Two major announcements from AMD this week mark significant movement in the global AI infrastructure race — developments that could have far-reaching implications for the financial technology sector, where fraud detection, credit scoring, customer onboarding, and real-time risk analytics depend on high-performance compute.

In separate disclosures, AMD said that AI research firm Zyphra has successfully trained the first large-scale Mixture-of-Experts (MoE) foundation model entirely on AMD Instinct MI300X GPUs, while Hewlett Packard Enterprise (HPE) confirmed it will adopt AMD’s new “Helios” rack-scale AI architecture for upcoming supercomputers and enterprise AI clusters.

Industry watchers say both moves underscore the growing role of open, energy-efficient infrastructure in supporting the next wave of fintech applications.

Zyphra achieves breakthrough with ZAYA1 model trained fully on AMD hardware

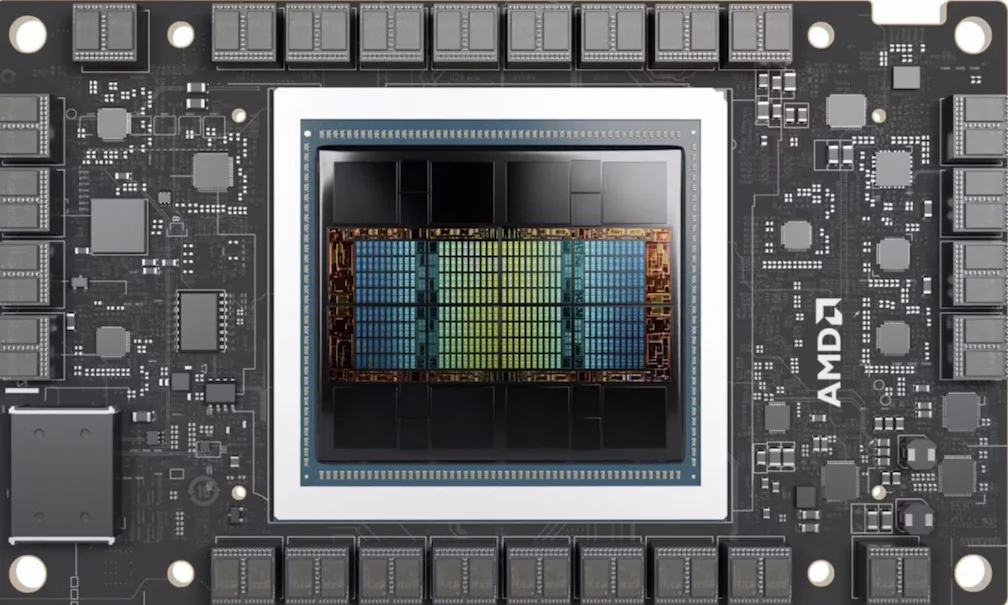

Zyphra announced that its new foundation model, ZAYA1, was trained end-to-end using AMD Instinct MI300X GPUs, AMD Pensando networking, and the open-source ROCm software ecosystem. The model is built on a frontier-scale MoE architecture known for strengths in reasoning, mathematics, and coding—areas increasingly relevant to automated financial modeling and AI-assisted development.

Zyphra attributed several efficiency gains to AMD’s hardware platform, including:

- 192GB of high-bandwidth memory, which eliminated the need for complex expert or tensor sharding

- Up to 10× faster model save times, improving training stability

- Simplified pipelines due to larger memory support

Performance benchmarks show the ZAYA1-base model matching or surpassing open-source peers such as Llama-3-8B, OLMoE, Qwen3-4B, and Google’s Gemma3-12B.

For fintech developers, these advancements suggest a maturing competitive landscape in which AMD-based systems present a viable alternative to Nvidia-centric training environments.

AMD and HPE expand partnership with Launch of “Helios” AI architecture

In a separate announcement, the chipmaker said it is deepening its collaboration with HPE through Helios, a new open, full-stack AI platform designed for large-scale enterprise workloads.

Helios integrates AMD’s EPYC CPUs, Instinct GPUs and Pensando networking with HPE Juniper switches built with Broadcom and the ROCm open software ecosystem.

Built on the OCP Open Rack Wide standard, Helios aims to give cloud providers, enterprises, and compute-intensive industries greater deployment flexibility. The chipmaker reports that the platform can deliver up to 2.9 exaFLOPS of FP4 performance per rack, alongside high-bandwidth, low-latency Ethernet fabrics and support for the emerging Ultra Accelerator Link over Ethernet (ULAoE) standard.

For fintech organizations operating AI-driven risk and compliance engines, Helios could offer improved scalability, reduced latency, and more efficient model training cycles.

Europe’s next supercomputer to run on AMD’s newest AI hardware

AMD and HPE also confirmed that Herder, Europe’s upcoming supercomputer at the High-Performance Computing Center Stuttgart (HLRS), will be powered by the chipmaker’s Instinct MI430X GPUs and next-generation EPYC “Venice” CPUs.

The system is designed to support hybrid HPC-AI workloads similar to those used in financial market simulations, insurance analytics, and complex risk modeling.

Potential impact on the Philippine fintech ecosystem

Industry analysts note that the rise of open, high-performance AI infrastructure could be particularly meaningful for the Philippines, where digital financial services continue to scale rapidly.

More advanced compute capabilities may support:

- Faster fraud detection and transaction monitoring

- More accessible AI tooling for fintech startups

- Lower-cost model training for local banks

- Improved national-level risk analytics

- Stronger AI governance and compliance mechanisms

As financial institutions adopt more sophisticated AI systems, infrastructure innovations from firms like AMD, Zyphra, and HPE could help broaden access to enterprise-grade AI capacity in the region.

The chipmaker’s latest technology milestones reflect a broader shift toward open, scalable, and energy-efficient AI ecosystems.

For the fintech sector — where speed, accuracy, and real-time analytics are essential — these developments may help accelerate the rollout of next-generation intelligent financial services.