by Rhyll Neri, Correspondent

Editor’s note:

In the wake of recent corruption scandals, the Philippine government has begun exploring blockchain technology as a tool for transparency and accountability. Senator Bam Aquino recently filed Senate Bill No. 133, proposing the creation of a National Budget Blockchain System to ensure openness and public participation in the country’s budget process. As discussions on blockchain’s potential to reform governance intensify, this article reflects the author’s personal experiences and insights on the technology’s volatile financial side — drawn from the dramatic events of the 2025 crypto crash. The opinions expressed here are solely those of the author and do not necessarily represent the views or editorial position of this publication or its affiliates.

In a dramatic turn this week, the cryptocurrency market was shaken to its core when U.S. President Donald Trump announced 100% tariffs on Chinese tech exports — a move that triggered sharp crashes in Bitcoin, Ethereum, and other major digital assets.

On October 10, 2025, the news surfaced: along with steep tariffs, export controls would be enforced on “critical software” exports from China. The announcement sparked a wave of panic selling. Bitcoin plunged over 8%, dropping to about US$104,782, while Ethereum tumbled nearly 5.8% to approximately US$3,637.

In total, the crypto market saw more than US$19 billion wiped out in a single session — one of the steepest single-day liquidations in recent history.

Crypto crash: What went wrong

Market observers point to a leverage-driven collapse. Many traders held highly leveraged positions (betting on price increases), and when the tariff news hit, cascading liquidations roiled the markets.

As one analyst described the crypto crash, “The altcoin complex got absolutely eviscerated… we’re at levels not seen in more than a year.”

Traditionally, Bitcoin and Ethereum are seen as more “resilient” in a crypto downturn, but even they were not spared this time — evidence that macroeconomic shocks can overwhelm crypto fundamentals.

The night it all fell apart

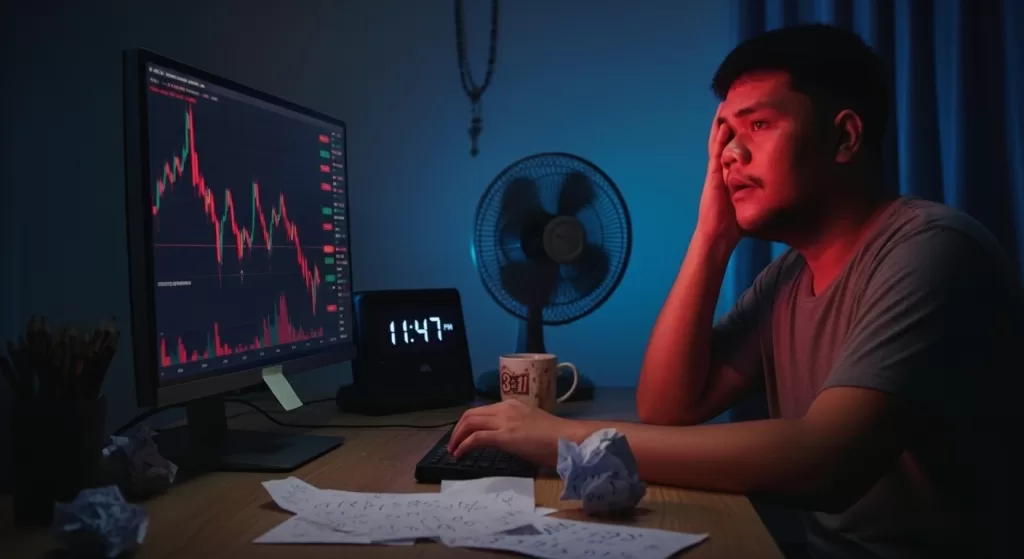

It was one of those boring Saturday nights — the kind where the hum of the ceiling fan felt louder than usual, and my neighbors were trying to hit the high notes of “She’s Gone” for the third time that night.

