A new partnership between the Philippines’ leading crypto exchange Coins.ph and global money transfer platform BCRemit is set to transform how overseas Filipinos send funds home — making transactions faster, cheaper, and more transparent through blockchain technology.

Beginning November 1, 2025, Filipinos in the United Kingdom, European Union, United States, and Canada will be able to send money to the Philippines in minutes, at a fraction of the cost charged by traditional remittance channels. The initiative uses stablecoin rails, a blockchain-based system that enables near-instant transfers while maintaining the value of the currency being sent.

Cutting costs, increasing speed

For decades, overseas Filipino workers (OFWs) have relied on legacy money transfer services that often charge between 5% to 10% in fees — plus hidden markups in exchange rates. These transfers can also take three to five daysto reach recipients.

Through the Coins.ph–BCRemit collaboration, remittances will now travel across blockchain networks in real time, potentially saving senders up to 80% in transaction costs.

Here’s how it works: when a sender initiates a transfer via BCRemit’s app or website, the amount is instantly converted into a stablecoin — a type of cryptocurrency pegged to a stable asset like the US dollar. This stablecoin is then transmitted across a high-speed blockchain and converted back into Philippine pesos (PHP) by Coins.ph before being deposited directly into the recipient’s Coins.ph account.

From there, the recipient can easily transfer the funds to any preferred e-wallet or bank account.

“This collaboration with BCRemit completely aligns with the company’s mission to make innovative digital finance accessible to every Filipino,” said Wei Zhou, Coins.ph Chief Executive Officer. “By integrating stablecoin rails into remittances, we’re unlocking near real-time, low-cost transfers that give overseas Filipinos and their families more value, transparency, and financial freedom.”

A digital bridge for Filipinos worldwide

BCRemit founder and CEO Oliver Calma said the partnership offers a long-overdue upgrade to how remittances are handled in the digital age.

“Millions of Filipino workers and their families across the UK, Europe, the US, and Canada deserve a solution that matches the speed and efficiency of the modern economy,” Calma said. “Our partnership with Coins.ph delivers exactly that — a faster, more affordable, and more transparent remittance experience.”

Both Coins.ph and BCRemit are regulated by the Bangko Sentral ng Pilipinas (BSP), ensuring that the new service adheres to the highest standards of consumer protection and financial compliance.

Coins.ph is licensed as both a Virtual Currency Exchange (VCE) and an Electronic Money Issuer (EMI), while BCRemit operates as a Money Service Business (MSB).

Beyond remittances: Building a two-way financial network

Looking ahead, the companies plan to introduce a QR-Payment Collection feature in 2026, allowing outbound payments from the Philippines to other regions — creating a fully integrated cross-border payment system.

“The planned rollout of QR payments will be a major leap,” Calma added. “It won’t just bring money into the Philippines — it will allow funds to flow outward as well, creating a complete digital bridge for Filipino families and businesses.”

Empowering inclusion through technology

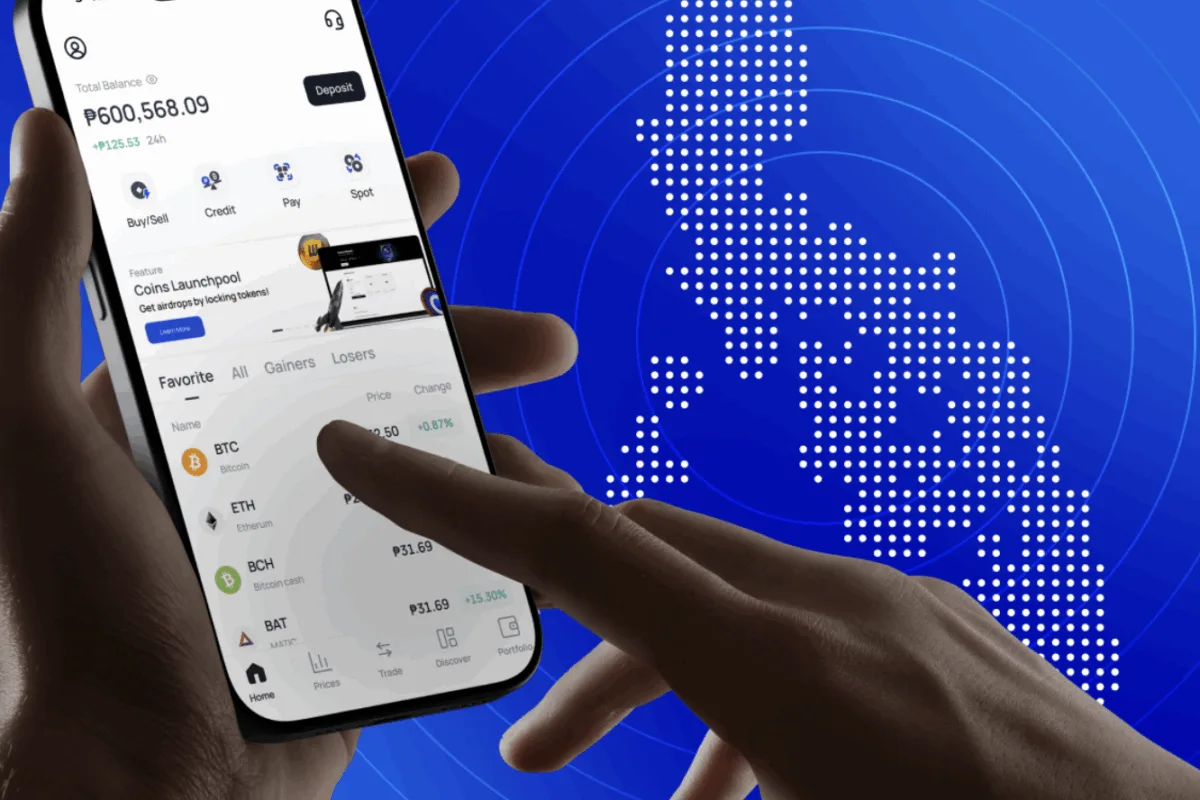

Founded in 2014, Coins.ph is the country’s largest and most established cryptocurrency exchange, serving millions of users. The platform allows Filipinos to buy, sell, and trade digital assets while offering e-wallet services for bills payment, mobile top-ups, and crypto remittances—all under the oversight of the BSP.

BCRemit, on the other hand, has built a strong reputation in the global remittance space, particularly among Filipinos in Europe and North America. The company focuses on delivering fast, low-cost, and compliant international transfers by leveraging digital infrastructure and partnerships with trusted fintechs.

Together, the two companies aim to make cross-border money movement as easy as sending a message, redefining how Filipinos connect financially with loved ones across the globe.