction volumes toward the end of December, reflecting year-end travel and leisure activity after Christmas.

VCA data show overseas spending peaks later than domestic activity, as Filipinos abroad continue to make travel- and leisure-related purchases through December 28 and 29, before tapering off toward the New Year.

Inbound tourism also plays a meaningful role in December payment volumes. Visa data show foreign cardholders visiting the Philippines spend primarily on lodging and entertainment, with the largest share of inbound transactions coming from the United States, followed by Taiwan and Japan.

Holiday spending in the Philippines is further boosted by tourists and returning overseas Filipinos, with top inbound corridors by payment volume coming from the United States, Taiwan, Japan, South Korea, and Singapore.

While Makati and Parañaque lead in transaction activity, six of the top ten holiday spending destinations are outside Metro Manila — including Cebu, Angeles, and Davao — highlighting how festive spending extends nationwide.

Payments infrastructure put to the test

Jeffrey Navarro, Visa Philippines Country Manager

“These peak periods really stress-test the payments ecosystem,” Bosiños said. Visa works closely with issuing banks and partners to ensure transaction flows remain stable and responsive during periods of high demand.

Jeffrey Navarro, Visa Philippines Country Manager, emphasized that seamless payments are now a critical part of both local commerce and cross-border travel.

“Christmas brings people together, and our data underscores the holidays’ enduring socio-cultural and economic significance,” Navarro said.

“For Visa, it’s important that we enable these personal journeys and experiences through payments that are fast, seamless, and secure — so Filipinos and tourists alike can celebrate anywhere across the country and abroad,” he added.

Navarro added that as more consumers rely on digital wallets and cards, close coordination among issuers, acquirers, and terminal providers is essential to ensure consistent acceptance and performance across devices and locations.

Looking ahead: Digital payments as the new normal

Visa’s insights suggest that holiday spending is not just culturally driven — it’s Visa’s insights suggest that while holiday spending remains deeply rooted in tradition, the way Filipinos transact is increasingly shaped by digital infrastructure.

As payment volumes concentrate into shorter peak periods and span both domestic and cross-border channels, the resilience of the payments ecosystem becomes critical.

For banks, fintechs, and merchants, the opportunity is clear: those who can deliver frictionless, secure, and data-driven payment experiences will be best positioned to capture not only the holiday surge, but also the Philippines’ accelerating shift toward a cashless economy.