I was scrolling through my crypto charts, half zoning out, when I noticed something strange. Not an earthquake, not a storm — but a tremor in the digital world. Prices started flashing red — one after another.

Then came the crypto crash: Bitcoin was free-falling, Ethereum was bleeding, and every altcoin looked like it was melting into nothing.

My heart started to race. I didn’t even know why yet, but something in me knew this wasn’t just another dip. I actually grabbed my Atenolol, thinking I was about to have a heart attack.

Then came the headline that sent chills down my spine: “Trump imposes 100% tariffs on all Chinese imports.”

For a moment, I froze. My hands went cold, my stomach tightened — it felt like the entire crypto world had just stopped breathing. Within minutes, Bitcoin nosedived, Ethereum crashed, and billions of dollars vanished into thin air. The bull run — that beautiful dream we’d all believed in — was over, thanks to this crypto crash.

The panic and the chill

If you’ve ever watched your portfolio collapse in real time, you know that strange mix of denial and panic. That night, during the crypto crash, I wasn’t just watching charts — I was living them.

Every red candle felt like a skipped heartbeat. Every alert from my phone sent a shock through my chest. I refreshed my trading app again and again — ₱60,000… ₱30,000… ₱10,000…

My throat went dry. I could feel goosebumps crawling up my arms, and a chill ran down my spine that wouldn’t fade. And then my phone buzzed — it was Frederico.

Meet Frederico and Juanico — Two faces of the crypto crash

Frederico is 27, a call center agent from Davao who started investing last year.

He wasn’t reckless — just hopeful. He had saved up for months, watched YouTube tutorials, and dreamed of financial freedom through crypto.

Then there’s Juanico, 29 — the “tito” (uncle) of our group despite being under 30. He’s the kind who lives on trading apps, studies patterns like puzzles, and swears he can “read” the market by gut.

That night, both messaged me within minutes.

Frederico: “Bro, bakit lahat red? I’m losing everything. Should I sell?”

Juanico: “Kalma lang, tito. This is just noise. Bitcoin always bounces.”

But as I watched the charts sink deeper, my heart pounded so loud it drowned their words.

Because that night… it didn’t bounce.

The tariffs that broke the market

The crypto crash didn’t come out of nowhere. For weeks, crypto had been blazing. Bitcoin touched US$42,000, and everyone thought the bull run was unstoppable.

Then Trump spoke — a single sentence that shattered confidence worldwide: “We are imposing 100% tariffs on all Chinese imports.”

The world froze. Markets tumbled, and within hours:

- The S&P 500 dropped 6% overnight

- The NASDAQ went into freefall

- The crypto market lost over $19 billion in value

Hedge funds liquidated. Traders panic-sold. As global markets collapsed, I felt my spine tingle — that eerie sensation of watching history unfold in slow motion.

Frederico’s desperation

By 2:00 a.m., Frederico called. I could hear it in his voice — the fear, the disbelief.

“Tabang (help), bro. My ₱200,000 is now ₱90,000. Should I sell before it hits zero?”

That’s when it hit me — this crash wasn’t about numbers. It was about people. Every chart line was someone’s dream collapsing.

Thousands of young Filipinos like Frederico had entered crypto during the 2020 hype, believing it was the future — our escape from financial struggle. But that night, all that belief turned into sleepless fear.

Juanico’s calm amid chaos

Meanwhile, Juanico was sipping coffee during our video call at dawn. His face was calm, eyes steady.

“Relax lang, bro. I’ve seen worse. Markets crash — they always recover.”

He spoke with a strange peace, but I could sense the tremor behind his tone. He’d been through past dips, but even he admitted, “I didn’t think politics could shake crypto this bad. I thought we were decentralized… guess not.”

That sentence lingered like cold wind through my chest. We used to think crypto was bulletproof — immune to chaos. That night, we learned otherwise.

