In a country where millions of workers still juggle bills between paydays, short-term borrowing has long been part of the Filipino financial story.

From payday loans to informal “5-6” lending, many employees find themselves trapped in cycles of debt that eat away at their hard-earned income. But a young fintech firm wants to change that narrative — one salary at a time.

AgadPay, a Philippine fintech startup launched just nine months ago, is introducing a simple yet transformative concept: letting employees access their earned wages anytime. Its early wage access platform — already gaining traction in the local fintech space — allows users to withdraw a portion of their salaries before payday, all through a secure, transparent system integrated with employers.

Shifting the payday mindset

At the heart of AgadPay’s mission is a promise of financial freedom — not through loans, but through empowerment.

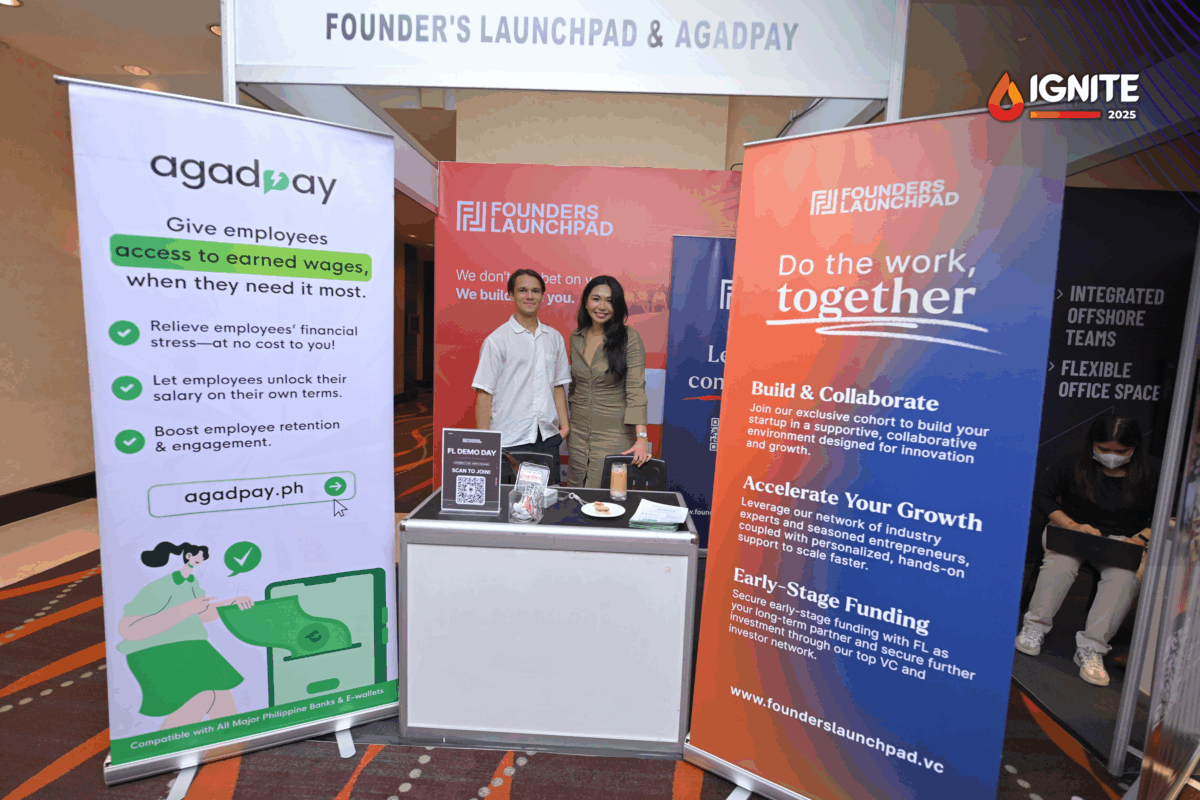

“We want to give Filipino workers financial freedom and remove the payday loans,” said Thomas Abentung, partner at AgadPay, in an exclusive interview with FintechNewsPH on the sidelines of the IGNITE 2025 event at Fairmont Makati. “Instead of borrowing money with high interest, employees can now access what they’ve already earned — instantly and securely.”

Unlike traditional lending apps, AgadPay doesn’t lend money. It connects directly with employers to give workers access to a portion of their earned salary — for a small transaction fee of about 3%, roughly the cost of an ATM withdrawal.

At the end of the month, the employer deducts the advanced amount and reimburses AgadPay: no interest, no hidden charges, and no debt accumulation.

For example, an employee earning ₱30,000 a month can withdraw ₱5,000 midway through the pay cycle to cover an emergency. It’s their own money, just made available sooner. “We just take a small transaction fee — that’s all we charge. There’s no lending involved.”

Financial inclusion, one paycheck at a time

AgadPay’s model fits squarely within the Bangko Sentral ng Pilipinas (BSP)’s ongoing push for financial inclusion and digital empowerment.

Since its soft launch, the platform has partnered with 15 companies and now serves about 400 employees. It has already processed more than ₱10 million in salary withdrawals, with the user base expected to double by the end of 2025.

“It’s mainly used for emergencies — medical bills, car repairs, or tuition,” Abentung shared. “Our users say it helps them avoid payday loans and gives them more control over their finances.”

That sense of control — of being able to manage one’s own income without turning to debt — is what sets AgadPay apart in a fintech landscape often dominated by lending products. This innovation helps fill crucial gaps in everyday money management and salary access — echoing the BSP’s broader goal of digital financial empowerment.

Beyond access: Building financial literacy

AgadPay isn’t just building a payout tool; it’s shaping a platform for financial wellness. The team is developing a financial education module that teaches employees how to budget, save, and manage their expenses more effectively.

“We want to help employees understand how to budget — how much to spend on living, food, and savings,” Abentung said. “We’ll also work with partners to offer discounts on essentials like groceries and transportation.”

This approach blends technology with financial education — a move that could help address one of the country’s most persistent issues: low financial literacy.

Why companies are getting onboard

Employers, for their part, have little to lose and much to gain.

AgadPay’s system requires no integration fees and poses no financial risk to companies. By giving employees more flexibility with their earnings, businesses see improvements in morale, retention, and productivity.

As one of the first Philippine fintech startups to roll out this model, AgadPay is pioneering a new kind of employee benefit — one that’s both tech-driven and socially impactful.

Early wage access: A fintech trend taking root in Southeast Asia

Globally, on-demand pay or earned wage access (EWA) is fast becoming a mainstream benefit, especially in emerging economies.

In Southeast Asia, startups like AgadPay are leading the charge, offering solutions that meet workers’ real financial needs.

“We see ourselves as a partner in financial wellness,” Abentung said. “Our vision is to make salary access as easy as using an ATM — no stress, no waiting, no debt.”

Fintech with a human touch

As the Philippine fintech ecosystem continues to evolve, AgadPay shows how technology can go beyond convenience — and make finance more human.

By turning salaries into accessible, flexible income, it’s helping Filipino workers breathe easier between paydays and fostering a culture of financial empowerment.

For employees, it’s about freedom and dignity. For companies, it’s about happier, more focused teams. And for the Philippines, it’s a glimpse into a fintech-powered future — where access, inclusion, and education finally move hand in hand.