The Bangko Sentral ng Pilipinas (BSP) expects inflation to remain well within its target range over the next few years, even as signs of moderating demand and governance concerns have begun to weigh on business confidence and overall growth prospects.

In a press release, the BSP said October 2025 inflation settled within its forecast range of 1.4 to 2.2 percent, reflecting the continued easing of rice prices in recent months. The central bank earlier projected October inflation to fall between 1.4 percent and 2.2 percent, citing mixed price movements across commodities.

“Upward price pressures for the month may stem from higher prices of rice, fish, vegetables, and electricity, as well as the depreciation of the peso,” the BSP said in a statement. “These could be partially offset by lower prices of oil, meat, and fruits.”

BSP sees steady inflation, but growth risks linger

The central bank noted that inflation is projected to average below the low end of the 2.0 to 4.0 percent target range in 2025, before settling within the 3.0% ± 1.0 percentage point target band for 2026 and 2027.

Overall, the BSP described the inflation outlook as “generally benign,” with expectations remaining well-anchored amid stabilizing global commodity prices. It added that potential adjustments in electricity rates and possible hikes in rice import tariffs could introduce mild upside risks but are not expected to derail the downward trend in prices.

At the same time, the Monetary Board noted a weakening in domestic growth momentum, partly due to governance issues affecting public infrastructure spending and the lingering impact of external uncertainties on business sentiment.

“Going forward, the Monetary Board will continue to review newly available information and reassess the impact of prior monetary actions in light of evolving economic conditions and their implications for inflation and growth,” the BSP said.

OFC assets surge, reinforcing BSP financial stability

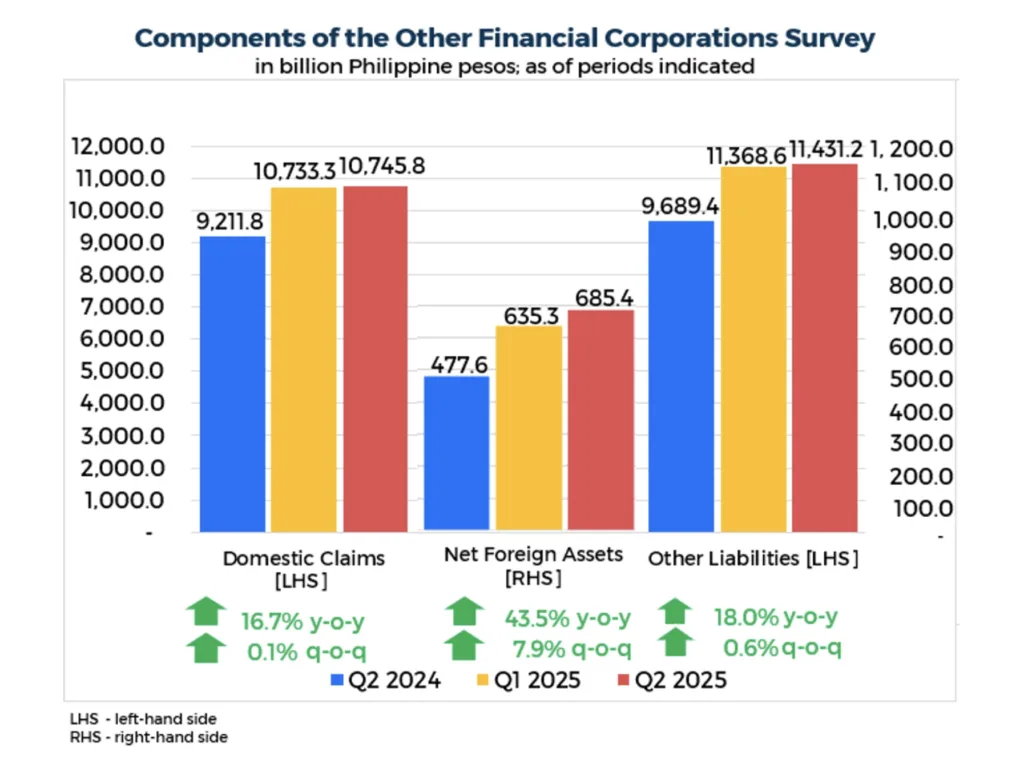

Beyond inflation, recent data also showed that the domestic claims of other financial corporations (OFCs) — a sector that includes insurance companies, pension funds, investment funds, and other non-bank financial institutions — rose to ₱10.7 trillion in the second quarter of 2025, up 16.7 percent year-on-year.

The modest 0.1 percent quarter-on-quarter increase was driven mainly by larger investments in equity shares of nonfinancial corporations, higher holdings of government securities, and more loans extended to households. This growth was slightly tempered by a decline in holdings of bank-issued debt securities.

Meanwhile, the liabilities of the OFC sector expanded to ₱11.4 trillion, boosted by higher share issuances and insurance technical reserves. The sector’s net foreign assets also grew to ₱0.7 trillion, reflecting stronger claims on nonresidents.

The BSP said the OFC statistics provide valuable insights into the broader financial system and help support its monetary and financial stability mandates.

“As the BSP continues to monitor domestic and international developments, it remains committed to a data-driven approach to monetary policy formulation,” the central bank said.