Breaking down the crypto crash 2025

1. Global policy shock — The tariffs hit like a global earthquake. Tariffs mean inflation fears, slowed trade, and investor panic. Money fled to the U.S. dollar — not Bitcoin.

2. Overleveraged traders — Thousands were gambling with borrowed money. When prices dropped, their positions liquidated — triggering a chain reaction of selling.

3. Whale manipulation — The “whales” — big investors — dumped early, bought back low, and pocketed the panic profits.

4. Retail panic — The rest of us, small traders, sold in fear — exactly what whales expected.

Mixed emotions and the long night

That night, I felt everything — fear, anger, denial, numbness. It was as if my body couldn’t decide whether to cry or laugh. Goosebumps would rise on my arms, then fade, replaced by cold sweat.

Every red candle felt personal. Every drop felt like gravity pulling me down.

And yet, beneath it all, a strange part of me felt alive. Because even in chaos — I was witnessing something historic.

The morning after

When dawn came, the sun rose like nothing had happened — but everything had changed.

Group chats were silent. Crypto influencers disappeared. Twitter (or X) became a battlefield of blame and disbelief.

Frederico messaged again: “I’ll just wait it out, bro. Maybe this will bounce. Sayang kung mag-sell ako ngayon.” His words carried both defeat and hope.

Juanico, ever the strategist, said: “Time to buy slowly. Not with fear — but with patience.”

Lessons from the crypto crash 2025

That night taught me lessons no chart ever could:

- Politics moves markets. Even crypto isn’t immune.

- Never invest more than you can afford to lose.

- Fear spreads faster than logic.

- Diversify. Always.

- Zoom out — every crash is just another chapter.

Beyond the numbers

It’s only been a day since that chaotic Saturday, but honestly, it still feels unreal. Prices are still bleeding, charts are still red, and everyone I know in the community is either silent or pretending to be fine. Confidence hasn’t recovered — not yet — but a small part of me believes it will.

When I think of Frederico, I vividly remember that sound in his voice — a kind of fear mixed with exhaustion — and the courage it took for him to say, “I’ll just wait it out.”

When I think of Juanico, I think of calm — that steady kind of patience that only comes from experience and a few old scars.

And when I think of that night, I still get goosebumps — that same chill I felt when I saw everything turn red.

Because the Crypto Crash 2025 isn’t just about Bitcoin or Ethereum. It’s about us — our emotions, our faith, our stubborn hope that somehow, things will get better.

Crypto isn’t just numbers on a chart. It’s the story of how we deal with fear — and whether we let it define us. So if you’re reading this with your portfolio deep in the red, breathe. Don’t let panic decide for you.

Every crash feels like the end, but history always finds a way to rise again. Until then — keep calm, keep learning, and hold on. Because in crypto, survival — not perfection — is the real victory.

Broader ripples: From digital assets to traditional finance

This crash didn’t just send alarm bells through crypto circles — it shook investor confidence across broader markets. Given the increasingly intertwined nature of digital assets and traditional finance (through institutional allocations, ETFs, and hedge funds with crypto exposure), the fallout could have spillover effects.

Financial firms with exposure to crypto-related instruments may see mark-to-market losses. Banks and investment houses closely monitoring crypto derivatives could also reassess their risk models. Moreover, this event may prompt regulatory bodies to consider tighter controls or oversight over leveraged crypto trading.

In Southeast Asia and markets like the Philippines, where crypto adoption is growing, such dramatic volatility can influence both investor sentiment and regulatory posture. The shock could reverberate into local exchanges, fintechs, and even domestic efforts to integrate cryptocurrencies into financial services.

What comes next

The crypto market is attempting a rebound. Some analysts argue that the tariff shock might have been overhyped — perhaps intended more as a negotiating tactic than a full implementation.

Still, recovery won’t be automatic. The challenge lies in restoring investor confidence, unwinding volatile positions, and managing regulatory scrutiny. If macro volatility remains elevated, crypto will likely remain at the mercy of global geopolitical developments.