by Edielyn Mangol, Reporter

A longstanding barrier to financial services in the Philippines has been identity verification. Millions of Filipinos, particularly in rural areas, either lack reliable government-issued IDs or avoid formal institutions because of cumbersome onboarding processes.

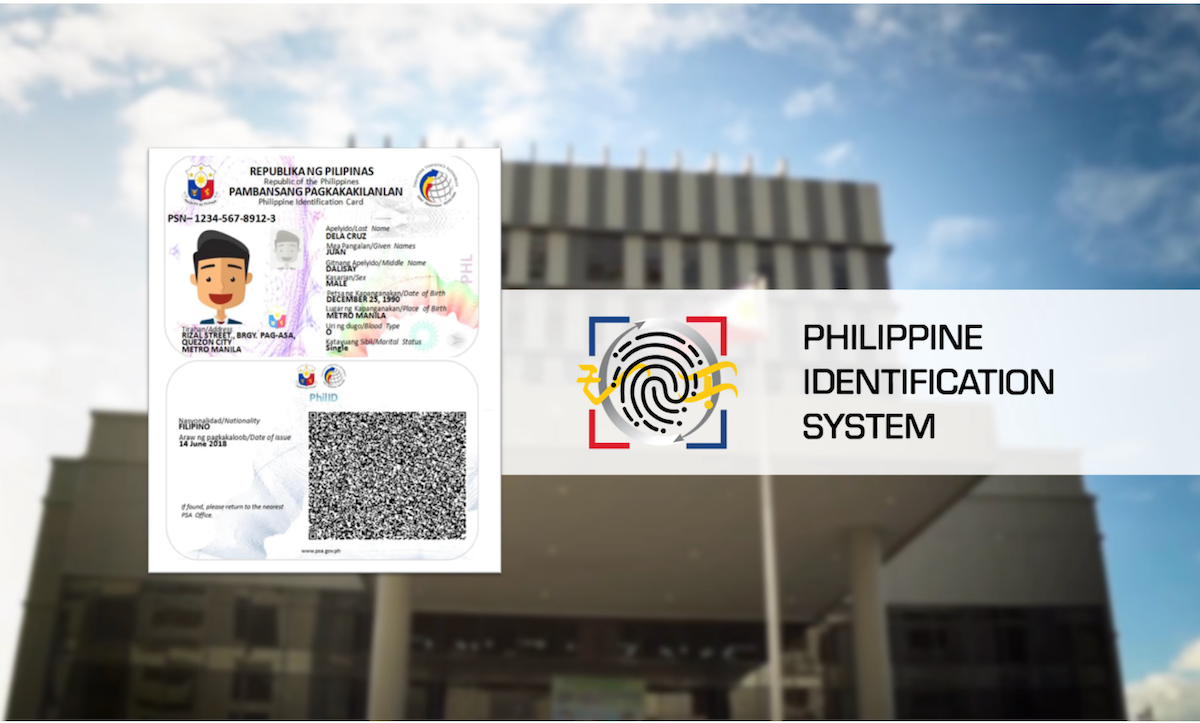

Recent policy initiatives and the nationwide rollout of the Philippine Identification System (PhilSys) are beginning to change that landscape. By enabling digital identity and electronic electronic Know Your Customer (e-KYC) processes, regulators and fintech players aim to make financial access more seamless, secure, and inclusive.

The regulatory and PhilSys foundation for e-KYC

The Bangko Sentral ng Pilipinas (BSP) has issued updated customer due diligence rules authorizing the use of digital identification systems for e-KYC by BSP-supervised financial institutions. Under these rules, PhilSys-enabled e-KYC systems— subject to the Philippine Statistics Authority (PSA) guidelines and authentication protocols—is recognized as valid under the PhilSys Act.

In line with this, the BSP has directed banks and other supervised institutions to place PhilSys IDs (PhilID or ePhilID) at the top of their list of acceptable documents for financial transactions. The use of the PhilSys Check authentication tool, which verifies information via QR codes and encoded data, is central to this framework.

Together, these measures establish a clear legal and procedural foundation for smoother digital onboarding, reducing friction in verification and allowing digital banks, fintech apps, and e-wallets to operate more efficiently.

Benefits for users, fintechs, and financial inclusion

For ordinary Filipinos — particularly those in underserved or remote communities — the impact could be significant.

By simplifying identity verification, PhilSys e-KYC lowers barriers to entry. Fewer physical visits to banks and reduced paperwork translate into time and cost savings. For the first time, many citizens have access to a standardized, government-backed ID that financial institutions can trust.

Fintech firms and digital banks also stand to benefit. Remote onboarding and minimized documentation requirements cut costs and manual workload.

A risk-based, tiered approach — as required by the BSP — lets institutions adjust verification levels depending on customer risk profiles. Faster onboarding, in turn, improves customer acquisition and retention.

From a broader perspective, placing the PhilSys ID at the top of acceptable IDs underscores an inclusion-first policy. Many Filipinos can now possess, or obtain, a PhilSys ID even without supplementary documents.

This levels the playing field, allowing more citizens to open bank accounts, access e-wallets, apply for credit, and engage with remittance and payment services.

Risks and implementation challenges

Despite its promise, implementation faces several hurdles. A robust and secure technology infrastructure is essential to prevent fraud and protect privacy. In areas with weak connectivity, remote verification can be delayed or disrupted. Consistent adoption of PhilSys authentication methods across all financial institutions is also critical.

Fraud and identity theft remain significant risks. As digital identity systems become more central, cybercriminals may attempt to spoof or manipulate them. Strong safeguards—such as liveness detection, encryption, and strict cybersecurity protocols—will be needed. Striking the balance between accessibility and security will be a continuing challenge.

Another concern is awareness and trust. Many users may be unfamiliar with how their data is being collected and stored. Smaller banks and fintechs may also lag in adoption. Regulators, financial institutions, and local governments must ensure that education, outreach, and transparent policies are in place to prevent marginalized groups from being excluded.

Future prospects: What’s next for inclusion and innovation

Looking forward, the success of PhilSys-enabled e-KYC will depend on continued cooperation among the BSP, PSA, financial institutions, and fintech providers.

Enhancements such as mobile identity checkpoints, offline verification, or hybrid systems could bridge gaps in remote or underserved areas.

Meanwhile, integration with other government services — such as healthcare, social welfare, and subsidy programs — may also increase the utility of PhilSys for citizens, provided that privacy protections are enforced.

Public education campaigns will be vital to building confidence in digital identity systems, while ongoing regulatory oversight will help safeguard data and ensure fair practices.