The Bangko Sentral ng Pilipinas (BSP) is easing borrowing costs just as foreign direct investments (FDIs) continue to flow into the country, offering a mixed picture of an economy navigating weaker domestic sentiment but sustained investor interest.

At its latest policy meeting, the Monetary Board lowered the benchmark reverse repurchase (RRP) rate by 25 basis points to 4.50%, with corresponding adjustments to the overnight deposit (4.00%) and lending (5.00%) facilities.

The central bank cited a benign inflation outlook and anchored expectations as key drivers behind the move.

Manageable inflation but softer economic momentum

Inflation is projected to remain manageable, with forecasts for 2026 and 2027 slightly rising to 3.2% and 3.0%, respectively — still within target.

However, the BSP warned that domestic economic conditions have softened further, as business sentiment continues to wane due to governance concerns and ongoing uncertainty in global trade.

Despite the drag, the BSP expects domestic demand to recover gradually as the effects of earlier policy easing filter through and as the government improves the pace and quality of public spending.

The central bank also signaled that the current easing cycle is nearing its end, with further adjustments to be “limited” and reliant on incoming economic data.

Even as the BSP loosens monetary policy, the investment landscape continues to show resilience.

BSP says FDI inflows remain strong this year

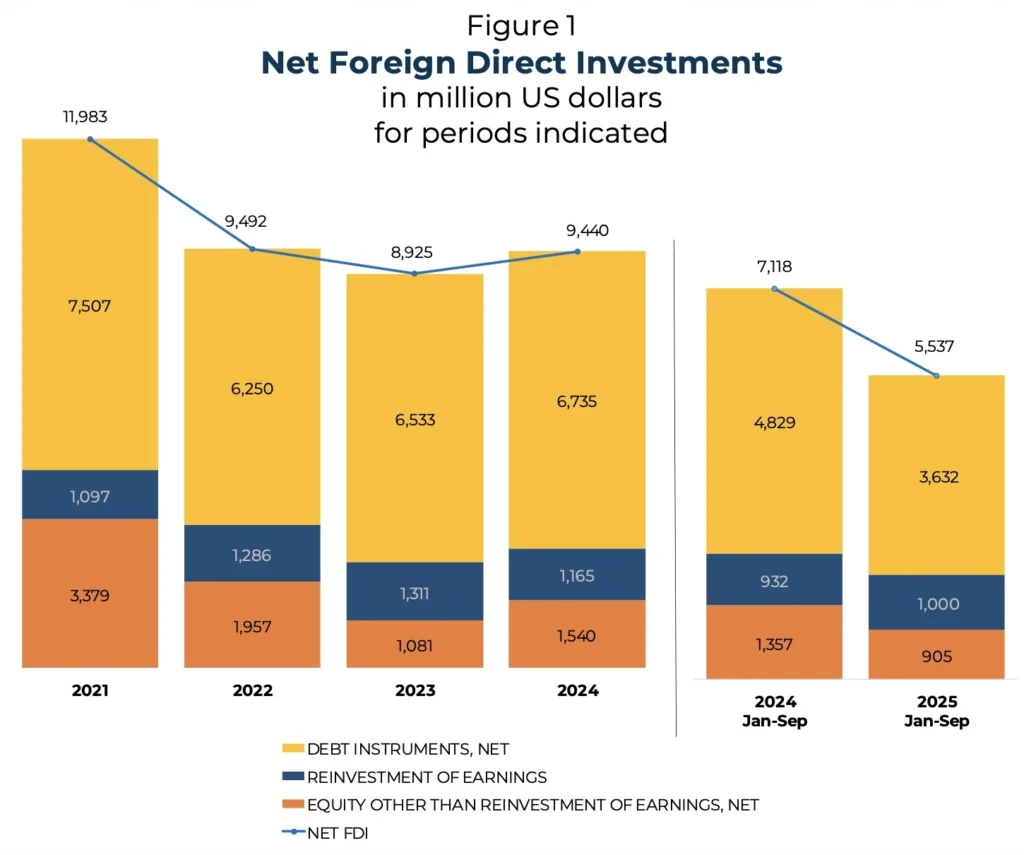

Latest data from the central bank revealed that FDIs posted US$320 million in net inflows in September 2025, 1 bringing year-to-date inflows to US$5.5 billion — equivalent to 1.6% of GDP for the first three quarters of the year. 2

Japan emerged as the top source of equity capital during the month, while the manufacturing sector remained the largest recipient of foreign inflows.

Cumulatively, investors from Japan, the United States, and Singapore were the biggest contributors from January to September 2025. Manufacturing, wholesale and retail trade, and real estate were the leading sectors attracting foreign equity.

The BSP noted that its FDI statistics reflect actual inflows, as measured under the Balance of Payments and International Investment Position Manual (BPM6), distinguishing them from investment commitments reported by other government agencies.

The combination of slower domestic momentum and steady foreign investor appetite underscores the delicate balancing act for policymakers: ensuring price stability, supporting economic activity, and maintaining confidence in the Philippines as a competitive investment destination.

—

1 BSP statistics on FDI are compiled based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). FDI includes investment by a nonresident direct investor in a resident enterprise, where the equity capital in the latter is at least 10 percent. It also includes investment made by a nonresident subsidiary or associate in its resident direct investor. FDI can be in the form of equity capital, reinvestment of earnings, and borrowings.

2 BSP FDI statistics are different from the investment data of other government sources. BSP FDI covers actual investment inflows. In contrast, the approved foreign investments data published by the Philippine Statistics Authority (PSA) are sourced from Investment Promotion Agencies (IPAs). These represent investment commitments, which may not necessarily be fully realized in a given period. Furthermore, the PSA data are not based on the 10-percent foreign ownership criterion under BPM6. Additionally, the BSP’s FDI data are presented in net terms (i.e., equity capital placements less withdrawals). On the other hand, the PSA’s foreign investment data do not account for equity withdrawals.