The Philippine economy continues to show signs of resilience and stability as key economic indicators — namely inflation, foreign reserves, and domestic liquidity — paint a picture of steady growth and solid macroeconomic fundamentals heading into the final quarter of 2025.

Latest data from the Bangko Sentral ng Pilipinas (BSP) showed that headline inflation remained steady at 1.7 percent in October, unchanged from September and well within the BSP’s forecast range of 1.4 to 2.2 percent.

The figure also remained below the government’s full-year target range of 2 to 4 percent.

According to the central bank, the modest inflation rate was mainly driven by declining food prices, particularly rice, which benefited from ample supply and sustained government efforts to stabilize costs. Vegetable and meat inflation also eased year-on-year, although both categories stayed elevated due to recent weather disturbances and logistical challenges.

Non-food inflation, however, saw a slight uptick amid higher electricity rates caused by increased generation costs. Still, core inflation — which strips out volatile food and energy prices — slowed to 2.5 percent in October from 2.6 percent in September, signaling that price pressures remain broadly contained.

“The October inflation outturn indicates a benign outlook for inflation,” the BSP said, adding that it will continue to monitor both domestic and external developments that could affect inflation and growth, consistent with its data-dependent approach to monetary policy.

Stronger external position

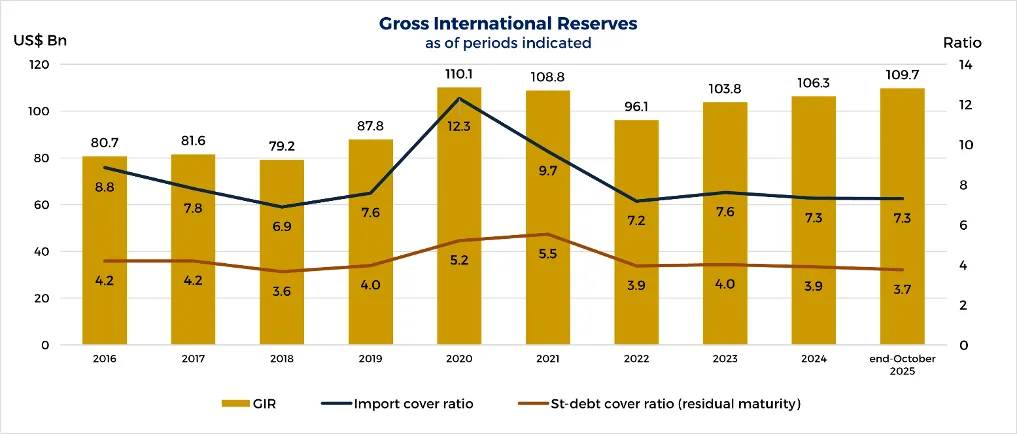

Complementing the low inflation environment, the country’s Gross International Reserves (GIR) rose to US$109.7 billion in October 2025, up from US$109.1 billion in the previous month.

The latest GIR level represents a robust external liquidity buffer, equivalent to 7.3 months’ worth of imports [1] and 3.7 times the country’s short-term external debt based on residual maturity. [2, 3]

Economists note that this cushion provides a strong shield against global financial volatility, ensuring that the Philippines can meet its import and debt obligations even under external shocks. The reserves consist mainly of foreign-denominated securities, foreign exchange holdings, and gold.

The BSP emphasized that an ample level of reserves “ensures the availability of foreign exchange to meet balance of payments financing needs in extreme conditions when there are no export earnings or foreign loans.”

Money supply expansion reflects healthy financial activity

At the same time, the domestic money supply continued to expand, indicating steady credit activity and liquidity growth in the economy.

Preliminary data showed that domestic liquidity (M3) grew by 7.3 percent year-on-year to ₱18.9 trillion in September, faster than the 6.6-percent expansion recorded in August. Seasonally adjusted data showed a 1.2-percent month-on-month increase.

The expansion was largely driven by rising claims on the domestic sector, including increased lending to private corporations and households, as well as higher government borrowings. This reflects sustained confidence in business and consumer activity despite global economic headwinds.

Meanwhile, net foreign assets (NFA) rose by 3.3 percent year-on-year, with banks’ foreign asset holdings increasing on account of higher investments in foreign currency-denominated instruments.

The BSP reiterated its commitment to ensuring that liquidity growth remains consistent with its price and financial stability objectives, suggesting that the monetary environment continues to be supportive of growth while keeping inflation under control.

Inflation outlook: A stable platform for growth

With inflation steady, foreign reserves strong, and liquidity expanding at a manageable pace, analysts say the Philippine economy is well-positioned to withstand external shocks and sustain its recovery momentum into 2026.

“These indicators together underscore the country’s strong macroeconomic fundamentals and the effectiveness of the BSP’s prudent policy management,” said one economic analyst.

As the BSP keeps a close eye on global developments — from oil price movements to geopolitical tensions — it appears confident that the Philippines’ balance between monetary stability and growth support will continue to anchor the economy on a steady path forward.

—

[1] By convention, GIR is viewed to be adequate if it can finance at least three-months’ worth of the country’s imports of goods and payments of services and primary income. The latest GIR level ensures availability of foreign exchange to meet balance of payments financing needs, such as for payment of imports and debt service, in extreme conditions when there are no export earnings or foreign loans.

[2] Short-term debt based on residual maturity refers to outstanding external debt with original maturity of one year or less, plus principal payments on medium- and long-term loans of the public and private sectors falling due within the next 12 months.

[3] The level of GIR as of a particular period is considered adequate, if it provides at least 100 percent cover for the payment of the country’s foreign liabilities, public and private, falling due within the immediate 12-month period.