Coins.ph and Vietnam-based fintech firm FinFan have entered into a strategic partnership aimed at modernizing remittance flows between the Philippines and Vietnam, the companies announced during the Singapore FinTech Festival last week.

Under the memorandum of understanding (MOU), Coins.ph will use its licensed infrastructure to convert funds into USD and send them to FinFan through standard international fiat channels. FinFan will then handle local USD disbursement in Vietnam.

As reported in TechTravelMonitor, the setup is designed to speed up settlement, reduce costs, and improve transparency for workers, families, and businesses moving money between the two markets.

Coins.ph and FinFan have formalized a strategic partnership aimed at streamlining cross-border remittance and payments. The collaboration was sealed with the signing of a Memorandum of Understanding (MoU) between Coins CEO Wei Zhou and FinFan CEO Nguyen Tuyen.

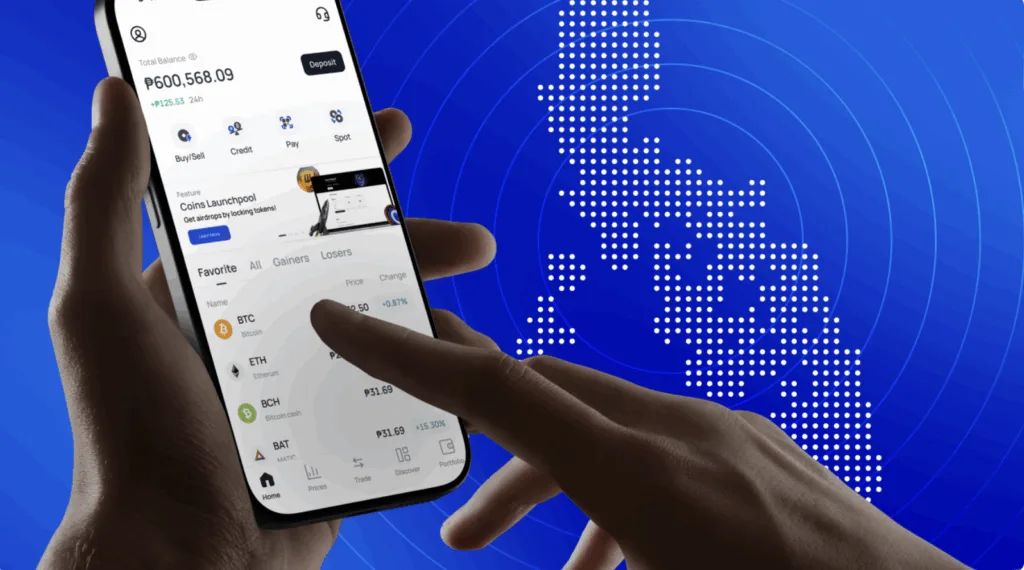

Coins.ph, one of the Philippines’ largest digital wallets and a licensed Electronic Money Issuer and Virtual Currency Exchange under the Bangko Sentral ng Pilipinas, said the collaboration marks an expansion of its regional cross-border capabilities.

FinFan, meanwhile, is licensed by the State Bank of Vietnam to operate international remittance services and provides backend payment infrastructure for global money transfer operators, banks, and digital platforms.

“We share a goal of making cross-border money transfers simpler and more inclusive,” said Coins.ph CEO Wei Zhou. “This partnership allows us to bring modern financial infrastructure to corridors that need faster and more affordable solutions.”

FinFan CEO Tuyen Nguyen said the collaboration helps bridge traditional payment rails with newer technologies. “We’re supporting partners and end-users in both Vietnam and the Philippines by integrating compliant, scalable systems that work around the clock,” Nguyen added.

Coins.ph strengthens remittance tech amid regional surge

The partnership comes as Southeast Asia continues to see rapid growth in digital remittances. The companies cited industry estimates placing new-technology-driven remittance volumes at roughly 23% of global flows today, with Asia alone projected to reach about USD 250 billion in such remittances by 2028.

Proponents say the appeal of these new rails goes beyond lower fees. Instant settlement—often in minutes and available 24/7 — has become a key competitive edge over legacy systems that rely heavily on intermediaries and batch processing.

Coins.ph, founded in 2014, now serves millions of users in the Philippines through its mobile wallet, international remittance services, and regulated financial products. FinFan operates what it calls a cross-border “money OS” in Vietnam, connecting banks, e-wallets, cards, and cash-out points through a unified API and integrating with networks such as Visa, MoneyGram, Ripple, and Lightning.

Both firms say the partnership is a step toward building more interoperable financial pathways across Southeast Asia—an increasingly important region for migrant workers and digital-first businesses alike.